Morning legend!

Unless you’ve been living under a rock, Oasis have released tour dates.

And those who do Airbnb these spots will be rubbing their hands with glee with their eyes turning into dollar signs a la Tom & Jerry.

Already there are reports of hotels tripling their prices as everyone looks to profit from this announcement.

The smart booked hotels on tour dates with free cancellation before the prices rose to lock in their accommodation.

This is similar to a futures contract with zero downside.

Although the smarter hotels cancelled those bookings and relisted the same rooms at higher prices (though of course they deny it).

What’s interesting is that Ticketmaster will always struggle when hugely anticipated gigs are released.

Think about it..

Why would Ticketmaster invest in its infrastructure so that events like Oasis run smoothly?

There’s no logical reason.

Firstly, these events are few and far between. It may not be worth it financially.

Secondly, the tickets will sell out anyway.

Thirdly, the whole “so many people want them the site is slow” narrative drives more demand..

So by not investing Ticketmaster is actually stimulating more demand on these rare hyped-up events.

And potentially saving itself some investment costs too.

Anyway, moving on!

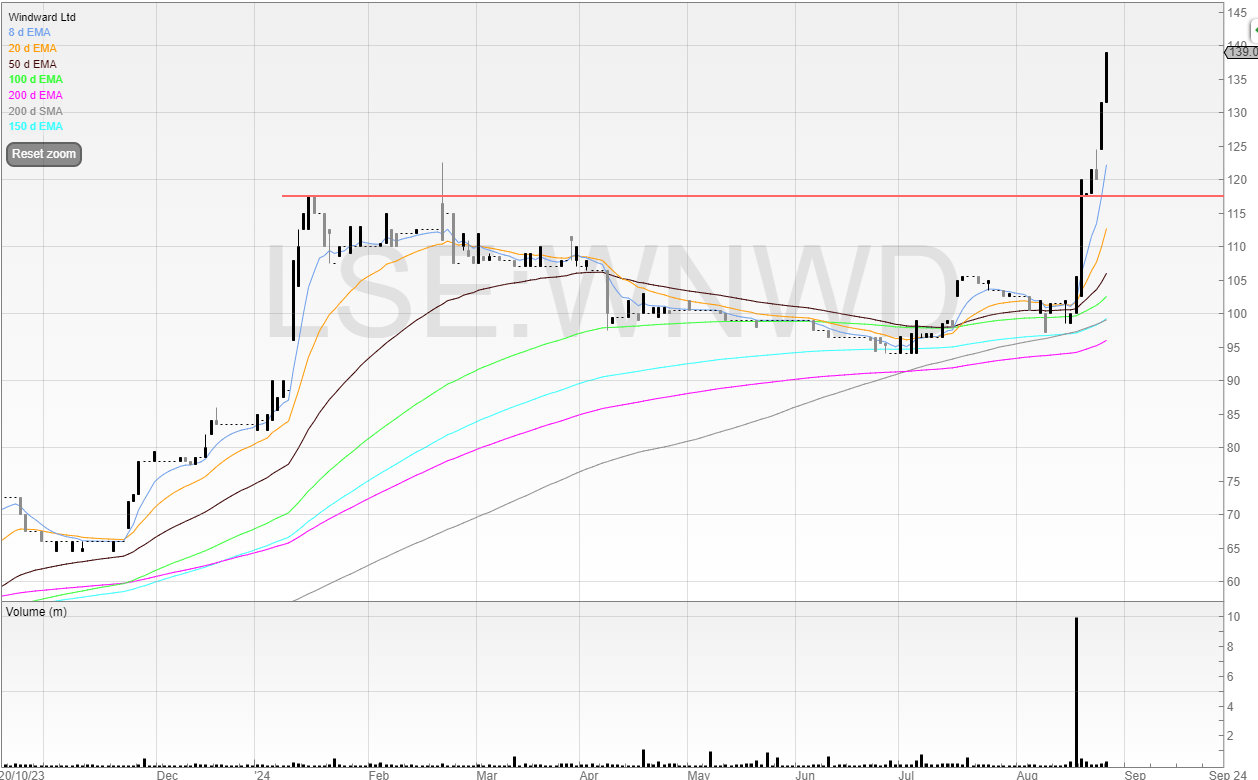

Windward (WNWD)

I’ve had Windward on the watchlist for some time.

It’s an Israeli tech company that monitors threats to shipping using AI.

Speaking of AI, I did see an AI window cleaning business the other day.

Though on second thoughts it’s probably just a guy named Alan.

But given the repeated news in the Red Sea, this shows the value of its offering.

It’s another Covid float - which as you might guess - listed and then tanked.

However, I traded the marked cup and handle for a quick move and since then the stock has powered higher.

It looked to be setting up an extended stage 2 base.

It’s now rallied through this resistance and continued.

It looks like a seller cleared and with the overhang removed the shares moved freely.

Unfortunately for me - I missed this and then didn’t buy at the point of resistance.

My thoughts were that the stock had made a quick move, and quick moves often mean quick profits.

And a great time to sell is at resistance.

Was this the wrong decision?

So far, in hindsight, yes.

But there are another 2,000 stocks listed on the London Stock Exchange, so although this trade has been missed, I’ll keep an eye on it should it make a future base to trade from.

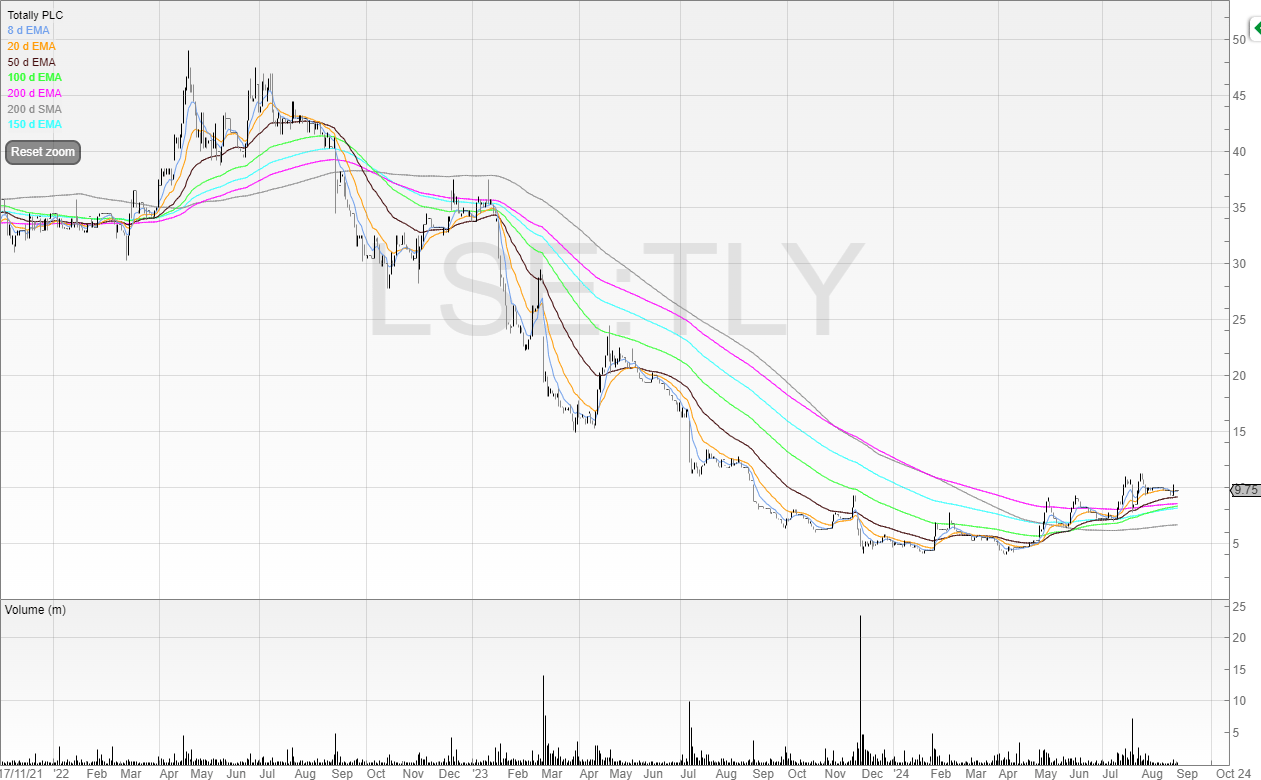

Totally (TLY)

Make no mistake, this isn’t a quality business.

It’s a business that provides outsourced services for the NHS.

But that doesn’t mean it can’t trend.

Here’s the chart over the recent years - we can see the price has collapsed and it’s been a stage 4 stock.

However, it’s risen 100% from its lows and the price is above the 200 moving averages with these now pointing up.

The business is cash flow positive again, and dividends have been stopped.

The recently announced contract wins suggest tender activity is picking up.

There is an independent review of the NHS due in September, which is likely to suggest more investment and services are needed.

Totally should be (but is by no means guaranteed) to be a beneficiary of this given that it is actively selling into and winning business from the NHS already.

And whenever you’re ready..

There are three ways I can help you.

If you’re wanting to profitably trade UK stocks then I’d recommend my entry level course:

Spread Bet Accelerator: The exact system I use to trade and get you to your first £10k in profits. Use the code GIVEME99 for a subscriber discount.

Want more trading ideas and a clearer view of the markets?

Buy The Bull Market Premium: Free 30-day trial covering potential trades and insights as a professional trader.

Want to work with me personally?

Alpha Trader is where I work closely with traders who want to get to a professional level.

We have our own channel, meet up, and have fun trading and learning [opening soon].

Speak soon!

Michael