Welcome to the January edition of Buy The Bull Market. And firstly – I’d like to thank you for joining me on this new venture.

My wish behind this project is to grow a community of like-minded people and also share what I learn in my journey as a full-time trader.

That means an extra pair of eyes and ears in the market: stocks I’m watching, things to be aware of, and relevant themes of the month. And you can share your thoughts in the comments too (your email will show up as your username)!

What is Buy The Bull Market?

Lots of newsletters have a theme. Goldbugs will write purely on gold. Uranium Insider has been going for several years now as uranium starting getting popular in 2021.

What’s my theme?

There are only a few things I truly believe about the market:

Markets are not efficient which means people like us can make great profits.

You can do insanely well just by being long in a bull market.. and making sure you hit collect.

This is the beauty of stocks. Mostly, they go up. It’s not like crypto which is full of whackos, or forex which is for smart people.

You can literally make money in stocks by buying an S&P tracker, automating a direct debit, increasing it when you get a pay rise, and doing nothing. You don’t even need to short (although these sometimes can be great trades).

But let’s be honest. That’s not what we’re here for.We want something bigger. A challenge. The market is a big infinite complex puzzle. A treasure hunt.

And the beauty is you’re justly rewarded for your efforts. If you trade and manage your money well, you can earn outsized returns which far surpass what you can earn as a salaried employee.

That in turn means you can support your family, look after parents and grandparents, live stress-free, and ultimately buy back your time (but if you want to buy a Ferrari – that’s OK too).

So this newsletter’s underlying thesis then is to find those inefficiencies where we can make outsized returns.. and to ride the coattails of the bull market, whenever they may come.

But that doesn’t mean I intend to only write during bear markets.Some of my best trades last year were shorts. Again, mispriced stocks due to markets not being efficient.So long as opportunity exists.. then is something to write about.

Macro outlook for 2023

I wrote a big Twitter thread on the macro outlook for 2023 from some of the world’s biggest financial institutions.

Almost all of the suits were bullish. They have to be, because the danger is if they tell their clients to sell everything they may pull their money, and then they’d lose their retainer fee! That won’t do.

But whilst it’s interesting to see what they say, it doesn’t make much of a difference to me. Our goals as traders is to find asymmetric risk/reward opportunities. Regardless of a bull or bear market, these opportunities will show themselves.

How do I see it?

At the start of last year John Hughman and I were talking about inflation and the rise in prices on the Investability podcast, and energy bills leaving people worse off.

I think this is likely to continue although many stocks are now looking like they’ve bottomed. I think the easy money on shorts has been made, and I’d think twice about going short now.

The next big card is the end of the Ukraine war

Back on Vaccine Day in November 2020, when news of a vaccine hit the market, it started a huge bull euphoric bull run which everyone enjoyed.

However, I didn’t fully capitalise on Vaccine Day at the time because I didn’t have a plan. I saw a big spike in volume and a share price rise and saw that this was across all stocks, so I knew it had to be something hitting the market. A quick check on Tweetdeck and I saw news of a vaccine had been released.1

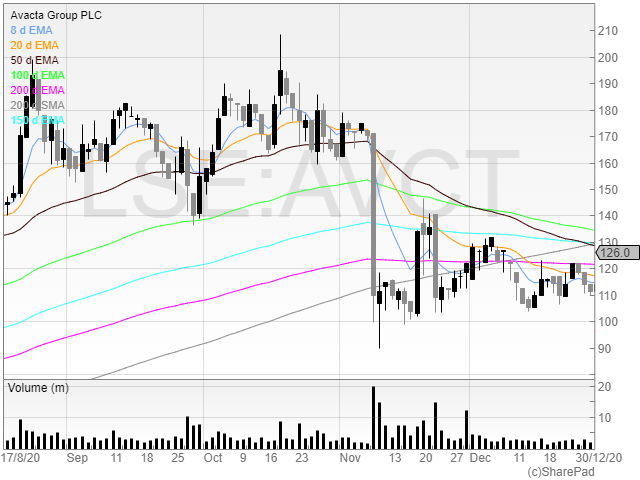

Unfortunately, I wasn’t ready. Lots of things immediately went up. Lots of things immediately went down.Covid testing stocks were slammed. Here are popular Covid stocks at the time AVCT and NCYT.

Free 1-month SharePad worth £74 for new subscribers

Notice the steep fall from 11p and even goes below 6p. A near 50% move in a day.

Unsurprisingly, retailers, airlines, leisure & hospitality stocks all hit the roof.

My mistake here was clear.

I didn’t have a buy list prepared in case of vaccine news.

Once I saw the news confirmed I knew I needed to get long quickly. But I didn’t have a go-to list to rattle through and buy. Instead if was “I need to buy something.. What sectors will do best? Oh, JDW will move, let’s buy that”.

Vaccine Day was a great day for me. But it could’ve been much better. And anyone long Covid testing stocks should’ve been prepared for that day to come.

That said, it could also have been a lot worse. I was just about to go to the shop for a bottle of sparkling water, so if I’d been five minutes earlier I would’ve missed it completely. Sometimes you just need a bit of luck, but you need to keep your seat at the table in the first place to benefit.

The key stocks affected by the Russo-Ukrainian war are the Russian basket (some of which have now been delisted and some brokers don’t actually let you buy the remaining ones – JRS for example) but also Ferrexpo.

Here’s the chart of Ferrexpo.

Classic signs of a stage 4 stock even before the invasion.

It was already well off its highs before the war and we can see the big lurch down on the day of the invasion.

However, the chart is looking a lot better. Let’s look closer.

Ferrexpo reacting to Ukraine invasion.

Already the stock is nearly 70% off its lows and threatening to break out above all moving averages. Whilst I’m cautious of saying we’ve seen the bottom in the stock – further Ukraine gains and a ceasefire would definitely see gains in the stock.

However, we know the market isn’t efficient. Nobody expected Russia to invade Ukraine even though Putin did it with Crimea. Nobody expected Russia to actually turn off the gas even though Putin had threatened it before in 2018.

What a sourpuss.

And this threat wasn’t even new in 2018 either. Here’s a cartoon from American Bill Mauldin in 1982.

Market is efficient? This risk was flagged 41 years ago.

Trump got laughed at by German diplomats when he suggested that Germany would become “totally dependent on Russian energy if it does not immediately change course” at the UNGA in 2018.

And guess what?Four years later Germany is shutting off hot water in gyms, dimming lighting on national monuments, and cooling its swimming pools.

You can bet they’re not laughing now!

When you put your head into a lion’s mouth, you shouldn’t be surprised if it bites.

If Ukraine wins

If Ukraine wins then Ferrexpo will be out of the traps quickly. Of course, if Ukraine’s infrastructure is damaged so heavily that the business can’t function, it’ll sell off eventually.

But not before everyone has piled in.

Gas prices are already coming down and are now lower than when Russia first invaded Ukraine. It’s hard to believe that a beaten Russia will suddenly want to fill the market with gas, but with war over then gas prices may take an initial hit.

Fertiliser prices have been high as a result of high gas prices. Nitrogen is a requirement for some fertilisers and so there may be a knock-on effect here.

If Russia wins

If Russia wins? That would be bad news for everyone. At the moment, the West has a great opportunity to fight a proxy war through Ukraine and drain Russia’s resources. Call me cynical, but sadly I think it may be in the West’s interest for the war to be prolonged for this reason.

If Russia wins then I’d expect a sharp lurch down in the markets initially. Airlines may take longer to recover, defence will move (as we already saw with BA. at the start of the war) upwards, but this shouldn’t affect leisure & hospitality in the long run unless they have some exposure to Eastern Europe.

If war continues

I think this is the most likely outcome. The West has dragged its heels on sending resources to Ukraine, and as mentioned above this is a great way to use another country to bleed a common enemy.

However, many stocks look like they’re already bottoming and have started turning upwards. I’ll be looking for them to break out of extended bases in order to get long.

That said, there is always the risk of Russia escalating with nuclear weapons. Even tactical battlefield nukes have the potential to send a serious jitter through the market.

If that happens – make sure you’ve got a plan. I intend to short the FTSE 100 if I see any mention of nuclear weapons being used.

And in the (hopefully unlikely) event Russia does wipe London off the map, then two things will happen:

I’ll be dead

The UK will retaliate

If that comes to pass, I suspect our biggest worries won’t be about how much long exposure we have.

In any case, here are 5 stocks (and maybe a few more) I’m watching.

Stocks to watch in January

AO World (AO.)

I mentioned AO. World in my Buy The Breakout newsletter on Monday.

The stock had rallied sharply and was surprisingly strong. Then guess what? It announces that it was revising its profit guidance from £20m-£30m of EBITDA to £30m-£40m. Funny how that happens!

Unsurprisingly, the stock sold off. As I wrote on Monday, those who’re in at the low 50s will be looking to take profit. That’s exactly what happened on this opportunity.

However, we may now get a breakout retest opportunity and so for that reason it’s not worth taking off your watchlist just yet. A stock I didn’t mention (and in the same sector) is Marks Electrical.

Marks came to the market in November 2021 and has done what most typical IPOs of that era did: dump.

But the trend appears to have reversed, and the business is performing well.

I’ve set an alert at the closing all-time high of 128p. I think it’s worth keeping an eye on for now.

Afritin Mining (ATM)

Afritin Mining is a tin mining company that owns the Uis Tin project in Namibia.Now, mining in Africa sounds dodgy. I get it. But stay with me..

It’s revenue generating. It’s increasing its operations. It’s not the basket case you’d immediately assume.

That said, the stock price is tied to the fortunes of the commodity it produces: tin. And that hasn’t been having a great period.

Source: https://markets.businessinsider.com/commodities/tin-price

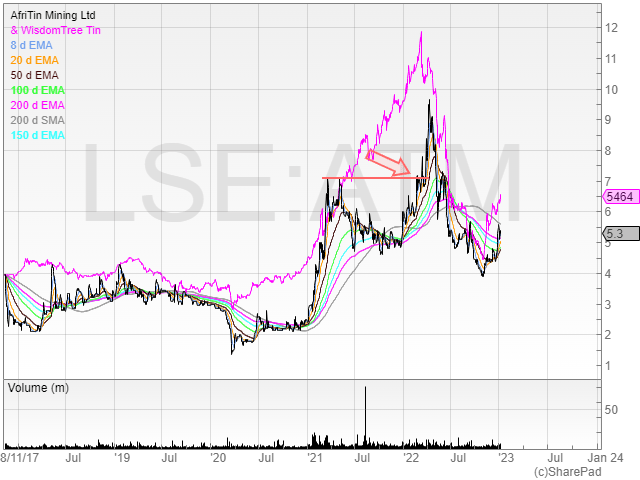

You can also overlay the Wisdomtree Tin ETF over the Afritin chart on SharePad. Here’s how that looks:

Correlation since IPO – we can see that ATM catches up eventually.

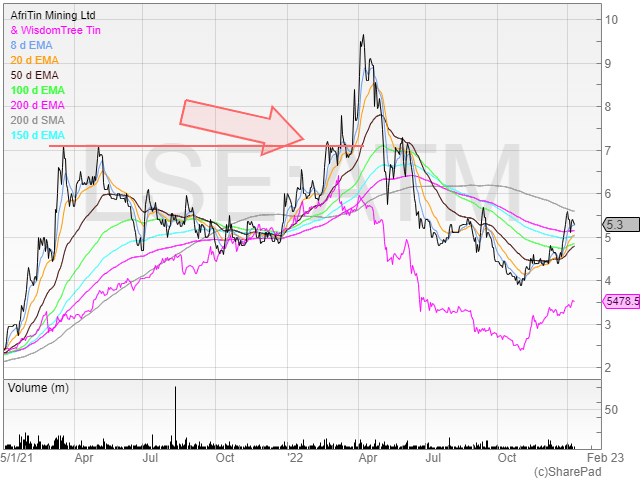

But here’s what happens when you show the correlation from 2021.Be careful!

Here’s a chart from January 11th.

5.6p is a breakout area

You’ll notice that the stock did tag the 200 EMA (pink line) earlier in September and trended back down to around 4p. I’ve marked resistance at 5.6p because that’s the recent high and the high I’d feel comfortable trading from.

The risks here are:

The stock is illiquid

The tin price could collapse

Bearish sentiment sees punters sell shares across the board

Remember, this is a SETSqx stock. There’s no order book here. If punters get scared and sell then market makers will put stink bids in because they know desperate people sell cheap.When dealing in SETSqx stocks you have to think like a market maker. They’re on the other side of your trade. They follow people on Twitter. They’re in our Facebook group.

I’m not saying you shouldn’t ever sell cheap, because sometimes selling quickly (and getting ripped off for price) is sometimes the best thing to do. But what I am saying is beware of it. One trader once told me “Sell when you can, and not when you have to” – and it’s stuck with me ever since.

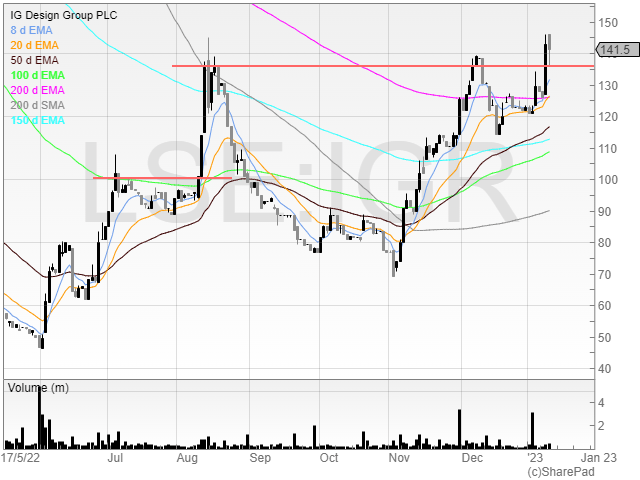

IG Design (IGR)

I’m watching this relentless tick up on my screen and break out (see below).

For some reason the price started moving. Don’t know why!

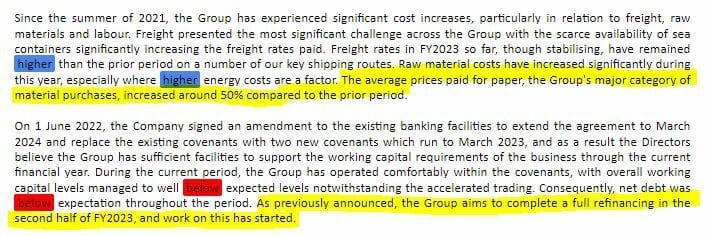

This is a lovely cup and handle breakout but you never know – it might come back for a retest.I’ve highlighted two pieces of information here below.

My highlights in yellow

Firstly, the average price of the group’s major category of material purchases (paper) has gone up 50%. That’s not good unless the company can pass it onto the customer or has hedged out its supply.

The second is more important:

As previously announced, the Group aims to complete a full refinancing in the second half of FY2023, and work on this has started.

Is that equity? What will that look like?

If the board are sensible and play the game, they’ll use this period to get the share price up and decrease potential dilution.

Management have also said that:

The Group has also seen stronger trading in certain Everyday categories than previously had been anticipated. Due to this, the Board believes that the financial results for the full year to 31 March 2023 will be ahead of expectations, delivering a small full year adjusted profit before tax.

I think this stock is worth watching for the breakout retest.Here’s the zoomed out chart.

From the above we can see that the profit warning in January 2022 drove the price down to as low as around 50p. The stock is now well off its lows, which tells me that the trend has (for now, at least) changed to the upside.

Let’s look closer.

The stock did pull back for a retest and maybe it’ll come back further. But I think this is a stock worth keeping on your watchlist if not for this base but for future bases. We could still be early in the trend here.

Just Eat Takeaway (JET) & Deliveroo (ROO)

I love Deliveroo. The fact that you can just order anything and have it delivered to your door (they even carry it up the stairs to my apartment) is amazing. And it’s why, at least in my view, this business model of drop offs is likely to stay.Last-mile delivery is a loss-making enterprise for a lot of these start ups. Why?Because they don’t have enough scale. Think about it. A rider with 5 drop offs realistically needs those 5 drop offs to be within a reasonable difference to save both time (and potentially fuel for those outside of London).

But with so much choice, some people will pick and choose which apps they use and which apps they subscribe to. Once they subscribe, that will be their main app most of the time (free delivery).

This is why the industry needs to consolidate. The economics become significantly better with more users and by acquiring those that are struggling you get scale.

It’s a long way to come. But let’s be grateful for all those VCs who are subsidising cheap delivery.

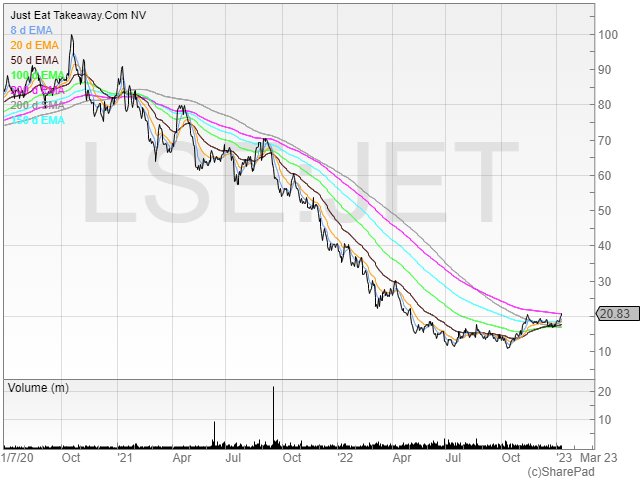

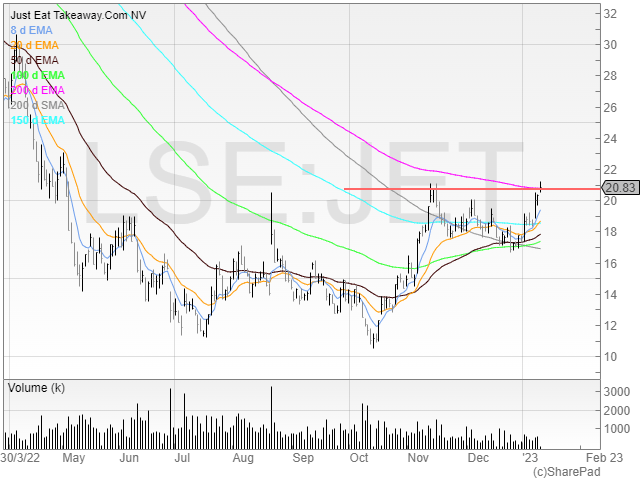

Anyway, here’s the chart of Just Eat.

This stock has been marmalised, given that it traded at 10,000p two years ago. At 80% down, it just goes to show that if you buy stocks and don’t pay attention, this is a great way for getting poor quickly.

However, the stock is also nicely off its lows. Let’s look closer.

This is looking like a cup and handle breakout.

There are a number of positives here:

We’re nearly 100% off the lows

The stock has marked the 50 EMA as support and bounced

Price is threatening to break the 200 EMA (not been above this since April 2021)

It’s SETS traded so liquid

Obviously, Just Eat is reliant on consumer’s not feeling poor and ordering takeaway. But if people don’t go to restaurants, maybe they order takeaway instead? But then if gas prices are down, maybe people will have more money than they think? What happens then? Who knows – I’m not smart enough to do all this work. I’ll leave it to the suits and use the chart instead.

I think this could be a potential trend forming here so it’s worth watching.

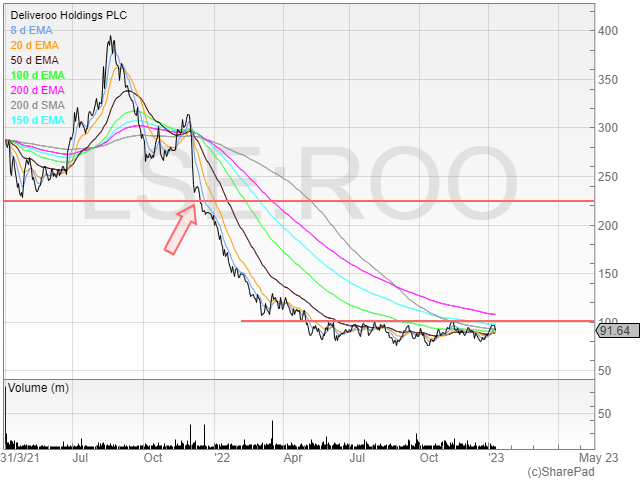

But what about Deliveroo?

This is another Covid mega-flop. Here’s the chart.

I lacked the minerals to short into the all-time low as the stock had fallen so much already. You can guarantee it would’ve rallied hard if I had.

Deliveroo has been rangebound now for the last eight months.

Is this an extended stage 1 base? It could be.

But we’ve not had a trading update since 21 October 2022 – so I’d be wary of taking any position at the moment.

Especially when the last news wasn’t exactly great – the company revised its guidance downwards.

“GTV growth now expected to be in the range of 4-8% constant currency, the lower half of the previously announced range (4-12%)”

I’ve set my alert for 100p.

100p is resistance but also a Big Round Number (BRN). If the market was efficient, BRNs wouldn’t be a thing. But it isn’t, so they are.

Though I think it makes sense to wait for the next update first and get any potential earnings risk out the way.

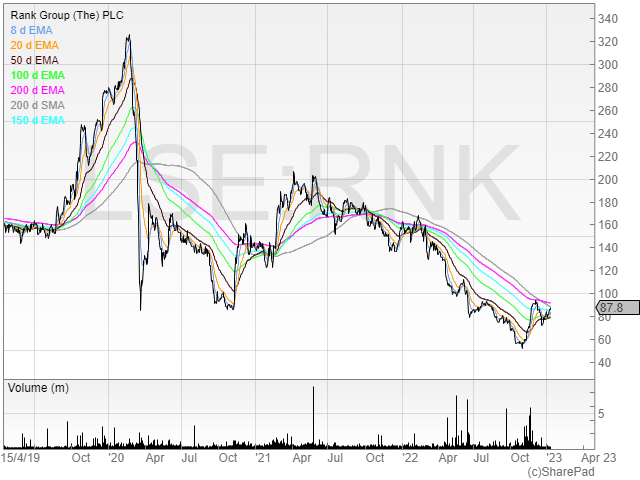

Rank Group (RNK)

Rank is a gambling company that owns casinos including Grosvenor casinos. Personally, I hate casinos, because I hate losing. But other people are quite content to lose money looking at flashing lights and spinning wheels, and given Rank’s financials it’s clearly a popular pastime for many.

Gambling companies did brilliantly during Covid although the online ones did far better than Rank – casinos weren’t open during lockdown and so Rank didn’t fare as well.

What a rollercoaster!

But a series of profit warnings have damaged the price. From a post-Covid high of 200p the shares sank to as low as 52p in October 2022.

However, the stock has bounced back since to print a recent of 93p.

To me, this looks like a potential cup and handle setting up.

Back in 2020 people told me I shouldn’t be trading cup and handles in stocks that were well off their 52-week highs. We know what happened next. There’s no guarantee these cup and handles will work, but you have to work off the available facts in the price action.

If there was enough sell supply in the market then the price would still be at the lows

Demand is clearly outstripping supply (for now)

The big volumes in November suggest a change in trend

We’ve also seen the dip bought in the low 70s.

We had a profit warning on the 16th December, but the price has started rallying since. Is the market starting to look ahead?

“We now expect Group LFL underlying operating profit for the year ending 30 June 2023 to be in the range of £10m to £20m, with the main variable being the performance of Grosvenor venues. Due to the high operating leverage within Grosvenor, and its relative importance to the Group as a whole, movements in its NGR will have a significant impact on the Group’s operating profit for the year.”

We’re not told the previous operating profit expectation, so we need to go back and find it in a previous RNS. It would be great if companies would tell us the expectations but this is a great way for the company to hide bad news – plenty of people don’t even bother to check!

I couldn’t find it mentioned at the time but checked the forecasts feature on SharePad.Go to Financials > Forecasts and this is part of what you’ll see.

1-month free trial worth £74 through me

Always double check this in the last trading statement/results if you can, but SharePad pulls the data from its data provider. It’s not always correct, but I use it if there’s nothing else and the company isn’t a tiny microcap with likely no coverage.

Rank’s last update didn’t sound too clever, and it said it would announce its interim results on 16 January 2023.

In my opinion, even if the stock does break out before then, it doesn’t make sense to play this trade before earnings. Especially when we can’t be confident they will be at least in-line or better.

Why take unnecessary earnings risk, unless you’re a gambler?

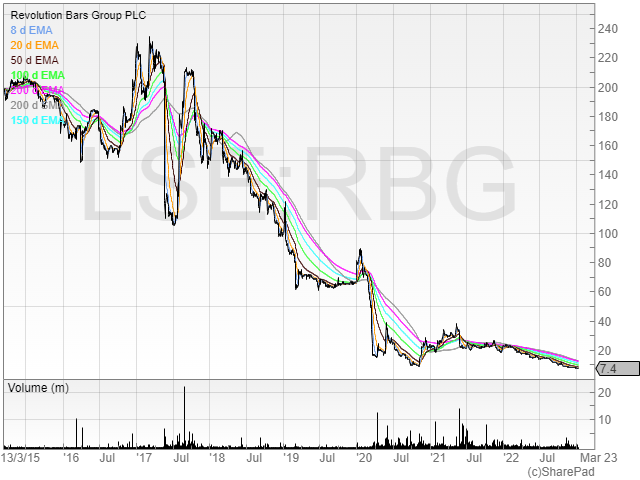

Bonus section: Nightcap (NGHT) & Revolution Bars Group (RBG)

The consumer discretionary has been whacked. People are spending less, and saving more, and this has translated into stock prices sliding.

But this is where I see a big opportunity in the future.The Cost Of Living Crisis (COLC) won’t last forever, and consumers will start spending again.Indeed, we only need to look at Ten Entertainment Group’s figures to see that the spend hasn’t evaporated everywhere.

Two stocks that are on my watch list (although they need to rise a lot before they become buys) are Nightcap and Revolution Bars Group.

These two are similar sector stocks and competitors but worth watching because they’ve been relentless hammered.

NGHT trading at all-time lows – definitely NOT a buy right now

Nightcap has increased its revenue run rate to above £50m now. And Christmas trading was positive.

Nightcap Trading Update – 11 January 2023

At £15m market cap, there is big scope for this company to become a future multibagger. I want to see signs of an uptrend first though.

I like management here because they decided to raise a load of cash when the market was frothy – the exact right time to be raising. It means the business has a healthy cash position and management have decided to be prudent and slow expansion to conserve cash. As the directors are heavy holders (and Allenby has confirmed this) the directors aren’t in any rush to dilute themselves unnecessary. Does this mean the company won’t place? Absolutely not – but they’d be hurting themselves as owners too.

Revolution Bars Group is the more established business. Don’t be fooled thinking it can get back to the highs though. The dilution here has been unbelievable.

No doubt shareholders wish they’d accepted the Stonegate offer now!

Like it’s younger counterpart Nightcap, Revolution is profitable and cash flow positive.

Single digit PE but awful chart… for now.

My view is to keep these on your watchlist and look for extended bases to get long from.

Ending note..

Thanks for reading!Buy The Bull Market is a work in progress. I want to know what you want to see.

Tell me what you like. Tell me what you don’t like. Tell me what you want more of.

February edition will be released on Tuesday the 7th.

1 For those who don’t have Tweetdeck it can be reasonably useful (it’s also free). I’ve set up my own “Curated” column which is a Twitter feed consisting only of macro accounts. This pretty much means I only see the headlines (which is often all you need) and is my “news”. I don’t read or a watch the news, and if I want to know more about a specific topic I’ll use Google.

The post The market was never efficient first appeared on Buy the Bull Market.