Trump’s assassination attempt has put him to be a shoe-in at the next election in November.

And he’s been bullish crypto.. but despite that, it’s not been enough to get Bitcoin to break new highs.

So what does this tell us? Despite the halving, crypto is not storming off into new highs.

But I also don’t think it should be ignored.

Bitcoin is still the best performing asset class of the last two decades, so dismissing it is foolish.

I’ll be watching for a breakout of any new high to take a long position.

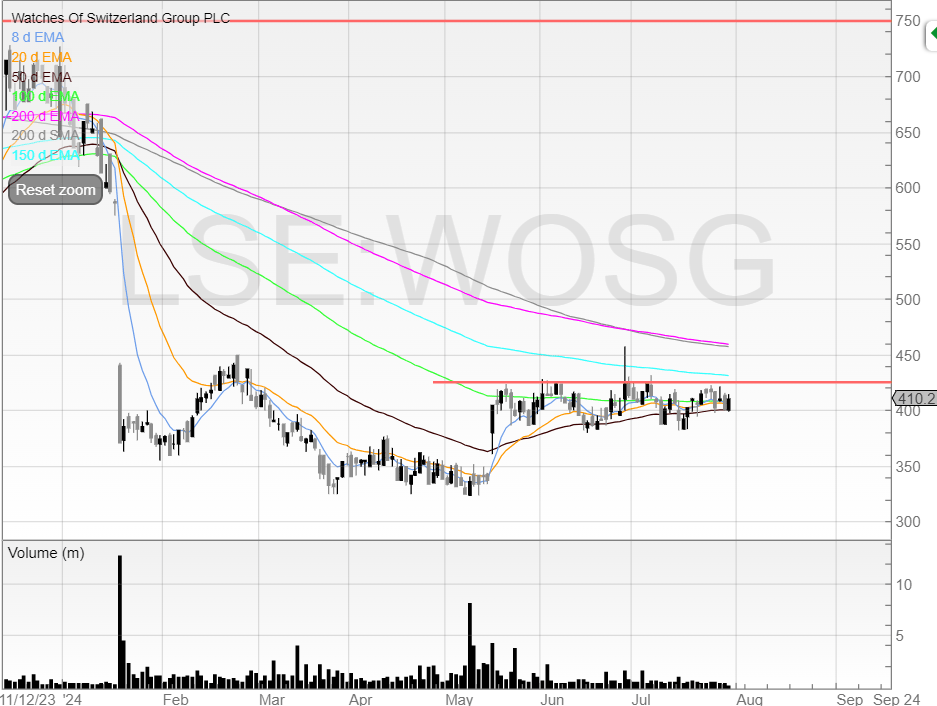

Watches of Switzerland Group (WOSG)

Watches of Switzerland Group is a retailer of luxury watches in the UK. As well as luxury watches, it offers luxury jewellery, fashion, classic watches, as well as jewellery and watch aftercare services.

It also has a US division which is growing healthily.

Watches of Switzerland was a previous growth darling on the UK market. But unsurprisingly, the stock price took a beating when the cost of living crisis kicked in and the grey market was flooded with watches selling below list price.

WOSG also took a further beating when Rolex announced it was acquiring Bucherer; the reason being that the market immediately (and not without reason) suspected that now Rolex had its own bricks and mortar stores it would favour allocating timepieces to Bucherer rather than Watches of Switzerland.

Bucherer has been a trusted retailer of Rolex since 1924, and with Joerg Bucherer having no direct descendants to take over the business, he wanted to preserve that relationship with a sale to Rolex.

I think it’s possible that these fears of favouring Bucherer are overblown. Rolex and WOSG have now opened the largest global mono-brand Rolex store on Old Bond Street in London. And Rolex has launched a new Rolex Certified Pre-Owned program (performing ahead of expectations) where WOSG has been a key player.

It doesn’t make much sense for Rolex to not be invested in WOSG’s success, because even though Bucherer is technically competition, WOSG is still a big distributor. The biggest in both the UK and the US, in fact. Therefore, one would expect any Rolex actions to be value accretive rather than destructive to Watches of Switzerland.

And there’s always the danger to Rolex that if a competing luxury brand was to acquire Watches of Switzerland then it definitely wouldn’t be great for Rolex.

Imagine if behemoth LVMH was to acquire WOSG? It could flood it with Bvlgari, Hublot, Dior, Fred, Tag Heuer, and the other brands it has, decreasing Rolex’s presence.

I could always be wrong… but it just doesn’t make economic sense for Rolex to not be fully invested in WOSG despite acquiring Bucherer.

In any case, it seems WOSG management is diversifying away from Rolex. Whether this was a deliberate reaction or pre-planned I don’t know, but on 9 May WOSG acquired Roberto Coin.

The US is the largest luxury jewellery and this acquisition gives WOSG a good stronghold to grow from.

And in the recent results the company reiterated its Y25 guidance, and that the “strategic momentum” underpins confidence in the Long Range Plan of doubling sales and doubling EBITDA.

Here are the forecasts pulled from SharePad.

Currently, the market cap for Watches of Switzerland is £983 million at 410p per shares.

That means the stock trades on a sub 10 PE.

There are risks, as this business is reliant on customer sentiment, as well as the Rolex relationship risks.. but so far the business is weathering the macro storm.

I see the 420p level as resistance.

It’s likely we’ll see a Q1 trading update in the next few weeks which is worth looking out for. We’ll have a better idea of the company’s FY25 guidance then.

It’s on my watchlist for now as a potential stage 1 stock.

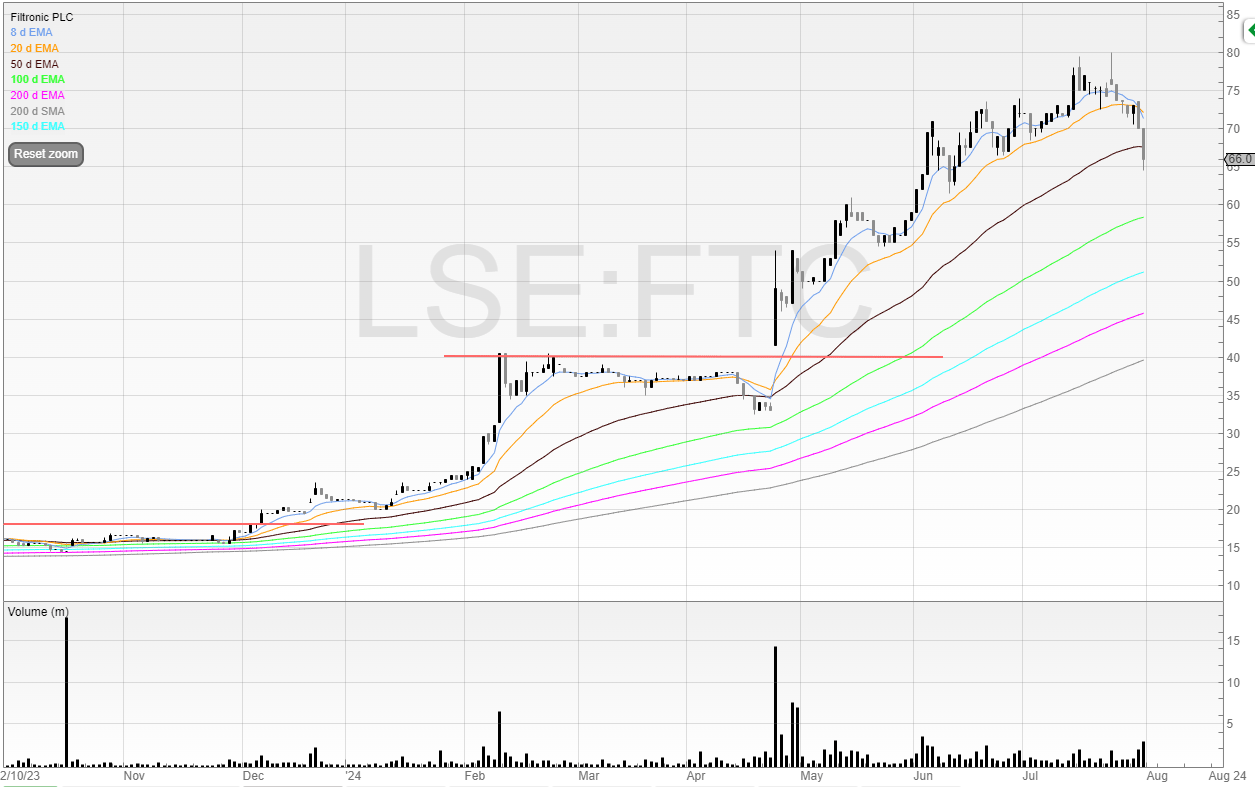

Filtronic (FTC)

I had a 1-on-1 meeting with the CEO and CFO of Filtronic this week following the company’s results (thank you to Walbrook for arranging).

It’s a stock I’ve highlighted here before and is a current holding, and despite the share price rally I feel there is more to come.

Remember, this is a business that was hugely successful in the Dotcom bubble.

Since then, it’s trundled along. But this year the business is ramping up again.

My gut feel is that after this huge move there is going to need to be some consolidation.

The shares were just above 20p in January, so it’s not unreasonable to expect sideways trading after such an extended move.

The valuation is also looking stretched, but then often the big market movers are.

Both Fevertree and Boohoo traded on eye-watering PEs back in the days when they were super stocks. But both businesses often beat those expectations and grew so fast that they ended up looking good value.

Is that the case with Filtronic?

Management don’t see a problem with scaling up. I mentioned how Surface Transforms (SCE) has its ceramic brakes which are incredibly light (I held one when I met them) and therefore hugely appealing to many Tier 1 OEMs.

The issue for Surface Transforms is that they can’t actually figure out how to make the things effectively and satisfy its contracts.

Management told me they didn’t think that would be a problem as they’ve already experienced a lot of scale. They’ve gone from having the product in basic concept to high volume in six months with rapid scaleup with SpaceX.

They have spare capacity they keep in case of upside that’s unexpected. And they’re also moving to another facility that will give Filtronic much more space and bring in more manufacturing capacity as and when needed.

This doesn’t keep management up at night because it’s well controlled.

Previously, the business had three big customers in Nokia, Motorola, and unnamed defence customer that isn’t allowed to be named.

That problem was solved with the addition of SpaceX, the European Space Agency, Qinetiq, but SpaceX is now by far the biggest and so it now has one big customer.

SpaceX is now 50% of revenue and though Filtronic is focusing on the whole business, obviously it doesn’t make sense to not take business from SpaceX to avoid big company risk. That’s just how it is.

What Filtronic helps with is essentially connecting people.

Low Earth Orbit (LEO) satellites help last-mile connectivity. For example, for people in remote areas, there was previously no economic model to support this connectivity. With SpaceX that has now changed.

With mobile phones, the signal connects to a base station, that connects to the network, takes it back into the system and then connects it back at the other side.

LEO is the same but only taking it 300 miles into space. Filtronic’s products amplify that signal (something SpaceX has tried and failed to do) and this allows a communication link to enable people in remote communities.

Elon Musk wants 50% of the internet going through his network. By connecting the last-mile he gains lots of users, but also uses direct to sell.

If you’re somewhere that has poor signal in the UK, like rural areas or Regent’s Park in London (2024 and I still struggle to play Spotify there on my runs), you will roam into a Starlink network on your phone. Your provider will then be charged by SpaceX for that service.

It’s not unreasonable to think that SpaceX may want to vertically integrate Filtronic but management think that if anyone was to bid then it would come from outside.

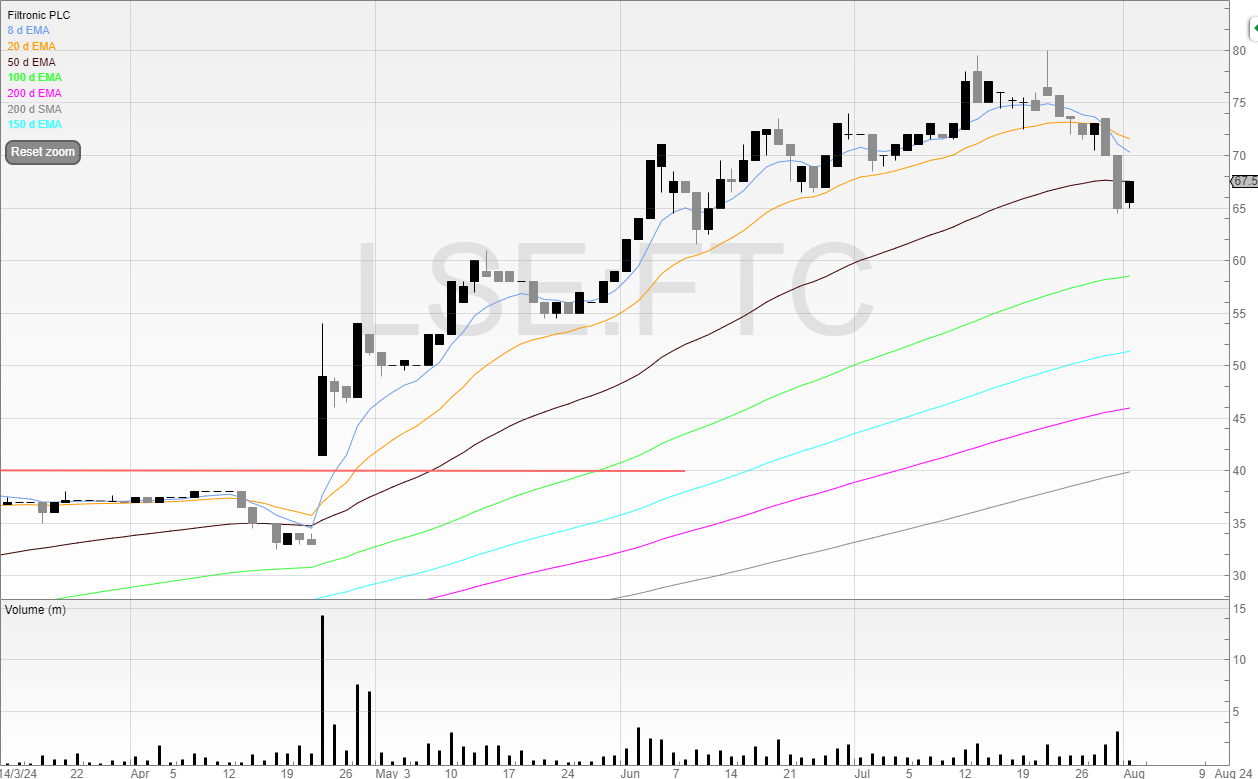

Based on the chart, I want to see the 50 EMA hold.

It’s not a disaster if it doesn’t as it’s still very much in an uptrend, but strong stocks that bounce quick generally perform extremely well over the next 12 months.

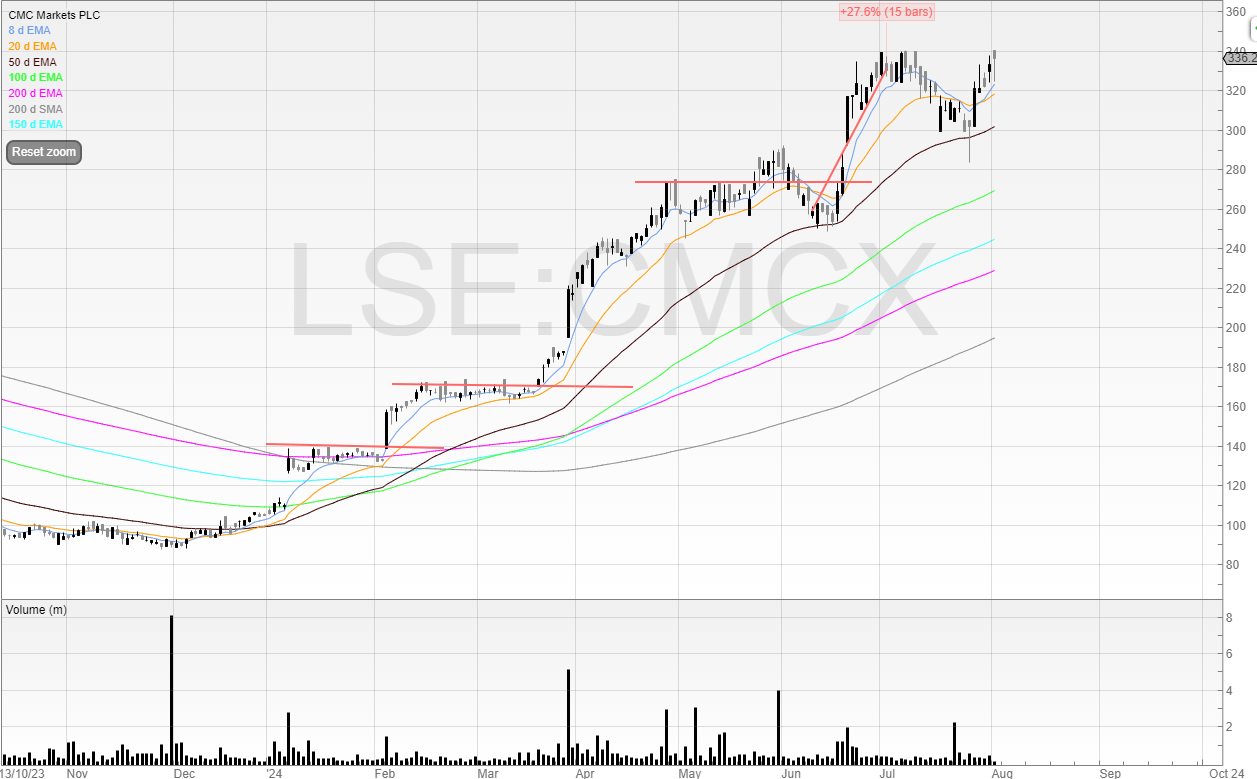

Look at what happened to CMC Markets (CMCX).

I think this is a hugely exciting stock and despite the rich valuation remain long.

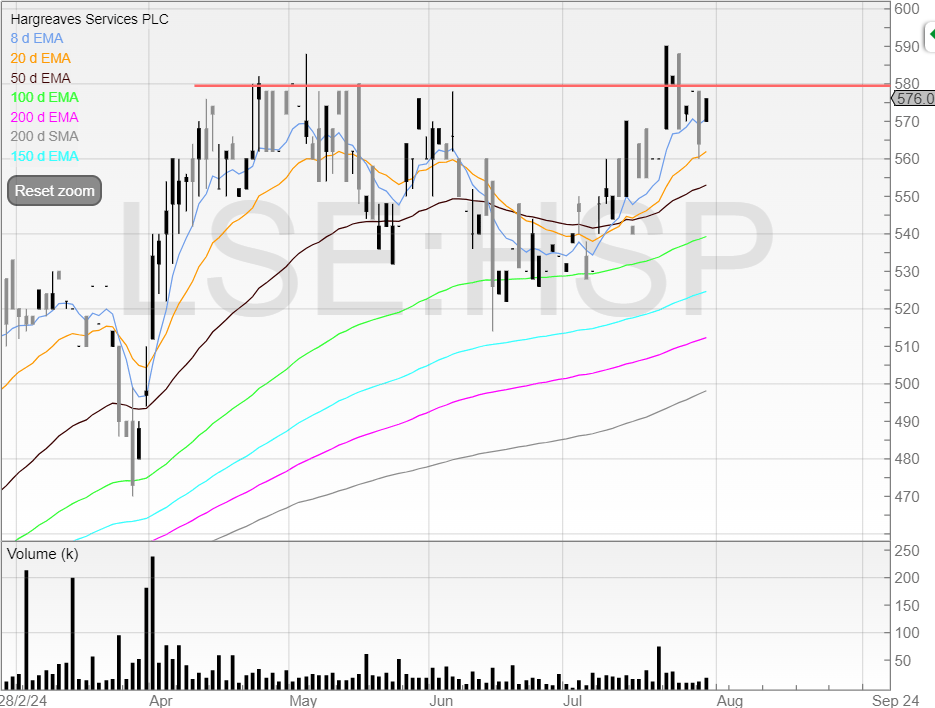

Hargreaves Services

I was invited to Harwood Capital on Stratton Street for a talk with Christopher Mills, where he went through the North Atlantic Small Companies Investment Trust holdings as well as some Harwood holdings.

Hargreaves Services had been on my watchlist because of the chart but I’d never bothered to look into it properly.

Nobody has, according to Christopher.

Because nobody seems to have realised that in January 2026, the Carbon Border Adjustment Mechanism (CBAM) comes into effect, which means that any material that is carbon intensive and imported into Europe will be subject to carbon tax credits.

Hargreaves Services produces pig iron, which has rocketed in price since the Russo-Ukrainian war. That price has settled a little, but Hargreaves Services produces 250,000 of pig iron per year.

We know that there will be half a credit to two credits attached per ton of imported goods, and we know the current carbon credit price is around €66, so €33 multiplied by 250,000 tons gives €8.25 million in additional profit.

Given that SharePad has profit after tax of £12.8, that’s a nice uplift.

There’s also a potential Russian embargo coming. Russia currently exports 1.6 million tons of pig iron but was dumping pig iron into Turkey, that was then being sold into European countries. It’s now being looked at by the European Commission.

Furthermore, Harwood believes that the existing asset backed price of the shares is 800p against the current market price of 560p.

That’s without any CBAM and without any incremental growth.

Obviously, fundamental analysis is nice and catalysts (even if they are a way off) are good, but the chart takes priority for me.

600p is clearly Big Round Number resistance.

However, looking closer, it looks like 580p is the breakout level.

I wouldn’t be getting too excited about this, because CBAM is more than a year away yet, and asset realisations are slow, but it could be a nice breakout trade.

Yellow Cake (YCA)

I have been bullish and long uranium since September 2021. It’s probably the closest thing to what I would call an investment as it’s a trade based on my view of the uranium market resurging, and the spot price of uranium going high higher.

The management of Yellow Cake are shrewd operators in my book. When the stock trades above Net Asset Value (and this is just a company that literally buys and stores uranium) management raise capital by selling equity, which they then use to buy more uranium.

And when the stock trades at a deep discount, management have decided to buy back shares due to the undervaluation.

I don’t know who created it but having checked it previously it was accurate, and I’ve no reason to suspect it wouldn’t be now.

Yellow Cake is clearly a stage 4 stock at the moment.

However, look out for a catalyst that drives the price closer to NAV.

It could be a change in sentiment or a new piece of regulation.

Yellow Cake is a proxy for uranium and so its price is tied to the spot price, but sentiment can affect that significantly.

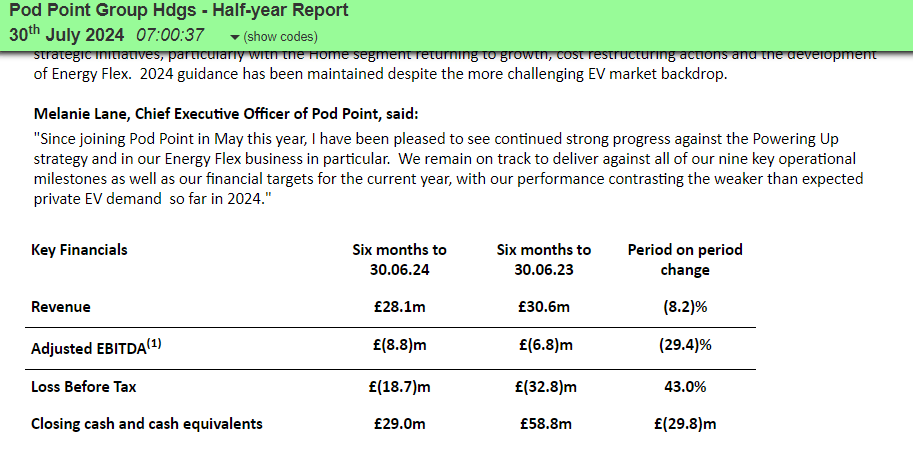

Pod Point (PODP)

Pod Point put out its half year report today.

I can’t see any reason to go near this business so I’m flagging it as an avoid.

Over the course of the last 12 months, the business has lost £29.8 million in cash. It has £29 million left, which, at this burn rate gives just under 12 months.

Yet adjusted EBITDA loss has increased and revenues have gone down!

The business does have a fully undrawn £30 million credit facility.

So it does have liquidity options.. but unless the business can dramatically start to scale revenues up I think an equity placing will be needed in the future.

Why get involved?