There’s no doubt the market is turning. Cash outflows have reduced as we’ve seen in the asset managers, and takeovers are still occurring.

Here’s an excerpt from this article.

Yesterday was Keyword Studios (KWS) with a bid of more than 70% premium.

Today it’s XP Power (XPP) with a 68% premium.

But look closer..

If you’ve followed this company you’ll probably see it.

There were two approaches not mentioned.

One on 24 October 2023, and another one the next month on 5 November.

Why does this matter? Well, the company did a fundraise a day later on 6 November. But they announced it on 6 November, which means that the deal will have almost have been in progress 5 November.

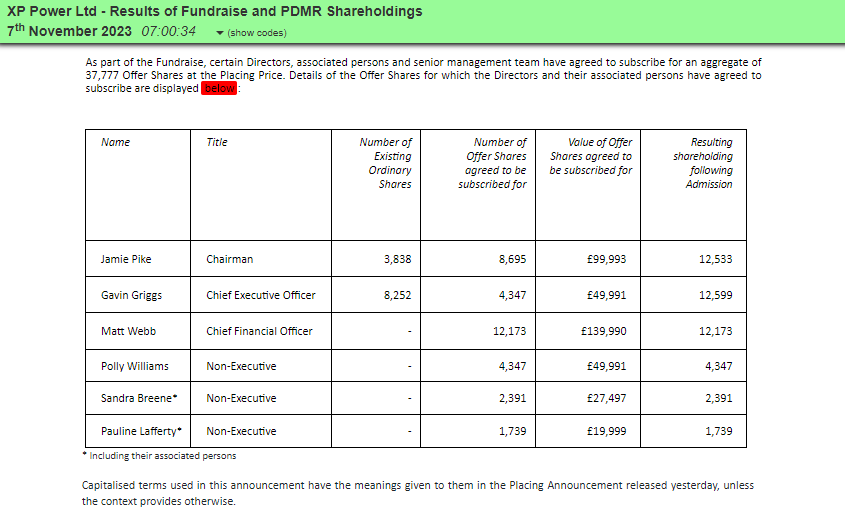

And look who subscribed for the deal.. six directors!

A big well done to these directors who loaded up in the 1,150p placing a day after rejecting a 1,850p offer from Advanced Energy.. that they didn’t tell anyone about.

If only I’d known about that bid when I was offered the placing.. I’m sure I would’ve taken it too!

But recently I’ve been looking at the commodities space.

As I said in my YouTube video, commodities will be a big driver of this new bull market.

The fact is, we need more and more of metals and minerals that aren’t hugely available. Therefore, prices rise. You don’t need to be Warren Buffett to know that. Which is good, because I’m certainly not.

And if you’ve been following any financial news you’ll know that gold has broken out and now rallying into new all-time highs.

This is significant.

Why?

Because gold broke out of a near five-year high.

When price breaks through a significant level, it’s telling you that there may be a significant move to come.

Which is why I love sideways consolidation and significant resistance breakouts.

I don’t trade commodities myself, but that is one nice cup and handle.

But higher gold prices mean higher profits for gold miners.

There are two ways to play here..

You buy the gold miners with the highest costs, because if they’re making small profits and the gold price risers, then profit margins can materially increase.

Or you can buy the gold miners with the lowest fixed costs because they’re already nicely profitable and additional price rises in gold drop to the bottom line (though this may not be a huge percentage increase).

My view is that it depends what’s in the price.

And personally I prefer companies that generate cash - and plenty of it.

I’ve had this company on my radar for two years and finally I believe there is a catalyst for a move.

Enter Thor Explorations (THX).

It’s a gold miner in Nigeria, which, before that puts you off completely, throws off a lot of cash.

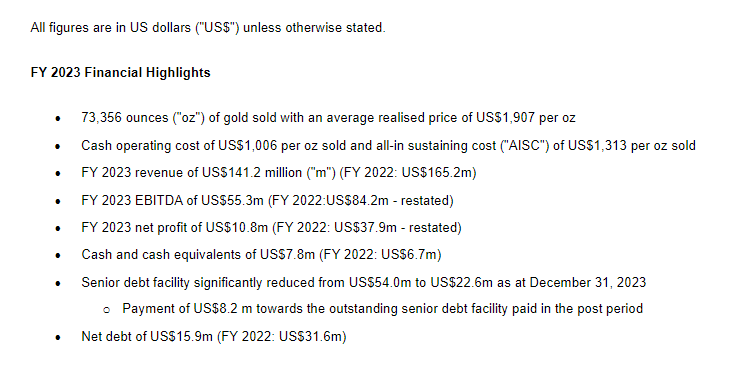

It’s worth noting that Thor Explorations doesn’t mention any hedging in recent RNSs. I’ve not asked the company but it’s reasonable to assume that the company is likely unhedged given the lack of any hedging contracts mentioned. So the current gold price of $2,400 is ~25 percent higher than the average realised price in 2023 which means extra profit.

EBITDA and net profits of $55.3 million and $10.8 million have driven net debt down to $15.9 million in FY23.

This was $65.6 million in FY21 and $31 million FY22. Cash generated has allowed the business to rapidly deleverage.

But what matters here are the catalysts.

First of all, the gold price. This is the obvious one. A higher sustained gold price and relatively fixed cost base provides operational gearing.

Secondly, work is ongoing to expand the mine. This is beyond my pay grade but I know that added resources adds to the NPV of the project (assuming the same discount rate, of course).

Finally, we have an improved chart.

After a failed two-year breakout last summer the stock more than halved in value reaching the lows of 10p.

This looks like capitulation to me.

Note how the volume has increased since the stock starting rallying.

This is distorted by the big candle in February, but when that’s removed volume is clearly up nicely.

I am long with a small position and looking for a breakout retest to increase.

The stock is more than 50% off its lows which suggests to me the trend has reversed.

Of course, that doesn’t guarantee the stock won’t start trending downwards tomorrow, but it does mean it’s more likely to continue than not.

It’s also above the 200 moving averages.

I think there is room for a move to 20p given that the stock listed in 2021 with minimal new share count since then.

The stock has deleveraged since then, and the strong gold price provides a nice tailwind.

I could be wrong but I think this is a nice risk/reward trade.

Referral Program

I’m always appreciate of the support I’m lucky to get. Especially given that I appear to have upset a few people who’ve now become trolls.

Beehiiv offers a referral program I’m now using as a thank you for those who share my writing.

Refer enough people and I’ll invite you to lunch (in London). And as much as I love Nando’s we can go somewhere better!

Take a look at the milestones and if you have any suggestions either for those or the newsletter in general I’d love to hear from you.