Free trial of Buy The Bull Market here:

https://newsletter.buythebullmarket.com/upgrade?offer_id=3f2ec885-4b68-4524-9c7b-2e16acc290e1

I’ve published my top stocks for 2024 here. Many of these have the potential to double (and you’ll be familiar with most of them) though they are, of course, not without risk.

But 2024 has started well and long may it continue.

In the last month, we’ve seen two big news events. Attacking the Houthi rebels and the approval of the Bitcoin ETF.

The SEC approving Bitcoin for an ETF is huge news.

Bitcoin was one of the best-performing assets of last year.

It’s one of the best-performing asset classes of this decade.

It was one of the best-performing asset classes of the last decade.

It’s easy to hate Bitcoin, but it’s easy to hate what isn’t easily understood.

Here’s the chart.

As crazy as the volatility is, Bitcoin gaining approval for ETFs now means more and more are going to take it seriously.

It means cash inflows, which in turn will drive the price. It’s not unrealistic to expect that Bitcoin will trade higher purely because of the money coming into the asset class.

But that’s not going to happen overnight, and many people will’ve bought the rumour and sold the news. So price now depends on how many people are selling the rumour and how many people are buying in due to this news.

Cash inflows can have a huge difference on asset classes. It’s no different to the crazily inflated prices in 2020 when scores of bored people at home suddenly joined trading apps and bought stocks. A cash inflow is the rising tide that lifts all boats. No different to quantitative easing.

I wouldn’t be surprised to see more crypto-focused businesses listed in London in the coming years to take advantage of Bitcoin and cryptocurrency’s more mature and growing profile.

But coming back to the Houthi rebels?

The UK is firing Sea Viper/Aster missiles which are estimated to cost around £1-£2m.

And the attack drones the Houthis are using are estimated to cost $20,000, or £15,690.

But if we say £20,000 to be conservative, that means the UK is using weaponry that is 50x as expensive as a minimum to combat drones.

Any of Britain’s enemies would surely be thinking that the more drones the Houthis fire, the quicker the costs will rack up to Britain, and therefore by providing weaponry it can hurt the Royal Navy in a financial war.

This is similar to how the Western world is using Ukraine as a proxy war against Russia. The West has delayed giving Ukraine the equipment it needs, because, in my opinion, a long war of attrition damages Russia (but comes at the expense of Ukraine).

In any case, this has the potential to escalate. But how much a driver it will be on markets I’m not sure, as interest rates falling has often meant that it’s game on again for stocks.

Finally, Ferrexpo has also introduced a dividend.

This is hugely significant and shows that the company clearly believes it is financially capable of maintaining this even though there is currently a war going on in its country of operations. My view: buy FXPO on any peace agreement/removal of uncertainty.

CMC Markets

CMC Markets is a spread bet and CFD provider. It competes with IG and Plus 500.

I’ve never met a CMC Markets or Plus 500 client in real life, but the business is doing better than expected as it released an ahead-of-expectations RNS earlier this week.

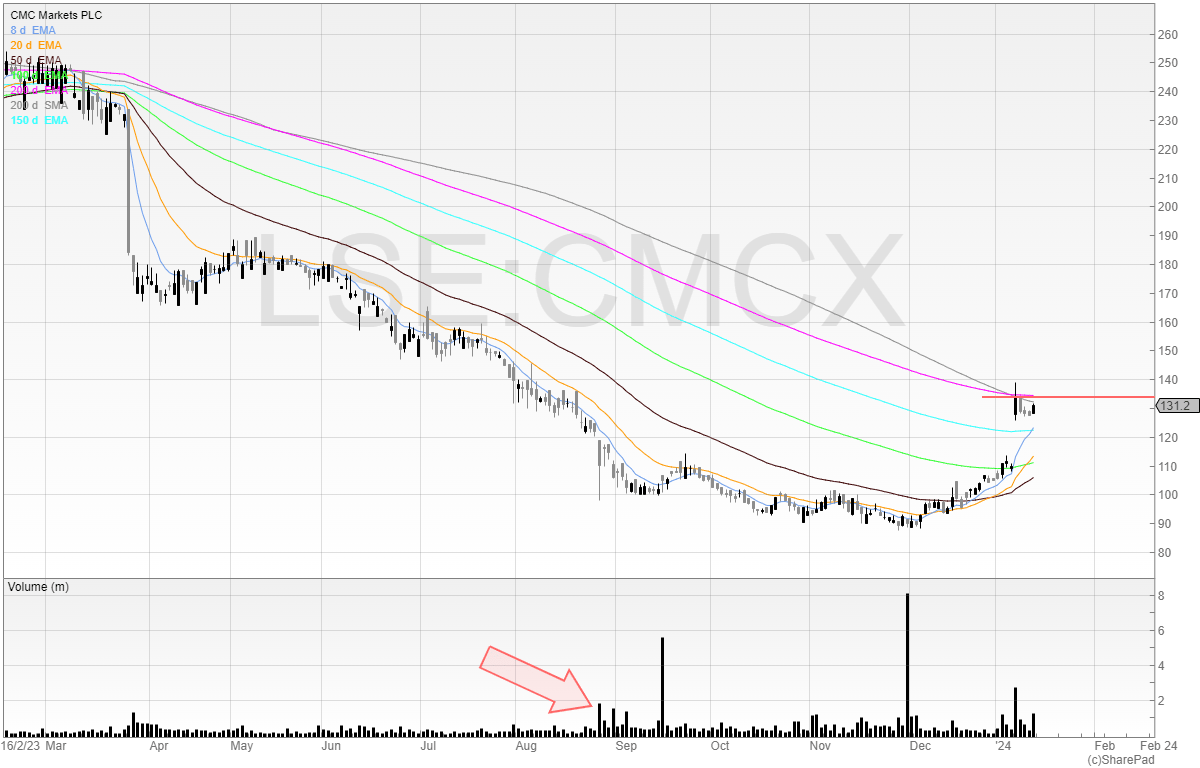

The stock started rallying in December and gapped up on the news. It was hard to do this trade in bigger size because it had rallied and so I didn’t want to be liquidity for people who were in the know.

That said, the stock is holding up against the 200-exponential moving average.

I think that if the stock forms a base and moves into new highs then I’ll be looking to take a swing trade long, with my stop under the recent price action.

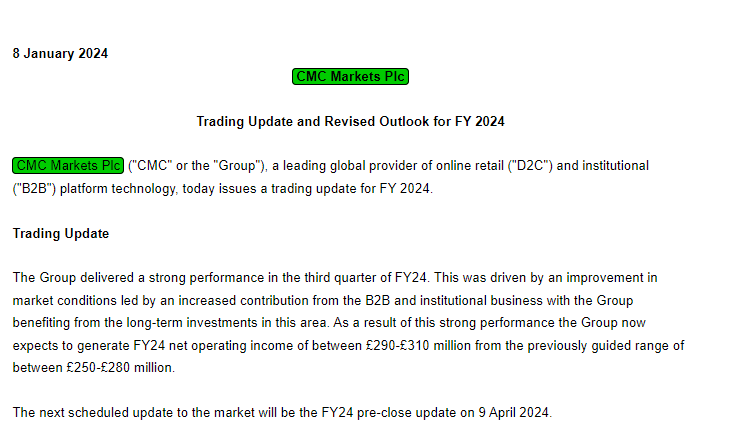

The next scheduled update is on 9 April 2024, and there could be a trade into the results as people take positions expecting another beat.

The recent update statement was announced on the same day as PLUS 500 (PLUS), and so I went long both.

But I also saw IG Group (IGG) hadn’t reported since September, which meant that there was a long period where the market doesn’t know how IGG has been performing.

The longer the period, the more uncertainty.. and in this case two of its competitors had announced they were ahead.

The result?

I went long on all three for an intraday trade.

Here’s the RNS from CMCX.

It says that this has been driven by an improvement in market conditions led by an increased contribution from the B2B and institutional business.

CMCX has taken a battering in the last year. It’s heavily geared to the markets due to its reliance on market activity.

When market activity dries up so do the profits.

The Grand Old Duke of York

However, we could be at the start of another ride upwards.

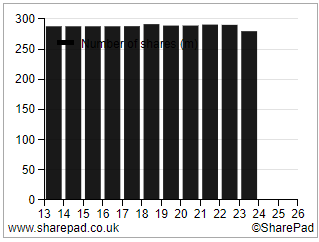

No new shares have been issued - in fact the share issue has come down (although not by much).

So there’s no reason why the share price can’t get back to where it was if profitability reaches similar levels.

Share issue is always important to check when looking at turnarounds. A share that was once 100p but has doubled its share issue is not going to get back to 100p as easily. The market cap would need to be double what it was at 100p because the number of shares in issue has doubled. This is something many investors fail to pick up on.

There’s an estimated four billion people voting this year with big elections across the globe, including the UK, the US, and a whole list here on Wikipedia.

That means potential for volatility and rate cuts are also on the horizon too.

Volatility is good for traders and it’s good for CMCX.

If this stock takes out the recent high and presses ahead of the 200 exponential moving average, then I want to test a long.

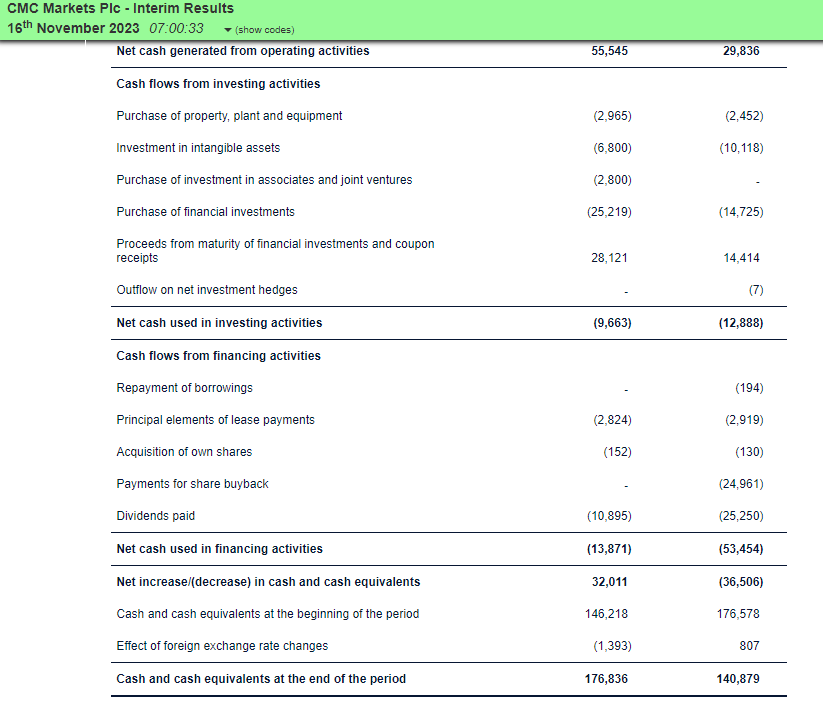

I was surprised when I looked at the balance sheet for a red flag checkup for it to be incredibly strong.

One thing I’d need to check is if ‘Amounts due from brokers’ is cash.

If so, then I don’t understand why it wouldn’t be in Trade and other receivables.

If it is cash, then that would mean the company’s cash balance would be more than its market cap. Obviously, this doesn’t factor in working capital movements as trade payables are roughly ~£90 million more than receivables, and it doesn’t include other liabilities, but it does mean the balance sheet is robust. Perhaps someone who understands this can let me know in the comments?

Cash flow is also strong.

Even though the company is talking about investing plenty, cash still grew in this market downturn. And the company is talking about having reached the “peak of the investment cycle” and that “operating expenses are expected to decline”.

To me, the positives are clear:

Market potential turning up with volatility events on the horizon and stock trading ahead

Price just coming off the lows

Strong balance sheet, cash flow strong even though it has been investing

What’s not to like?