I go on about position sizing a lot.

But this is because nothing is more important when it comes to both protecting and compounding your account.

Traders who manage risk effectively not only see lower drawdowns but also get more bang for their buck on the positions they trade.

Why is this? Because trading is about manoeuvring your pieces around the board in order to fight battles where you have an edge.

Would Napoleon ever commit to a battle without believing he had a decisive advantage?

No. And neither should you.

Keep reading and we'll look at how you can lose less and increase your P&L through robust account management.

Equal sizing is for amateurs

Lots of traders believe that your position sizes should be equal.

But not all trades are created equal and neither should your positions.

What's the point in having the same amount in two positions if one trade has a 10% stop and the other has a 20% stop?

That means one trade has double the amount of risk!

And sometimes trades should have varying amounts of risk. But this should only be if you have the data to show why.

If you're going to have random and inconsistent risk then you can expect random and inconsistent profits.

Scale up and scale down

When you start trading, your risk should be consistent.

Only when you've earned the right to vary up your size through data analysis should you be changing this.

Let's say you have a funded trading account.

You have a 4% stop loss, and you have 5 losing trades in a row. Look at how this has affected your account.

After five losing trades, this account has now seen its risk per trade increase by 25%.

Risk per trade has gone from 4% on a full account to 5% on the depleted account.

This means that the risk has actually increased even though the trader is seeing the account perform poorly!

You need to be aware of this when on losing streaks.

Scale down the account when losing and scale it back up when winning. And regarding risk - is 4% a good risk per trade?

In my opinion, it's a lot. But if you're wanting to aggressively grow by taking on some risk then it can make sense.

That said, just remember losing 5 trades in a row is not uncommon.

If that happens you're then 20% down.

And before we continue, a quick thank you to our sponsor who helps towards the upkeep of this newsletter.

Learn how to make AI work for you

AI won’t take your job, but a person using AI might. That’s why 1,000,000+ professionals read The Rundown AI – the free newsletter that keeps you updated on the latest AI news and teaches you how to use it in just 5 minutes a day.

Adjusting your size for risk

When starting out your risk should be constant.

We want to avoid the issue of having inconsistent risk per trade and so the solution is to adjust your position size for risk.

We can do this with the following formula: Monetary risk / risk per share

Monetary risk is the number of pounds we're risking on each trade. Your risk per share is simply your entry minus your intended exit (stop loss).

Here's an example.

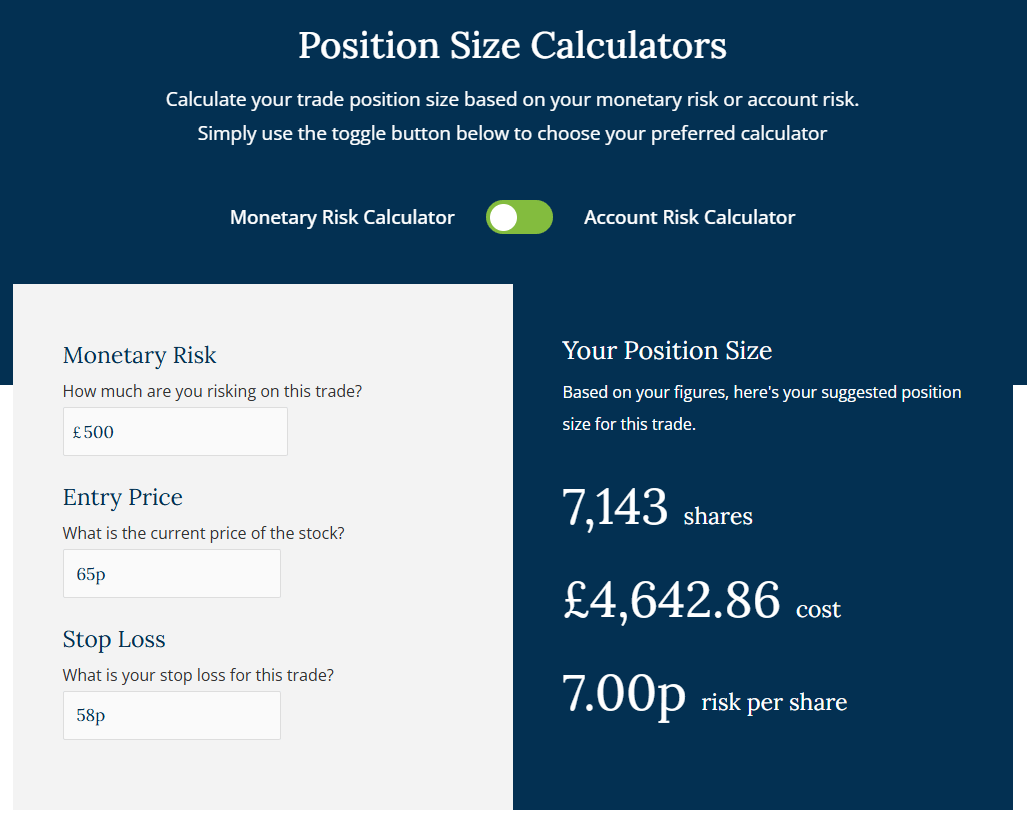

Let’s say I buy Calnex Solutions (CLX) at 65p with a stop loss of 58p.

That means my risk per share is 7p (65p - 58p).

Now I'd need to plug in my monetary risk to know how many shares to buy in order to position size for my risk.

You can use the formula, or use my free position size calculator tool on my website.

This is how it looks on the position size calculator.

Let's say I'm risking £500 on this trade.

I put this in the monetary risk and then put in my entry and exit where the trade would be confirmed wrong.

The calculator automatically calculates my risk per share (7p) then divides this by my monetary risk.

We can see that I'd need to buy 7,143 shares at 65p for this quantum of risk.

Position sizing matters and is the difference between success and failure.

Don’t sleep on it.

UK Stock Trader Pro

UK Stock Trader Pro kicks off tomorrow!

This is an 8-week live cohort program where we’ll go through everything on trading UK stocks with sensible risk management and scaling your account.

Speak soon!

Michael