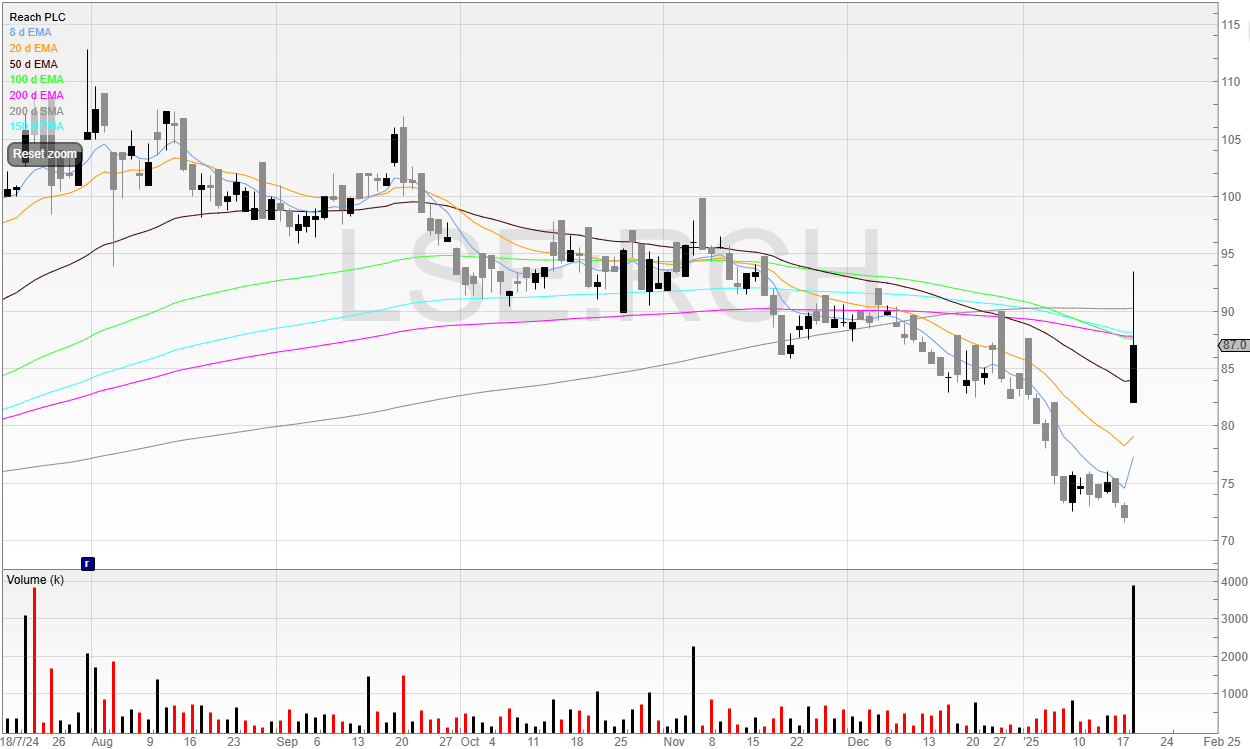

Reach (RCH) put out an ahead of expectations RNS yesterday morning.

It was the first ‘ahead’ update into a falling chart.

Firstly, this tells me that the surprise update was indeed a surprise.

If it had been expected, the chart wouldn’t have been falling.

Unless it wasn’t the first ahead update, but a quick check of the news showed that the update a few months early, whilst good, wasn’t ahead of expectations.

Here’s the update.

We’re told that “trading in Q4 was strong”.

Anyone could reasonably assume that means the business traded well and that would mean revenue growth being the main driver of profit growth.

Well, you’d be wrong.

And before we look at why, a quick thank you to today’s sponsor Morning Brew who help towards the upkeep of this newsletter.

Here’s Why Over 4 Million Professionals Read Morning Brew

Business news explained in plain English

Straight facts, zero fluff, & plenty of puns

100% free

What actually happened is that revenue was almost unchanged but costs were down, and this drove additional profit.

If you’re not familiar with Reach, you’ll definitely be familiar with their clickbait-filled websites that are about as much fun to navigate as scrubbing caked-in dog turd from your shoes.

Reach was previously known as Trinity Mirror and owns the Daily Mirror, Sunday Mirror, Daily Express, and the Daily Star.

And 240 local news websites which are stuffed full of ads, so much so that the pages barely load.

Panmure Gordon’s broker note has more colour.

Print revenue was unchanged at £409.2 million.

Digital was upgraded to £129.9 million from £128.6 million. So an extra £1.3 million in Q4.

But costs fell to £442 million from £444.2 million - a £2.4 million drop and nearly double the rise in digital revenue (which is not profit).

Now, we can also see that Profit Before Tax was upgraded to £98.1 million from £94.6 million.

So a £3.5 million gain.

Stripping out the cost savings leaves us with £1.1 million.

Which means that digital revenue is 85% gross margin.

So the big questions… can digital keep growing, and at what pace?

We know that the ad market is recovering due to Audioboom’s (BOOM) higher ad CPMs (my summary of BOOM’s management call coming later this week).

Therefore, it’s definitely possible.

And on a PE of 4, with a dividend yield of close to 10%, not much is priced in.

However, remember Reach does have a huge pension it needs to pay. And it also had an extra £5 million to pay yesterday.

It looks to be a one-off:

“As part of the due diligence to prepare the WF Scheme for buy-out, a historical error has been discovered resulting in an estimated £5m additional funding requirement, which we expect to pay in 2025. We have reviewed our other schemes for the same error, and we have not identified any material items. This is unrelated to the 2022 triennial pension valuations for our remaining schemes which remain unchanged.”

The pension has been the millstone around the neck of the stock and yet it hasn’t stopped Reach going on several multibagging runs.

Plus, the end is in sight, with these payments scheduled to end in 2027.

I think it’s worth watching - I hold a small position left from yesterday with a tight stop loss below yesterday’s open.

If it is going to be in an upgrade cycle from now on, the stock could print higher.

But to know that we’ll need to wait for the next trading update.

And whenever you’re ready..

There are three ways I can help you.

If you’re wanting to profitably trade UK stocks then I’d recommend my entry level course:

Spread Bet Accelerator: The exact system I use to trade and get you to your first £10k in profits. Use the code GIVEME99 for a subscriber discount.

Want more trading ideas and a clearer view of the markets?

Buy The Bull Market Premium: Free 30-day trial covering potential trades and insights as a professional trader.

Want to work with me personally?

Alpha Trader is where I work closely with traders who want to get to a professional level.

We have our own channel, meet up, and have fun trading and learning [opens February - reply to get priority access].

Speak soon!

Michael