Uncertainty has been brewing and Typhoo collapsed into administration last week after 121 years.

Rising debts and cash flow issues are the cause - though this wasn’t helped by trespassers who broke into the company’s factory and occupied it for several days.

This cost the business around £24.1 million.

Source: Typhoo Tea Limited’s accounts on Companies House

Gross margins were also abysmal, with the business in 2023 almost selling its tea for less than the cost of producing it!

Nor are these losses untypical. Typhoo hasn’t actually made a profit since 2017.

But as a shareholder in Supreme (SUP) which has just bought Typhoo out of administration, I think it’s quite exciting and potentially a significant transaction.

And before we continue, a quick thank you to our sponsor who helps towards the upkeep of this newsletter.

Learn AI in 5 minutes a day

This is the easiest way for a busy person wanting to learn AI in as little time as possible:

Sign up for The Rundown AI newsletter

They send you 5-minute email updates on the latest AI news and how to use it

You learn how to become 2x more productive by leveraging AI

Supreme has bought Typhoo for £10.2 million, which you might think costs a lot for a failed business.

Sure, the brand’s heritage may be worth something… but not £10.2 million.

However, as always, we need to look further…

This acquisition includes stock and trade debtors with a value of £7.5 million.

We also know Supreme isn’t taking on any liabilities in this acquisition.

So that means it’s paying £10.2 million, but getting £7.5 million of assets for that price.

Remember, for EV we need to take the market cap, add the debt, and subtract the cash.

Trade debtors aren’t cash, but I’d hope one day they will become cash, and so if we assume they’ll all convert without getting written off it’s a low EV.

This acquisition further diversifies Supreme away from the vaping side of the business - which is definitely a good thing.

Whilst the vaping business is a money machine, regulation only ever goes one way and even though there is no uncertainty on the horizon here and a while before the vaping duty kicks in, it’s definitely a good idea to diversify.

And this isn’t Supreme’s first rodeo.

Source: Supreme plc Annual Report 2023

Since then, Clearly Drinks has been bought too.

Considering Typhoo went bust on Wednesday, announcing this deal on Monday is pretty quick.

And there are licensing opportunities too with potential in other nations.

It’s going to be earnings accretive, but at the moment not possible to say.

But there’s potential to create new types of drinks for other markets - iced tea, for example, which is hugely popular in the US.

It seems an asymmetric bet where if it fails it hasn’t cost much, and if it succeeds then it could be a big contributor of profit.

Whilst it remains to be seen, and there is obviously a lot of work to do before that is possible, I like this deal, and remain a shareholder.

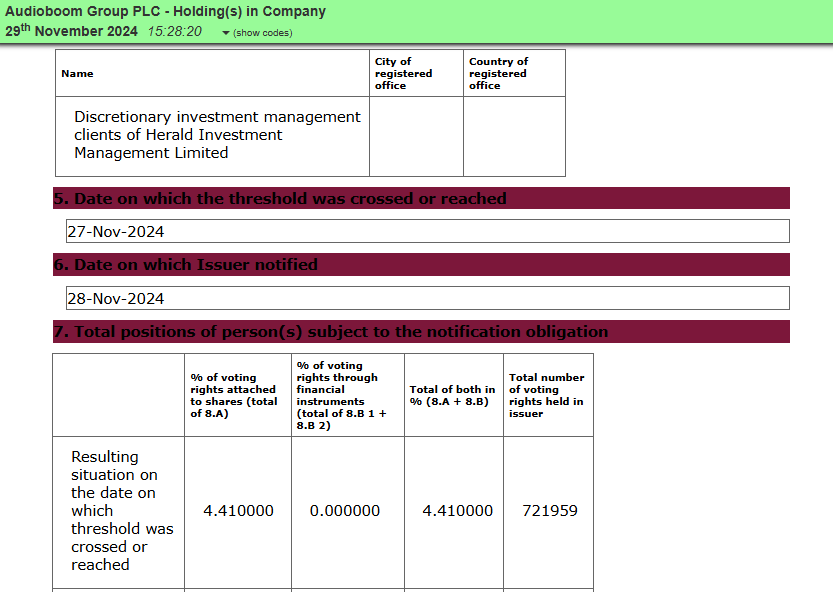

Audioboom (BOOM)

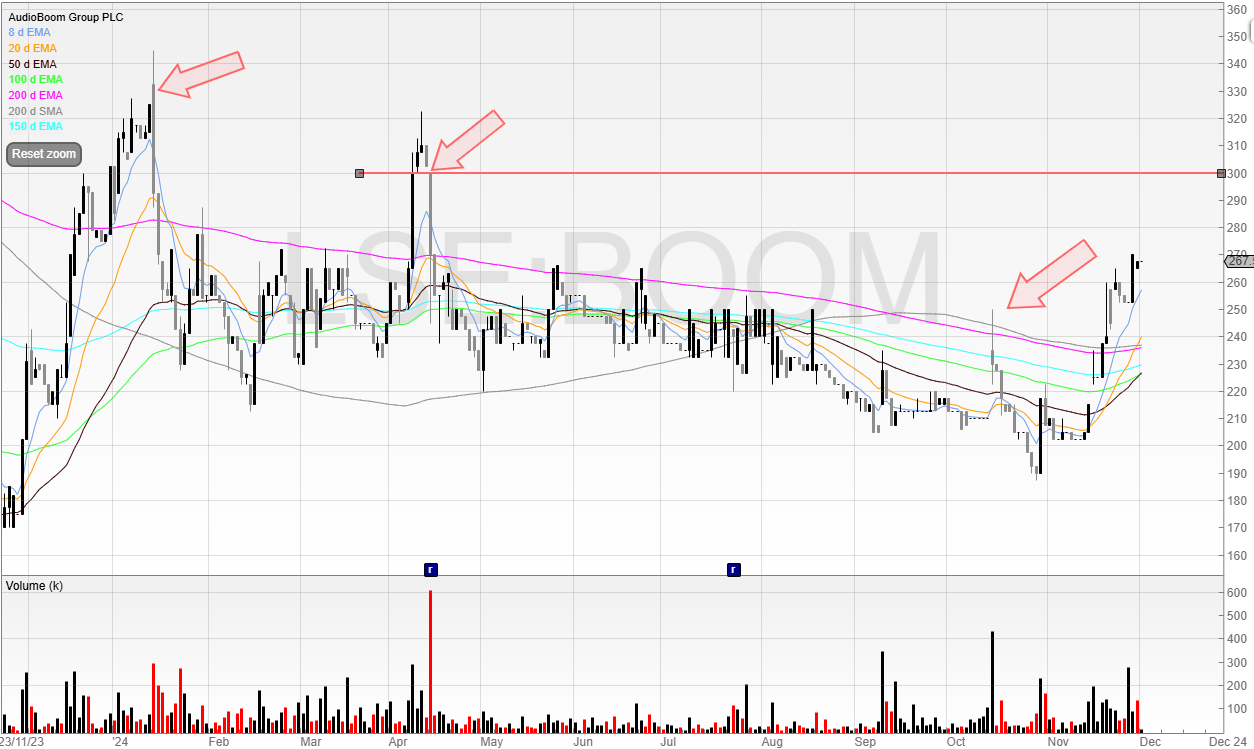

Has the seller finally cleared at Audioboom?

This has been on my watchlist for some time.

The arrows mark the times the stock has sold off on results.

And the yellow spot is the first time it didn’t!

Since then, Herald has also taken a slug.

It’s the first notification as its previous holding was 0%.

I see 300p as the Big Round Number and potential resistance to break.

I’ll be watching should the stock get close to this level.

It’ll also be more than 50% off the lows - a good indicator for the bottom being in.

The gap up in November marks the second time the company has upgraded its expectations.

Perhaps there’s more to come? Let’s see.

Next Tuesday I’ll be starting the first live session of UK Stock Trader Pro at 6.30pm.

All sessions are recorded and go into the exclusive community.

And anyone joining the cohort before next Tuesday gets £300 off the final price, plus all live sessions and Q&A, and the fully polished course once it goes live in Q1 2025.

Hope to see you then!

Speak soon,

Michael