Happy Friday!

The greatest show on earth failed to live up to the hype.

No, not Wrestlemania.

Nvidia’s results.

The company said that it expected $32.5 billion in revenue in the third quarter, plus or minus two percent.

This was actually ahead of analysts’ consensus earnings.

So why did the stock go down?

I remember years ago I bought easyJet stock when it announced ‘record profits’.

I was sure the stock would go up, and then I’d sell for a quick profit.

I had trading nailed!

Well, unfortunately I bought, the price went down immediately, and I cut my losses and spent the day licking my wounds wondering what went wrong.

The reality is prices only ever move for two reasons.

1) Anticipation of an upcoming event

2) The expectations in relation to the event

Stocks will often rally ahead of results, as traders take positions anticipating that the results will be good.

And when those results are announced, the price moves because the expectations may not match the reality of that event.

Hence the old stock market saying… “Buy the rumour, sell the news.”

I learned a long time ago to play the cards in front of me.

Lots of people try to predict and get in front of news - especially when it comes to binary events like Phase III trials or oil drills.

Most Phase III trials fail to meet their primary endpoint.

Most oil drills fail to discover oil - and even if they do it still need to be proven commercial.

It’s far better to trade the reaction to these stocks and not have the gap risk.

Now, I’m not comparing Nvidia to a speculative pharmaceutical or an junior oil exploration company.

But what I am saying is that when the hype gets too high, the stock can blow off some steam.

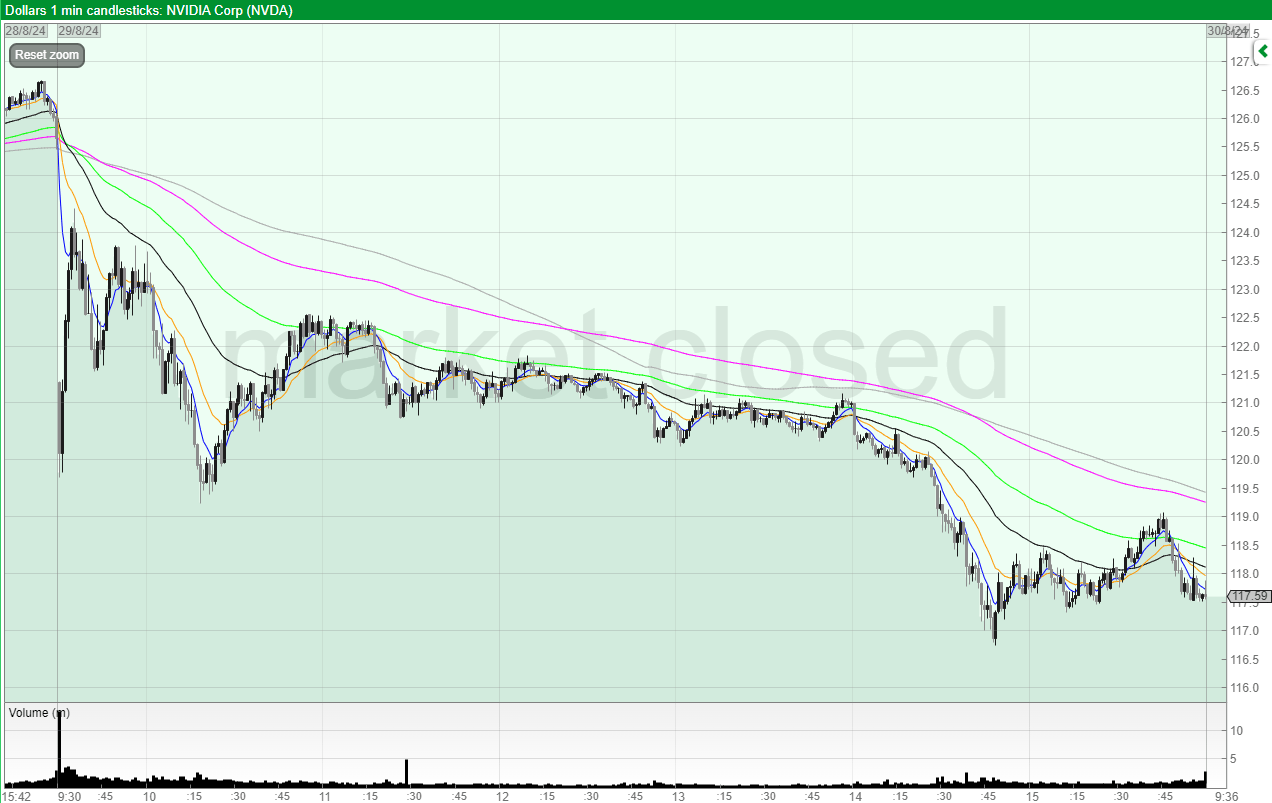

We can see the stock gapped down, rallied sharply in the first few minutes, but failed to reach the previous highs, and closed near the lows.

So even though the stock performed better than analysts expected, the market was hoping for more.

This is why it’s not enough for a stock to beat expectations. It also has to beat the actual expectations of the market.

Because if everyone is expecting a stock to beat its expectations, and it does, but not hugely, then the stock can actually fall.

Nvidia has blown its previous expectations out the water.

That didn’t happen this time. Oh well!

Future Group (FUTR)

I’ll always have a soft spot for Future Group as it was the first real business I did well on that wasn’t penny garbage.

I traded this recently and got stopped out.

However, it looks to be still consolidating and tightening.

It’s an early stage 2 stock, and the valuation remains sensible at a single digit PE.

That could easily expand if the market believes the stock is now back to steady growth.

The 50 EMA has been strong support so far.

It’s a similar chart to this next stock.