Funny how things change!

93rd minute: Southgate needs to go, poor tactical decisions, no fresh legs on the pitch, should’ve taken Bellingham off a long time ago.

94th minute: BELLINGHAM SCORES! IT’S COMING HOME!!!!

Now, whilst football is a results business (like trading), the process should always be the focus. Maybe England got lucky when it mattered. Maybe it was all part of Southgate’s plan.

But sentiment is fickle and if England win the Euros this game will be forgotten about and Southgate will be an hero.

That sentiment can also quickly affect stocks.

A lot has happened in a month.

Some stocks have pulled back whereas others have roared onwards.

And it seems people are happy to take risk given recent moves in CPX, SAE, and good news is seeing stocks rally and not reverse.

We’re also at the half point of 2024. In a few days, we’ll be closer to 2025 than we are to 2023.

It’s worth having a look at my five picks for 2024 at the six month mark.

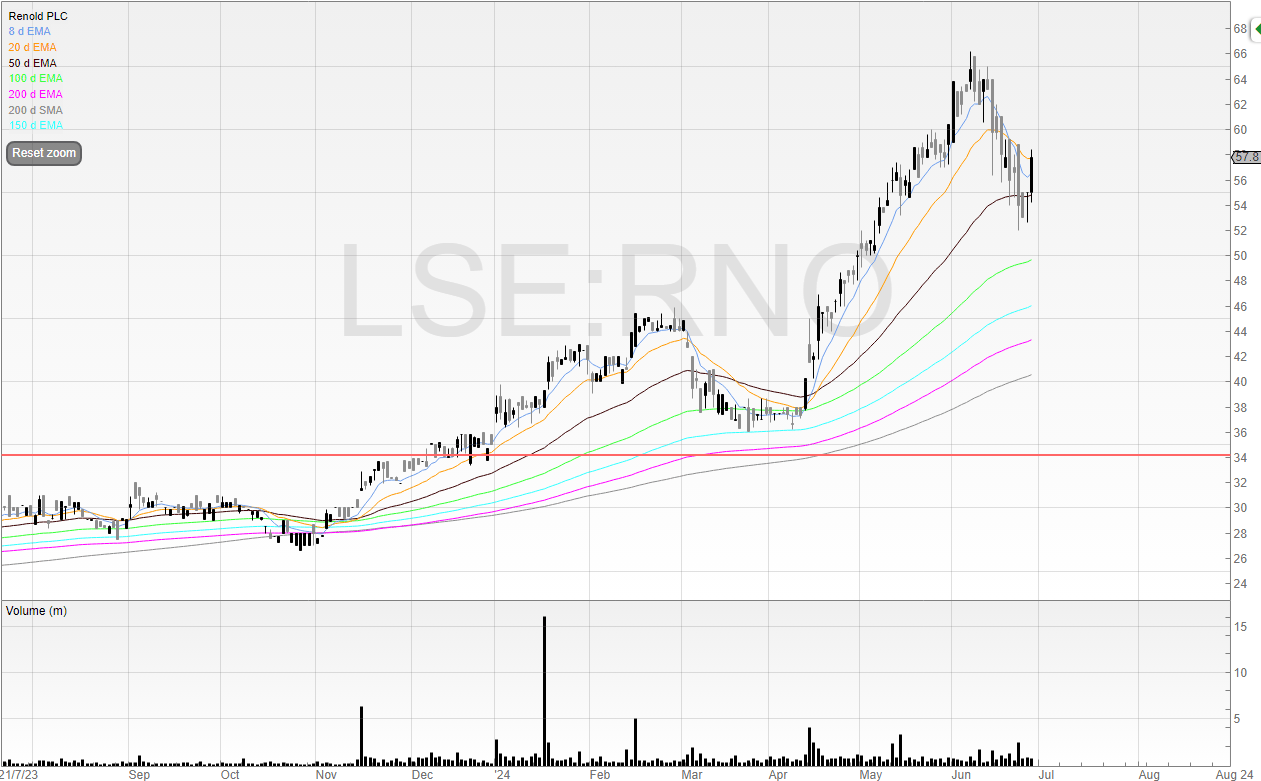

Renold (RNO)

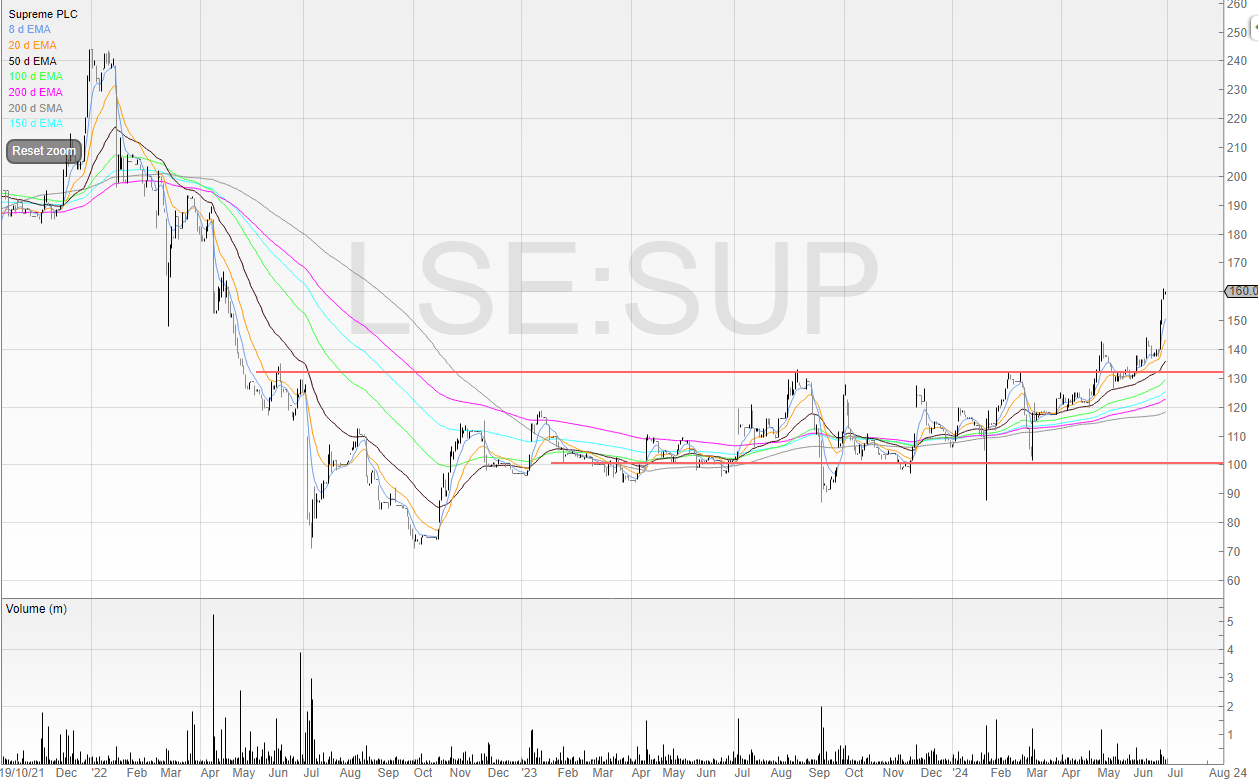

Supreme (SUP)

Afentra (AET)

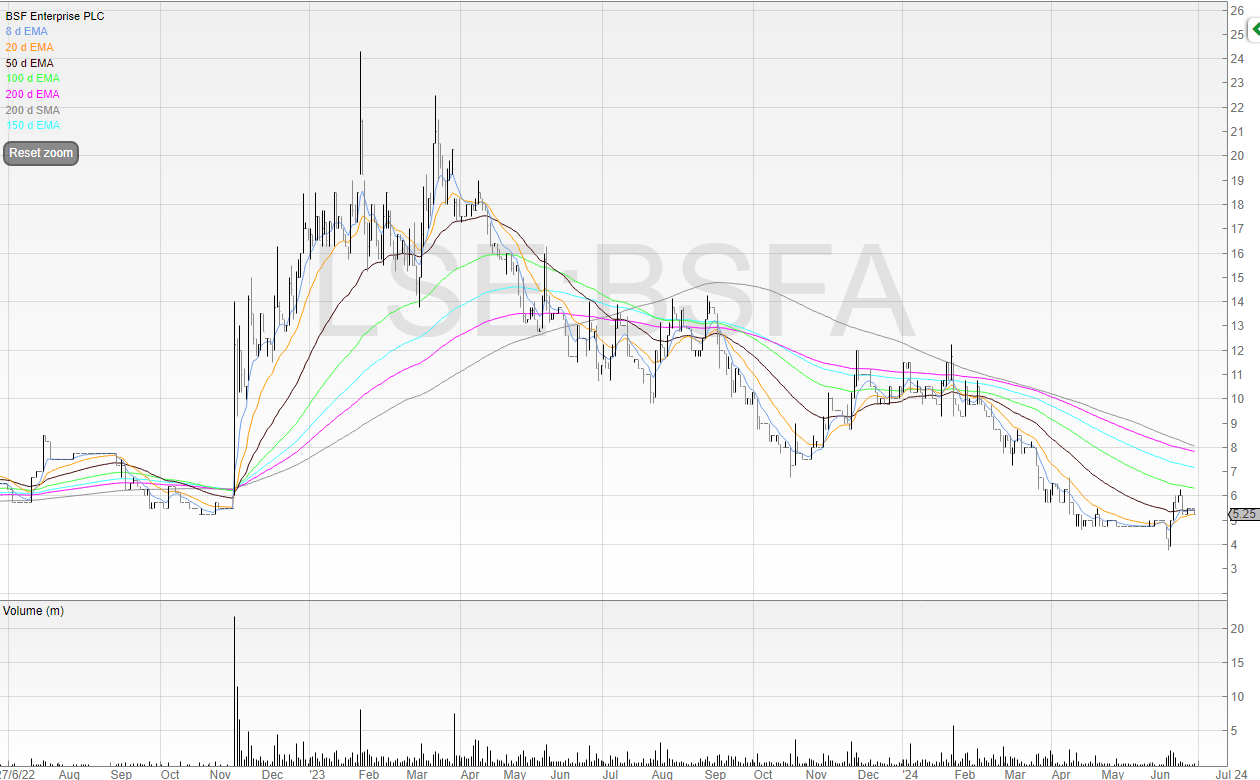

BSFA Enterprise (BSFA)

PCI Pal (PCIP)

Renold (RNO), picked at 34p

My first pick was UK based manufacturer of industrial conveyer chains and machine components Renold.

I mentioned that the company had a high debt position and that this could be a problem should the business see any turndown in business but felt that this was more than priced in with the PE less than 6 at the time.

And with the current uptrend I feel I that the market agrees with me (at least for now!).

Renold announced on 15 April that the results for the full year were going to be materially ahead of current market expectations and so it’s clearly firing on all cylinders.

I don’t see any reason to change my view and if anything, it has been strengthened in the news since my last update.

Supreme (SUP), picked at 112.5p

Supreme is well-known for its vaping division but outside of that it also has deep established distribution and trade sale relationships with Duracell, Panasonic, and Energizer.

In fairness, vaping does generate a lot of the revenue and much of the profit, and as I mentioned back in December the consultation was a big risk.

That’s now passed, and Labour has outlined their proposals (and are likely to be forming the next government).

So, unless Labour introduces much stricter regulation than what they have already lined out, many of the known about potential risks have been either removed or significantly reduced.

That doesn’t mean there aren’t risks any though, and my belief is that the modest PE ratio of under 7 reflects that.

Growth will be tricky and potentially impossible to forecast. Will retailers stock up on disposables before the ban in anticipation of vapers bulk buying? Or will vaping reduce as disposables are removed from sale? My belief is that vapers will continue to vape and use whatever products are available.

With the house broker forecasting a slight fall in profits for the financial year 2025 to £22.6 million, I feel there is risk to the upside here as the balance sheet has moved from a net debt to a net cash position given the company’s strong cash generation.

The acquisition of Clearly Drinks has gone down well with the market and is now clearly (pun intended) in a stage 2 uptrend.

Like Renold, I don’t see any reason to change my view here and believe that the thesis is playing out exactly as I hoped.

Afentra (AET) picked at 31.5p

I put oil & gas producer Afentra into my five picks because I believed in the management team who are Tullow old hands who had backed themselves by buying stock in the market.

The business strategy is sound too. By buying existing assets that the company believes can improve the existing lifecycle and economics, the company can generate strong free cash flows for the business which can then be reinvested into more assets.

So far, this strategy is bearing fruit, and with the share price not far off doubling already I feel there is much further to go.

BSF Enterprise (BSFA), picked at 9.5p

BSF Enterprise is as risky as they come and I highlighted this in December.

It’s unprofitable and is a blue-sky story that intends to replace animal tissue with lab-grown scaffold-free bio-equivalents. This means that the cultivated meat looks, tastes, and smells like animal tissue and so the potential market here is huge.

The company has failed to set the market alight though in recent months. A lack of tangible progress for investors to get their teeth into has seen the shares slump.

Whilst the cash position is still plentiful at £1.37 million as of 31 March 2024 meaning the company has a long runway, as mentioned in previously if it can’t progress to a level that raises the valuation of the company then the next fundraise may not be at a great price for current shareholders.

We’re in early-stage bull market, and anything can happen, but I would be remiss if I didn’t point out that this stock remains strongly in the speculative end of the market.

I have warrant exposure here but the stock is in a stage 4 downtrend, so I see no reason to buy it.

PCI Pal (PCIP), picked at 60p

PCI Pal provides payment solutions for Card Not Present transactions.

Until this week it was being sued by competitor Sycurio in the US. The UK trial was over, with a total victory for PCI Pal in both the trial and the appeal, as well as the weakening of Sycurio by invalidating some of its patents.

In my view, this is transformational news because for the first time since September 2021, the uncertainty of the lawsuit has been removed and the company can now focus fully on growth.

Management said before this trial that the case was designed to slow down PCI Pal and cause it to lose focus. Admittedly, some of the money raised in 2021 was redirected from growth to the lawsuit, but a small top-up fundraise of £3.5 million done in March (less than 10 percent of the shares in issue at the time) strengthens the war chest as well as the additional £1.3 million that should have been received from Sycurio (£1.1 million already confirmed).

I was supportive of this raise, and believe that PCIP’s ability to raise capital at a nil-discount to the prevailing price showed Sycurio that the company was ready to continue the legal case, putting itself in a strong position for the US leg.

I was expecting a settlement before the US trial was underway and now that it’s here I think this changes the company’s risk/reward.

Remember, the stock price was 89p before the announcement of the case back in September 2021. Granted, this was in a low interest rate environment and it was the post-Covid euphoric bull market.

Rates are now higher. And so the dynamics have changed, and there are slightly more shares in issue due to the top-up raise, but the company is in a far stronger position with a much lower valuation.

The company is expected to be both cash generative and produce its first year of profitability in FY24. And now the lawsuit is resolved, it could leave PCIP open to a bid.

I would hope any bid (should one come) would be well in excess of the 90p offered by Sycurio.

The stock is approaching 52-week highs and a rally to 73p would see it testing 30-month highs.

Get value stock insights free.

PayPal, Disney, and Nike recently dropped 50-80%.

Are they undervalued?

Can they recover?

Read Value Investor Daily to find out.

We read hundreds of value stock ideas daily and send you the best.

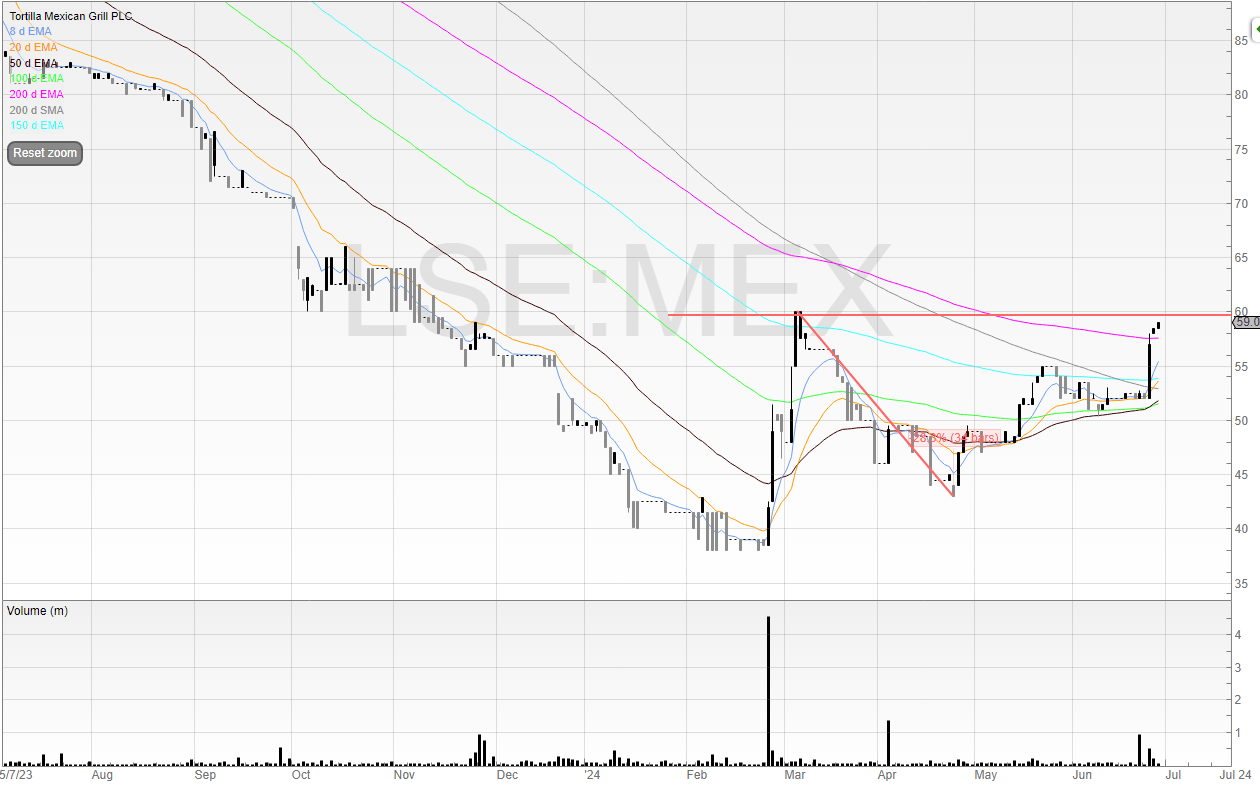

Tortilla Mexican Grill (MEX)

Tortilla has been a poor performer since its IPO.

I’ve covered this in previous issues but here’s the chart since the stock floated.

Tortilla is setting up for what could be a breakout into stage 2 territory.

It announced it had bought its largest European competitor Fresh Burritos for €3.95 million. Surprisingly, at least to me, it did this without raising equity.

The company floated and raised money to grow. It’s done that, but if the rollout can now be self-funding (and the evidence suggests it can be) then the share price gains could be significant.

I don’t believe this is ever going to be a high quality business but if there is some consolidation before a breakout I’d certainly consider taking a short-term trade.

Pensionbee (PBEE)

Pensionbee is an online pension provider and I believe potentially an overlooked business in the UK.

Why? Because Pensionbee has incredibly sticky customers. Once people have a pension somewhere, they’re unlikely to move it.

That means Pensionbee could kill its marketing tomorrow, and whilst it might not generate much new business, its existing business is unlikely to leave for some time generating future cash flows.

It looks like the business is starting to scale and is almost positive on an adjusted EBITDA level (expecting to be positive in 2024). Assets under Administration (AuA) increased 44 percent to £4.9 billion, and marketing spend efficiency increased too with net flows per £1 of marketing spend jumping 22 percent.

The US strategic partnership which will be part-funded by Pensionbee opens up an even bigger market, as a US-based global financial institution wishes to use the Pensionbee brand to grow its market share.

And whilst the stock must be classed as expensive as only £1.25 million of net profit is forecast for 2025, it is easy to see how the predictable and repeatable revenue can scale here and build in the future.

Notice how since October the business has been powering up through the gears. It’s also been giving very little back in terms of pullback.

I’ve got a small holding here and will watch to see how this develops.

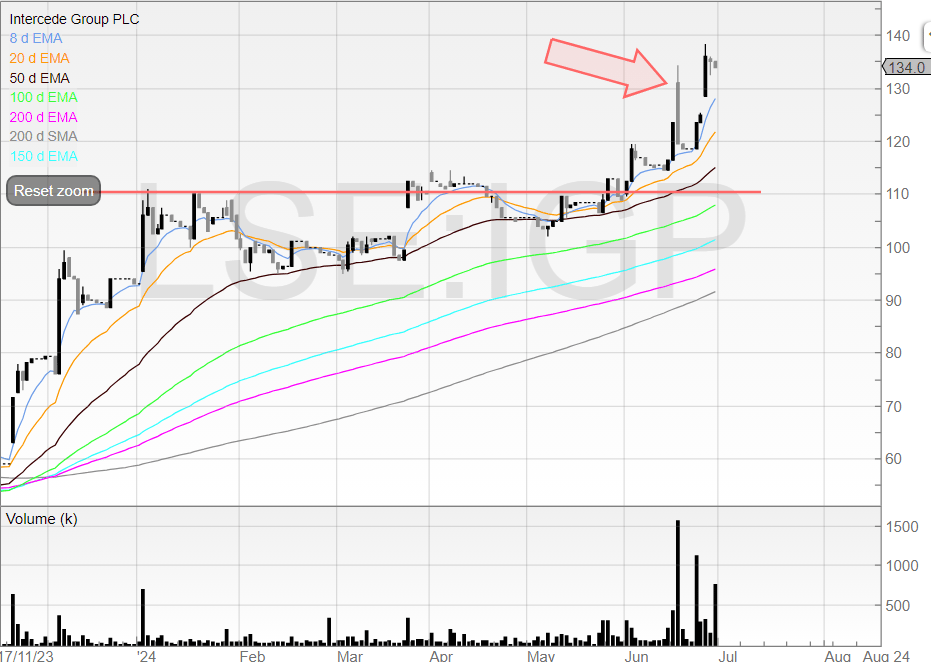

Intercede (IGP)

Intercede is a technology company that offers identity and credential management software. One of its products includes MyID, and since the new chief executive took the helm the business has been focused on expanding its product suite and increasing sales.

It’s taken some time (although there was of course a pandemic since he took over in 2018) but sales are now starting to gain traction. And with a gross margin of 97 percent, additional sales fall to the bottom line in earnest and convert into cash.

That has been shown by the company’s full year net profit for the financial year 2024 jumping to £6 million from £1.3 million and cash accelerating to £17.2 million versus last year’s £8.3 million. With no debt the balance sheet is rock solid and there is a hint of value accretive acquisitions in the pipeline to accelerate growth further.

The company has done its best to tell the market that due to a large one-off contract 2024 that 2025’s profits will be slightly down. One-off contracts are good in my book, because it shows the company can win big projects and it can also mean there may be future contract wins of that calibre in the future.

Nevertheless, with a punchy PE ratio of 25, the market is pricing the company as a strong turnaround. And with eight profit upgrades already I am inclined to agree.

I am long since the breakout marked on the chart and think this is an exciting share to be in. I’ll be looking to average up and increase my holding here.

You’ll notice that the stock had results recently, gapped up, and was heavily sold into.

I opted not to take any profits because for me it was a Trade 2 Hold (T2H) and not a Move 2 Move (M2M).

Had I been in for a quick M2M then I would’ve been pressing the sell button. But because I believe this is a longer term swing trade and therefore a T2H I sacrificed the short-term volatility in my favour in the hope of a bigger gain in the future.

I wasn’t expecting to see the stock rally above this price so soon but it’s definitely a positive.

Cavendish Financial (CAV)

Cavendish Financial is the result of a merger between Cenkos Securities and finnCap. These were two mid-sized brokers active in UK equity capital markets who have now joined forces and are no longer competing against each other. As a result, £7 million of annualised cost savings have been locked in already as of December last year, and delivered quicker than forecast.

The business has a strong balance sheet too with cash totalling £20.8 million as of 31 March 2024 against the company’s market cap of £48.1 million.

Full-year pro forma revenues are up seven percent to £54 million. This isn’t rapid growth, but build in the cost savings and the business is much leaner than its previous two entities. And if you believe the interest rate cycle has peaked (my belief is that it has), then risk will be back on the menu for UK stocks and deal flow should pick up. With over 200 clients, Cavendish is in a prime position to take advantage of this rebound in the UK small cap space.

I’m long here and think there is more to come. But we need to see the next update as we’ve been in the dark on trading for nearly three months.

Filtronic (FTC)

Filtronic is a UK-based company that produces products that are used in telecommunications infrastructure, as well as aerospace and defence.

More excitingly it is involved in low earth orbit (LEO) space markets and is working with SpaceX – the company founded and ran by Elon Musk (who most likely needs no introduction). It has a strategic partnership with SpaceX and there is the option for SpaceX to take some equity in Filtronic with 10 percent of its share capital.

The company has been on a huge tear so far in 2024 hitting highs of 71p from a starting price of 21p in January but Filtronic has been winning more contracts and bigger contracts which are yet to fully show themselves in the financials.

It goes to show that companies can and do have renaissances, as Filtronic has been going since the Dotcom area, and enjoyed a significant price appreciation in its share price during this period.

My belief is that the company has now turned a corner and this could be just the start of a brighter future.

I’m long but I want sideways trading to be able to average up.

The problem here is that although it’s clearly a stage 2 stock, it’s choppy and just keeps trending up.

It’s not allowing a low risk entry for another position. My view is to keep an eye out and wait for consolidation.