One of the objections to small cap stocks is that they’re more volatile.

Which is absolutely correct.

Smaller cap stocks carry more risk due to illiquidity and the early-stage business model.

But its size factor means small cap stocks are more agile and can navigate changes quickly.

And yes, whilst smaller cap stocks are more likely to have volatility to the downside, when a profit warning hits a large cap, it also falls.

But on the upside… large cap stocks don’t move as much because they’re already well-established businesses that don’t have much room to grow.

Look at Unilever (ULVR) for example. The suits wet themselves if the Home Care division grows by 1.9%.

It already owns over 400 brands and operates in 190 countries.

And sure, it’s not going bust anytime soon… but where’s the growth coming from?

Plus, if there is a profit warning, the stock will get hammered as every stock does.

This is why I believe the risk/reward is more favourable in smaller stocks, so long as you do your own research.

Here’s another example, Wood Group (WG.).

Down more than 75% in three months.

Despite the full-year guidance in line, this doesn’t look too clever.

“The results presented in this trading update, and our full year outlook, are before any potential impacts from the independent review.”

So not only do we have surprise negative news but also unquantifiable bad news which means nobody has any idea of the actual downside.

As that dude from Star Wars says.. Ouch time.

And yes, small cap stocks can be just as terrible.

Look at Surface Transforms (SCE).

It’s raised money almost (if not more now) 20 times since being listed.

Management keep promising and failing. I was on a management call a few months ago where one investor blew his top at the lack of untrustworthiness of management.

The long-standing Chair fell on his sword, and yesterday the new Chair since September appears to have decided things are so bad (my assumption) he left yesterday too. Not a good look.

And the stock tanked another 25% on the day.

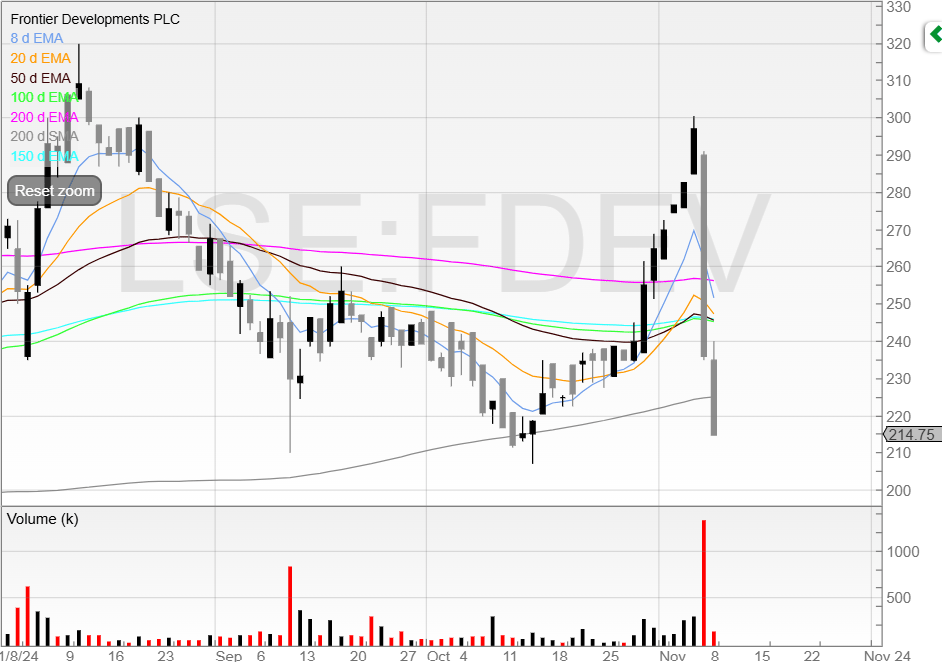

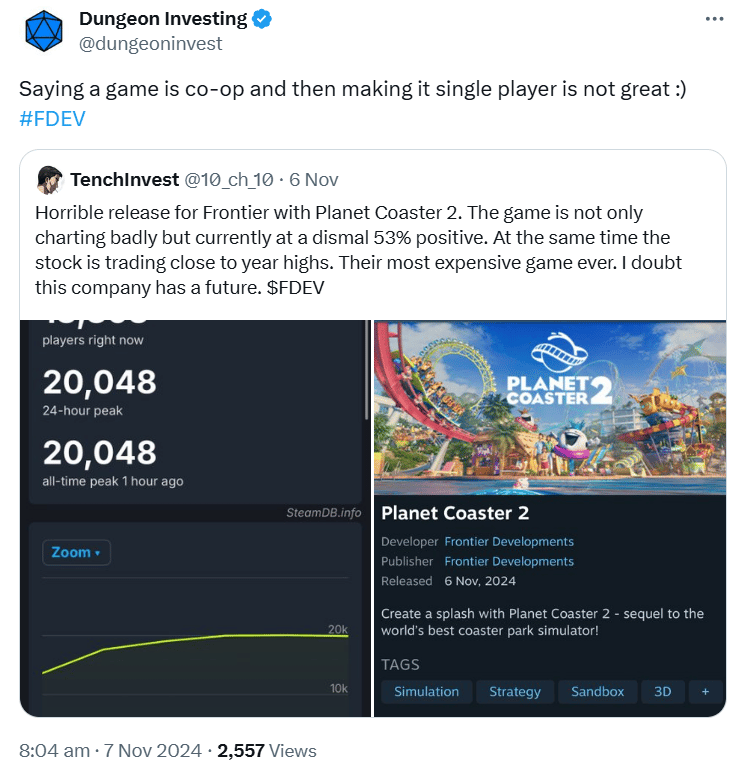

Frontier Developments (FDEV) also took a hit.

I’ve written about this stock before, and whilst I liked it, I talked about the risk of it being focused on only a handful of releases. That means any flop is going to do some serious damage to the share price.

Looking at the share price, you can probably guess what happened.

Now if you were holding these stocks, how could you mitigate the damage?

Both Wood Group and Frontier Developments are SETS traded stocks.

That means you can buy and sell shares on the electronic order book through Direct Market Access.

You’ll need to do this through a broker that offers this (I use IG).

You’ll then need to go into My Account > Data Feeds > Shares - LSE (UK) and pay the £7.20 under ‘Level 2 fee’.

Once done, open a dealing ticket, and click the “On Exchange” option.

You can then place an order onto the order book using this method.

I’ve covered this extensively in my book How To Make Six Figures In Stocks which you should already have - let me know if not and I’ll ping a copy across!

But setting stop losses in this way means you’ll be taken out of the market even if you’re not sat at your screen because the order is in the market.

Finally, the Priority List for the new UK Stock Trader Pro live cohort is now significantly oversubscribed.

There are only 100 spots available in the live cohort, and it’s now possible that some are going to miss out.

If you want to make sure you get early access before everyone else, this short survey gets you on the Priority List.

It’ll tell me what you want from the program and help me to give you what you need to become a profitable trader.

And hit reply if you have any questions!

Speak soon,

Michael