We’re entering the close of the year. Christmas is slowly starting to appear in the shops, mulled wine is featuring on menus, and sales teams are getting the “let’s circle back in the New Year” objections.

But the market remains open for business and so traders get little rest until the four-day spell from Christmas from Friday the 22nd until the markets reopen on Wednesday the 27th.

A lot has happened since the last edition, so let’s get into it!

But before we do - I’ve relaunched my YouTube channel and I’m now posting weekly videos every Monday.

Along with my free trading course coming soon.

Warren Buffett has been busy. Last quarter Berkshire Hathaway sold $7 billion of stock. And bought only $1.7 billion.

So what did he buy? We don’t know, because he asked the SEC to treat his holdings as confidential for now. Which they allowed.

But the cash pile has grown to a record $157 billion. It’ll be interesting to see when he starts to buy.

Because then maybe he’ll be being greedy whilst everyone is fearful?

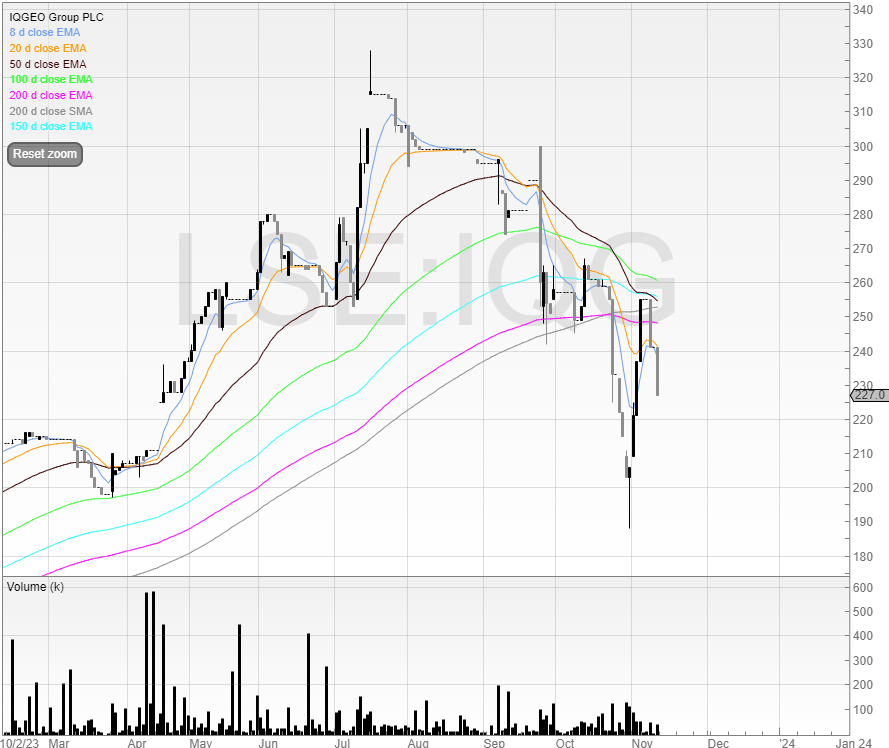

IQGEO (IQG)

Last month I highlighted IQGEO as a potential short if support broke.

Support did break, and the stock collapsed.

Free 1-month trial worth £74 through me: www.sharescope.co.uk/michaelsp

I closed two/thirds of my position and left a third running, only to have the stock rebound strongly and clear out a lot of my profit on my final third.

I later found the stock was tipped hence the reaction, but the stock then moved above the support turned resistance.

To me, this looked like a great time to reload as the book was weak, I could have a tight stop, and any longs may be nervous due to the fact the stock had already cratered. I’m now short again and looking for a test of 200p.

These trades are great because when a stock falls through significant support the market makers can really stick the boot into the longs by offering low bids and thin liquidity. With every sell the market makers mark it down further looking for more bid chasers. Then where there is significant demand for the stock they simply run it back up and offload for a profit.

I think at 200p the valuation is still a little high, but the further the stock falls there is takeover risk. This isn’t a terrible company - it’s rapidly growing revenue and soon profit. But a trade is a trade and if successful it’s onto the next.

Fonix (FNX)

Speaking of hefty valuations - Fonix currently trades at 21x earnings.

It doesn’t get better next year with the current price being ~20x next year due to the low growth.

What are holders paying for here?

Sure, revenue is relatively sticky and predictable. The company is a steady grower. But valuation seems relatively high given we’re in the post-low interest rate environment.

The chart isn’t filling me with confidence either.