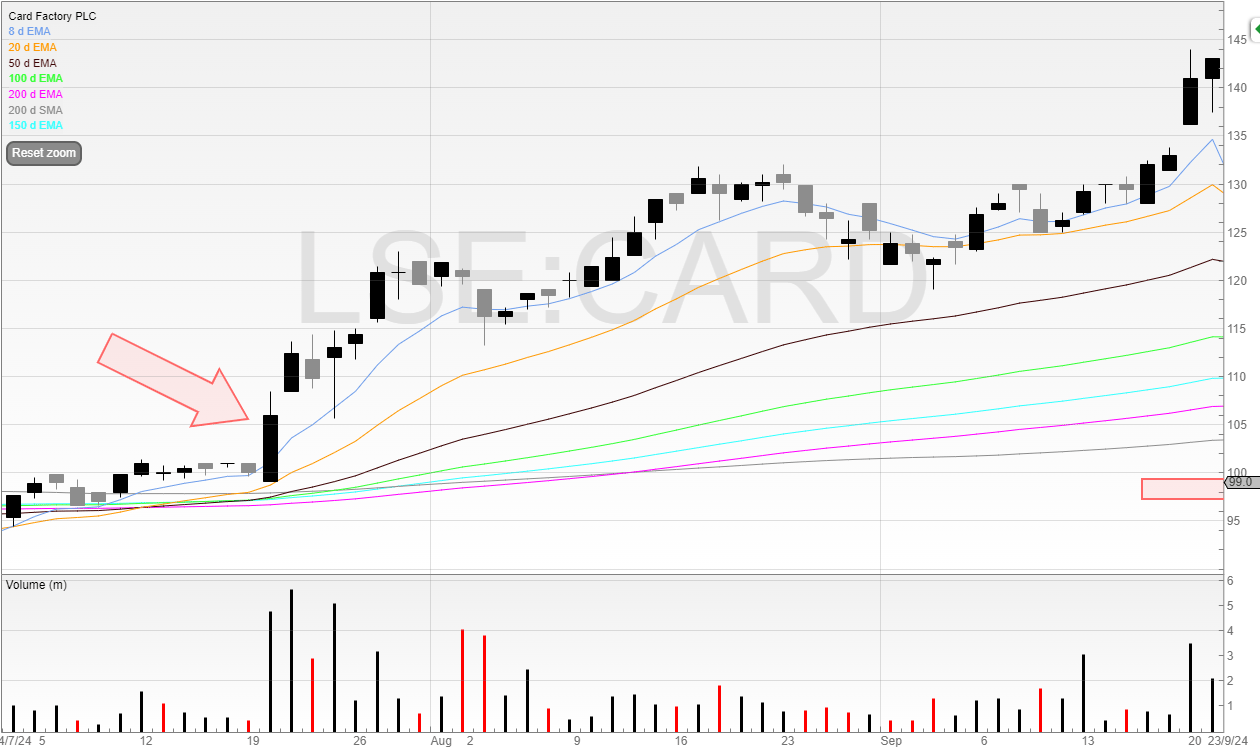

A few weeks ago I emailed to say that the seller Teleios had cleared by announcing it sold all of its shares in Card Factory (CARD), and that this was a buying opportunity.

The shares rallied from 106p to 143p because there was no overhang in the stock.

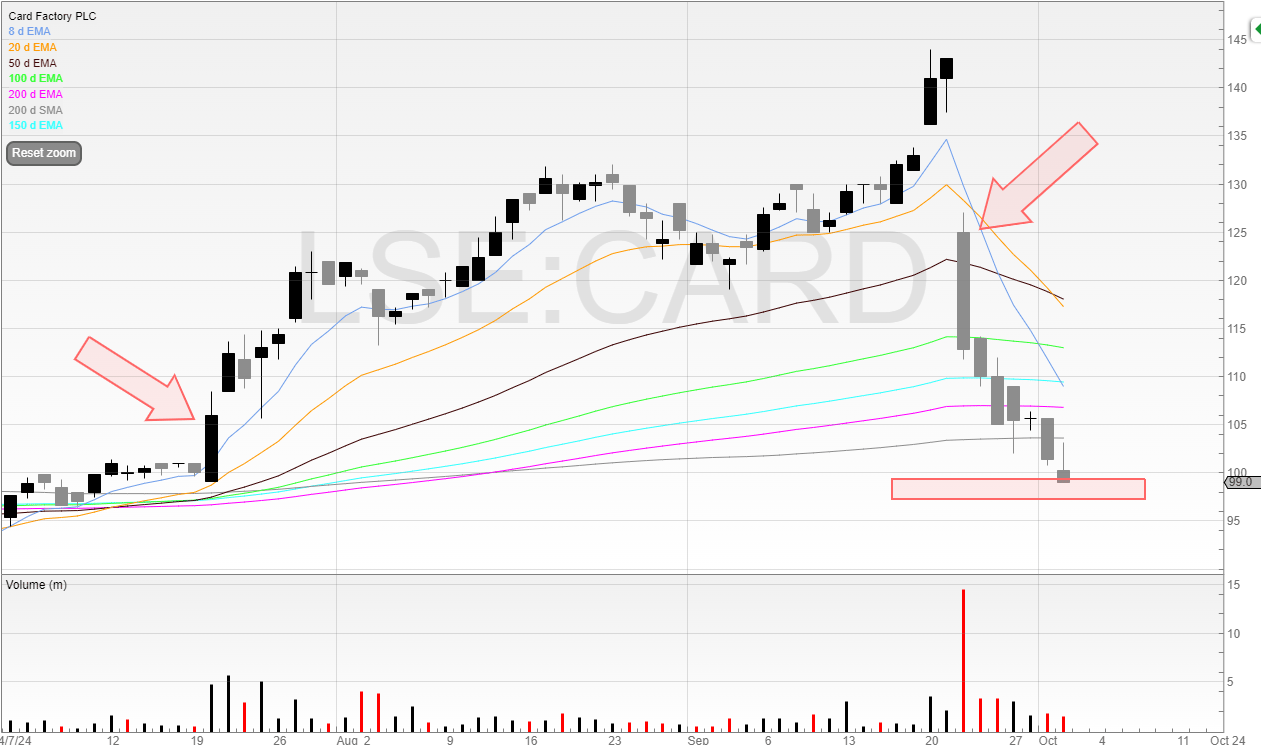

However, the results left the market worried.

Card Factory reiterated its full year guidance. In line. But was it fine? In this instance, no.

Higher wage costs have hit H1, and so there’s a big H2 weighting now.

What this means is the business is going to have to perform brilliantly through the key Christmas trading period in order to deliver its full year guidance.

And we have to remember that Card Factory’s online proposition sucks.

Which means it’s reliant on bricks and mortar sales.. which in turn are reliant, to an extent, on good weather.

If it pours down, that means less sales. If it’s exceptionally rainy for a few weeks, that means a bigger fall in sales.

Yes, people who’re buying a card may go and buy that card another day. Or they might log online, buy it there, and then realise how easy it is and never go back into Card Factory again.

We’ve also got to factor in that nobody likes H2 weightings. Nobody.

I like them as much as I like getting to King’s Cross in good time only to find out my train is cancelled, which means schlepping it to Pret and ordering a Cheese Ploughman’s.

I forgot, it’s been gentrified to “Posh Cheddar & Pickle Baguette” now. Probably so they can justify fleecing us, but I’m digressing…

The point here is that what was an attractive proposition now has uncertainty built in.

And when there’s uncertainty.. there’s a sell off.

Which is exactly what happened.

Annoyingly, I missed my short entry for by a few ticks, and then watched the stock fall with no position.

This was a great opportunity to take off any remaining long positions as there was now a cataylst to the downside, and the optimisim of Teleios clearing had now worn off.

This is why understanding the story and the narrative that drives a stock is important.

However, Card Factory is now entering the zone beneath 100p.

Lots of stop losses will be around 98-100p getting triggered.

My view is that there is a scalp long opportunity here, to get long in the stop loss liquidity.

Obviously, if CARD keeps falling, I’ll be cutting the loss quick.

But my view is I risk 2-3p and look for a 4-6p rally.

This is similar to how I’d trade the breakout retest. And if don’t know, I’ve got some free training you can watch here on my course page.

It’s not the most exciting trade. But as Ben Affleck says in Boiler Room: “We aren’t saving the manatees here.”

Card Factory currently trades on a PE of 6.8.

It’s cheap - but only if it doesn’t warn. And I won’t be around long enough to find out if it does.

At least not whilst I’m holding.

And whenever you’re ready..

There are three ways I can help you.

If you’re wanting to profitably trade UK stocks then I’d recommend my entry level course:

Spread Bet Accelerator: The exact system I use to trade and get you to your first £10k in profits. Use the code GIVEME99 for a subscriber discount.

Want more trading ideas and a clearer view of the markets?

Buy The Bull Market Premium: Free 30-day trial covering potential trades and insights as a professional trader.

Want to work with me personally?

Alpha Trader is where I work closely with traders who want to get to a professional level.

We have our own channel, meet up, and have fun trading and learning [opening soon].

Speak soon!

Michael