Tipsters have long been known to move stock prices.

Piers Morgan knew it, hence why he bought a stock before his paper would tip it.

There are two types of people when it comes to tipsters.

Those that complain about their ability to move prices, even if they’re not great at stockpicking, and make no money.

Those that accept the way things are and find a way to make money from it.

I plant myself firmly in the latter camp.

Between 2016 and 2017, there was one Twitter account (no longer trading) who would buy an illiquid stock and ramp it to the Heavens.

An RNS would come out, and this company would often be a complete dog, yet he’d find some glimmer of positivity in it and pick that to tweet about it.

Over time, I came to realise that the two trades roughly between £1,000 to £1,500 within a few seconds of each other were his.

And so whenever an RNS would come out that looked like his specialty, I’d load up Level 2 and look for his signature prints.

Once I saw those go in, it was the green light for me to load up (preferably close to his price and not too much of a premium) before the tweets would start coming through.

The beauty here is that even when he’d sold, he’d continue to pump as long as it was going up, because he could claim it as ‘his pick’ that went up 50% because of his stockpicking skills, and not because he ramped an illiquid stock to his followers.

So long as I dumped before everyone else, it worked.

Then there was the summer of 2018 where stocks would rocket yet there would be little to no noise on Twitter.

A quick check on the bulletin boards and there was a username that kept popping up.. and was often the first name on the scene before the stock would go up.. A person that went by the name ‘welshshark’.

And wherever welshshark went, the stock would shoot up. It was if he had the Midas touch.

So what I did was set up a 15-second auto-refresh on his London South East bulletin board profile and then bought any stock that appeared on his page.

Like everything, it worked until he got banned - never to return.. But for a time it was an almost guaranteed way of making money because he would ramp it and his followers would buy in.

And then there’s Small Cap Share Watch (SCSW).

In a bull market, they can move the market as trigger happy punters jump on the tips.

This was the case with AdvancedAdvT (ADVT) last month.

Here, there was a slight gap up.

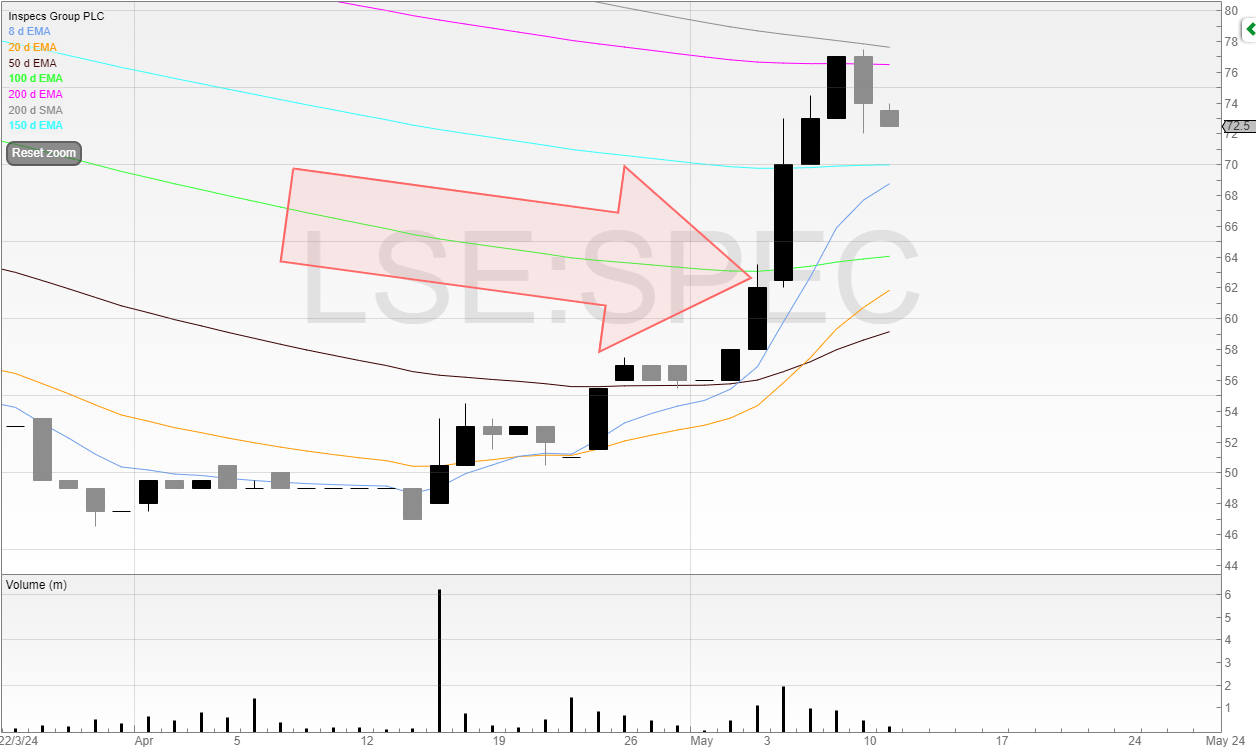

And this month for Inspecs Group (SPEC) there was no gap with an even bigger move.

When you see a stock that could potentially move, but is not gapping up, that means there is no premium factored in.

It then means the stock could be an excellent risk/reward trade.

If the stock does move due to the tip, you’re paying nothing for the upside as it hasn’t been factored in.

And if the market doesn’t take any notice, you can get out quite quickly perhaps escaping with the cost of the spread.

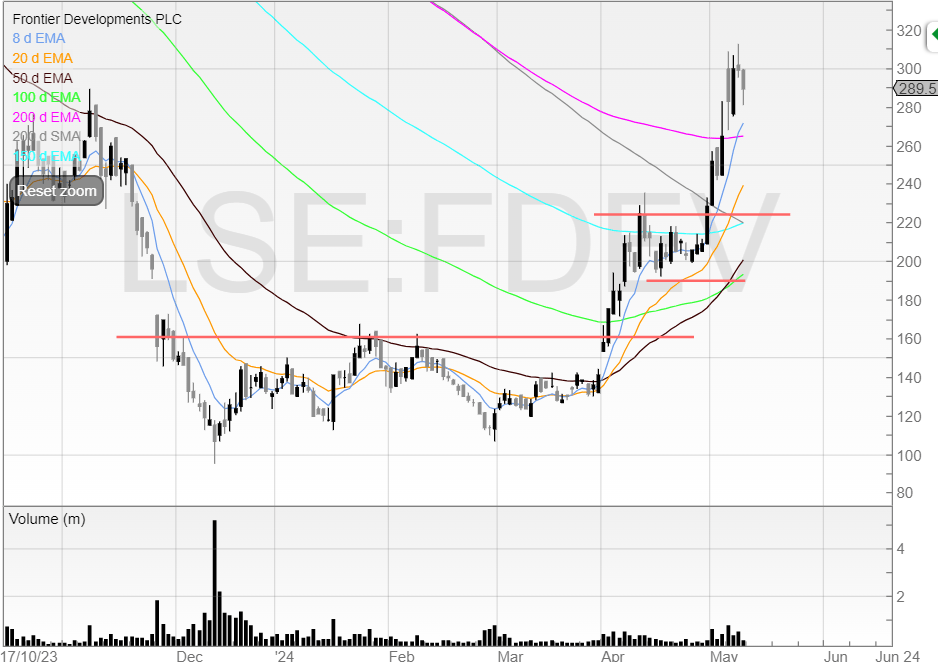

Last week I nailed my Frontier Development (FDEV) profits down into strength.

300p is a Big Round Number and the stop had been on a big run, and it was a nice multi-R trade.

I don’t think this is the end of this stock for me though as it’s looking like an early stage 2 uptrend.

But for now, some consolidation needed.

Some other things I’ve noticed last week..

Despite us being in an early stage bull market (I think there can’t be any doubt now) there are still shorting opportunities.

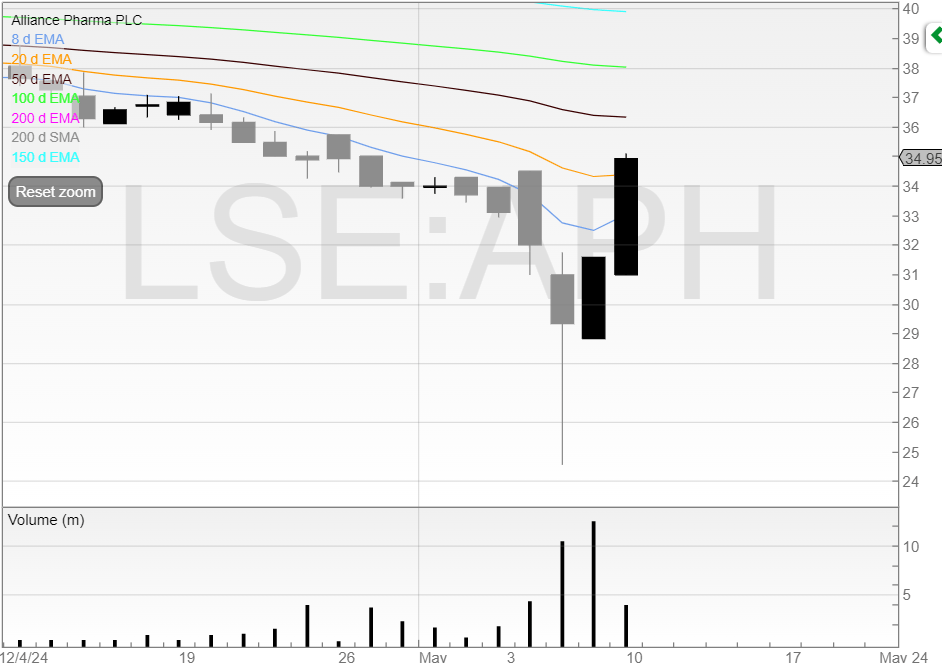

Alliance Pharma (APH) delayed its results and the CEO decided to leave in the same day.

I took my eye off the ball here and it gapped down slightly, plunged, then snapped right back up and rallied the following days.

Same for Boohoo (BOO) which missed its numbers.

It gapped down, fell, then rallied straight back up.

And similar for Ultimate Products (ULTP).

OK, there’s been no rally but still a bounce from the lows.

This tells me that the downside on shorts at the moment is limited. Markets are looking past bad news and to the future.

Let’s see what happens next week!