Just a quick one..

What do you get if you take a stock that’s rallied, a Big Round Number, and results that are nothing new?

I’ll give you a hint.. think back to Warpaint last week.

The answer is the stock usually falls.

And that’s exactly what we had with Kitwave.

400p is the BRN

Now, don’t get me wrong.. I like this business and think it’s a good operator.

It’s a rare 2021 float that’s actually done well.

But what matters is price and where price is potentially going to go next.

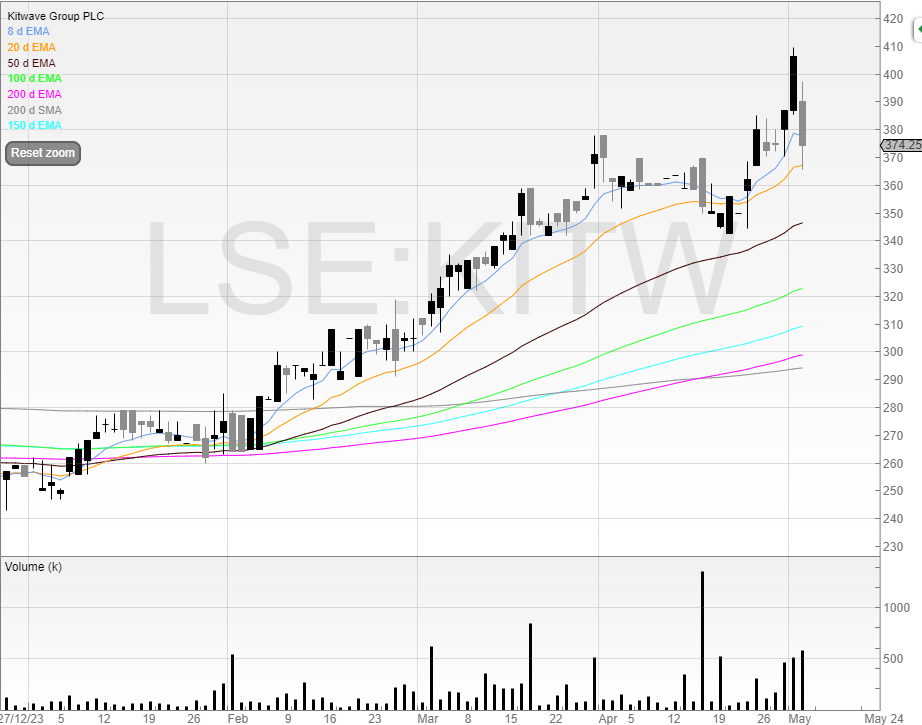

Here, we can see KITW moved from around 340p all the way to 410p.

News comes out that’s not ahead, and gives a cautionary note.

So what do we have?

Big move in anticipation of news

Big Round Number at 400p

News not ‘ahead’ and cautionary

Potential profit takers

Sound familiar?

Warpaint London (W7L) also had a big move, the Big Round Number, and potential profit takers (unfortunately I closed my short for a profit before the placing!).

Trading is a lot about pattern spotting and trading those patterns with good risk/reward.

I whacked KITW and covered for a quick dip.

My rationale was simple.. nobody is buying the news - especially after that move. And so all you need is a few profit takers for a move.

Deltic (DELT)

Here’s one I missed..

Unfortunately, the Energy Profits Levy (‘Windfall Tax’) has appeared to have done real damage to this company.

I mean, who could’ve predicted that? (This is a rhetorical question)

Companies don’t want to invest in the North Sea now because of the uncertainty.

Which means that a lot of potentially profitable projects will now no longer go ahead because of the increased risk.

And that’s exactly what’s happened at Deltic.

The company believes that it may not be able to secure a farm-out partner for Pensacola before the end of May 2024, and in the current market it’s also unlikely to be able to raise £15 million net which it would need to do so to meet its 30% share of the Pensacola well.

Here’s the real bad news.

If an industry and/or funding solution is not in place by the end of May 2024, being the point at which Deltic will be required to demonstrate its capacity to fund its share of costs, Deltic will be required to take steps to ensure the Company is not exposed to further expenditure on the Pensacola well if there is no reasonable expectation that the Company will be able to meet those additional liabilities which will be incurred going forward.

In such circumstances, Deltic will be required to withdraw from the Pensacola licence and transfer its interest in Pensacola to the Joint Venture partners.

And if there’s no Pensacola.. then what’s the point of the company?

It seems I wasn’t the only one who missed this pre-market..

There are plenty of trade opportunities in the market.

IG Design (IGR) rallied significantly on good news. A sign that perhaps sentiment is changing?

Good news was heavily sold into last year but recently it seems like it’s no longer the case.

Frontier Developments (FDEV) broke out (I highlighted this on Twitter) and rallied 20 percent.

No doubt there will be more next week!

Have a good weekend.

P.S. I saw Argo’s April operating update. Better than I expected. But still (in my opinion of course) will need cash.