Today’s the big day.

This afternoon we see how painful the budget will really be.

My guess is that it won’t be as bad as expected, and received positively.

Although I could be wrong!

I wrote about the importance of a plan a few days ago.

Here’s a quick reference sheet.

Business Property Relief and Inheritance Tax

There was an FT article last night with a quote from the head of small cap strategy at Quilter Cheviot saying that they don’t believe Business Property Relief (BPR) will be removed from AIM shares in the budget.

Therefore, if it is, my guess is that this would be a surprise to the market.

My goal here would be to hit some of the most popular stocks in IHT funds.

Even better would be to target ones that haven’t fallen so much, because that means it’s less likely this worry is priced in for certain stocks.

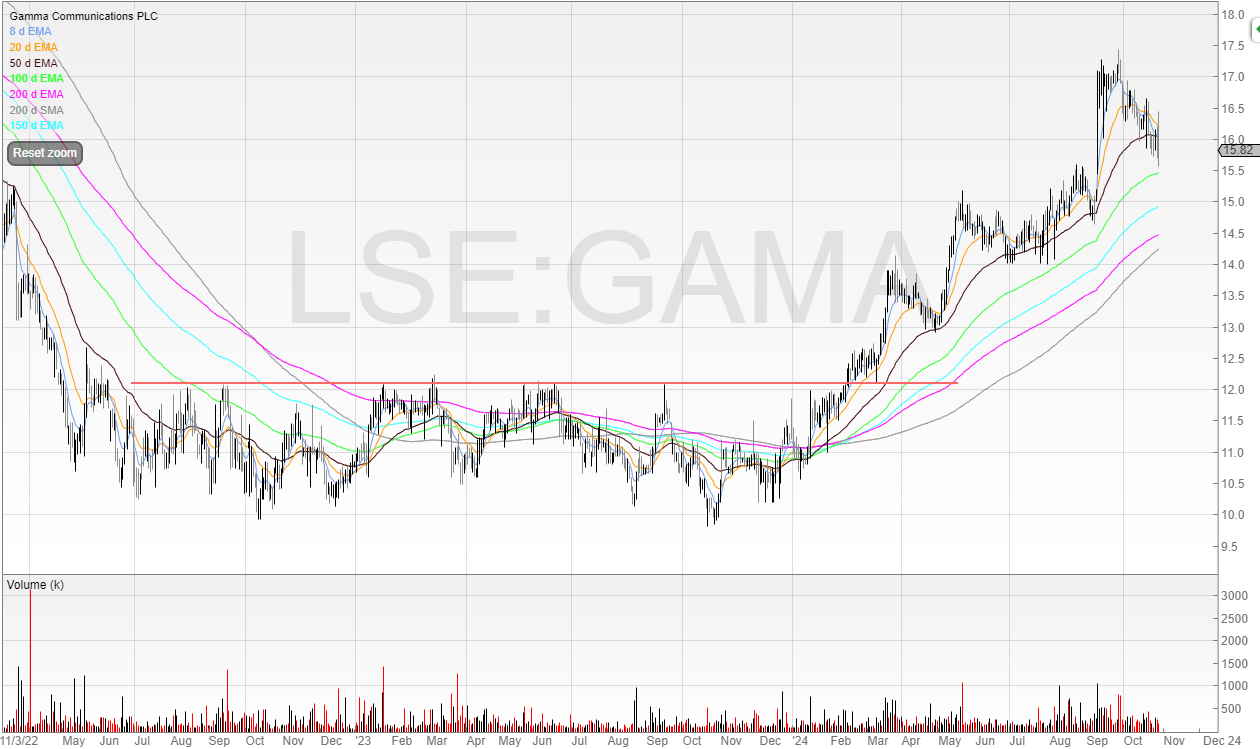

Here’s Gamma Communications (GAMA), which is in a clear stage 2 uptrend and sitting on support.

It’s also rated at 21x earnings, so not cheap either.

Gamma is a top holding in 16 funds focused on holding AIM shares that will be exempt Inheritance Tax.

Renew Holdings (RNWH) is another one, held by 16 also.

We know Octopus has been selling here putting an artificial lid on the price.

So if we already have a seller, and now there’s a potential reason to sell, my guess is this would be a great risk/reward trade if BPR is removed.

Jet2 (JET2) is another popular one held by 10 funds - but at £3 billion market cap the moves may be less exagerrated.

Remember, trading is not necessarily what will happen, but what people think might happen. And in a less liquid stock, if people start selling thinking something might happen, that alone can trigger a move.

Gambling companies

Nobody will be shedding a tear if gambling companies get raided.

Rank Group (RNK) is an obvious target here given that 83% of its revenues are from the UK.

It’s clear that 65p is significant long-term support. So if the stock does get smacked and overshoots - then that 65p level could be a support buy trade?

Evoke plc (EVOK) is the old 888 and owns several brands including William Hill.

Given that 70% of its revenue comes from its UK operations this is also another obvious target.

However, I’d be wary of hitting this as the price is relatively near the lows.

This suggests to me that an additional gambling tax is already priced in - indeed we can see the fall from when this idea was leaked to the press two weeks ago.

So maybe if there are no changes to gambling duties then the trade is to be long!

And before we continue, a quick thank you to our sponsor who helps towards the upkeep of this newsletter.

Billionaires wanted it, but 66,737 everyday investors got it first… and profited

When incredibly rare and valuable assets come up for sale, it's typically the wealthiest people that end up taking home an amazing investment. But not always…

One platform is taking on the billionaires at their own game, buying up and offering shares of some of history’s most prized blue-chip artworks for its investors. In just the last few years, those investors realized representative annualized net returns like +17.6%, +17.8% and +21.5% (among assets held 1+ year).

It's called Masterworks. Their nearly $1 billion collection includes works by greats like Banksy, Picasso, and Warhol, all of which are collectively invested in by everyday investors. When Masterworks sells a painting – like the 23 it's already sold – investors reap their portion of any profits.

It's easy to get started, but offerings can sell out in minutes.

Past performance not indicative of future returns. Investing Involves Risk. See Important Disclosures at masterworks.com/cd.

Employer National Insurance

If wages go up then this means companies where staffing is a big factor of revenues as a percentage will be hit.

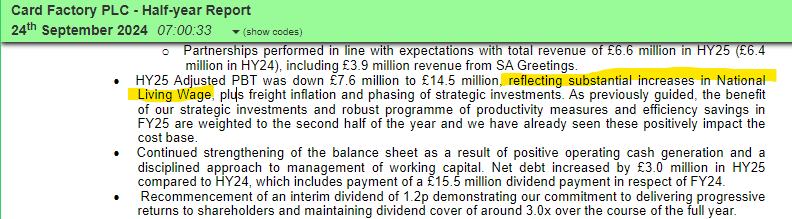

Card Factory (CARD) has already told us profits were down £7.6 million to £14.5 million as a result of substantial increases in National Living Wage.

However, this has already taken a big hit and is now on a low earnings multiple of 6x.

This wouldn’t be my play here but retailers and hospitality are in the firing line.

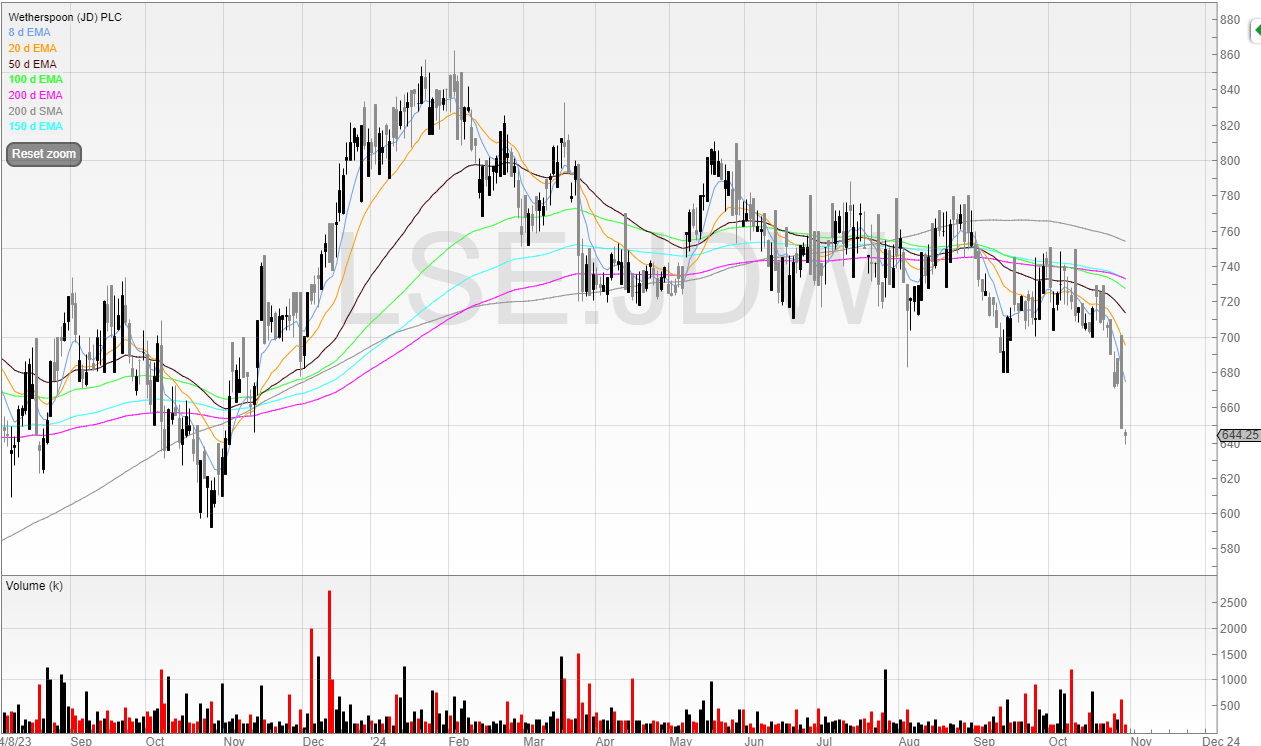

Another clear candidate is JD Wetherspoon plc (JDW).

Staffing costs make up 33% of JDW’s costs and so a big increase in wages will not be insignificant to its overall cost base.

It also looks like this has been reflected in the share price!

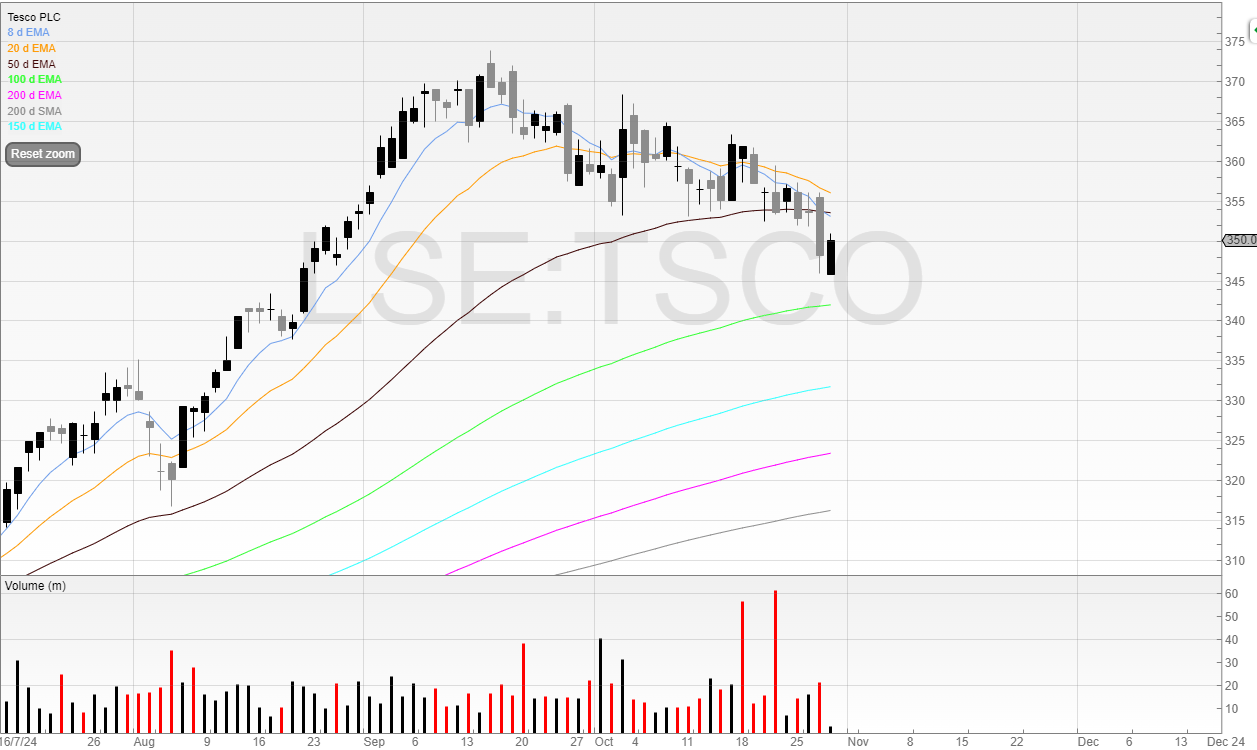

Supermarkets are also a good idea.

Tesco plc’s (TSCO) staffing costs are around 11% of its overall costs.

So a big jump won’t hurt do too much damage here, which is also probably reflected in the chart.

Energy Profits Levy

The Energy Profits Levy is silly.

Already it is driving away investment in the North Sea, which in turn affects jobs, and future taxation.

And we’ll still need oil & gas, so instead we’ll need to buy it elsewhere instead of collecting tax revenue from the UK’s own assets.

These are facts, and not political point scoring (but for the record: both parties are ran by muppets).

So far a revisit on the EPL hasn’t been mentioned.

But if is and there is a positive amendment (less tax) then Serica Energy (SQZ) is the go-to candidate for me.

The stock is 72% down off its lows, and generates high free cash flow with $98 million in the first six months of 2024 compared to its market cap of £507 million.

Profit was $82 million.

As the price of natural gas is now rising with the averaged MTD gas price of 97.9p per therm, the strongest so far in 2024, and sentiment at rock bottom, I think this will move significantly on any news of less taxation going forward.

Green energy

We know this government is a fan of green energy.

Therefore, any grants or tax-advantages for low-emission energy or clean/green energy will see an uplift in sentiment in alternative energy stocks.

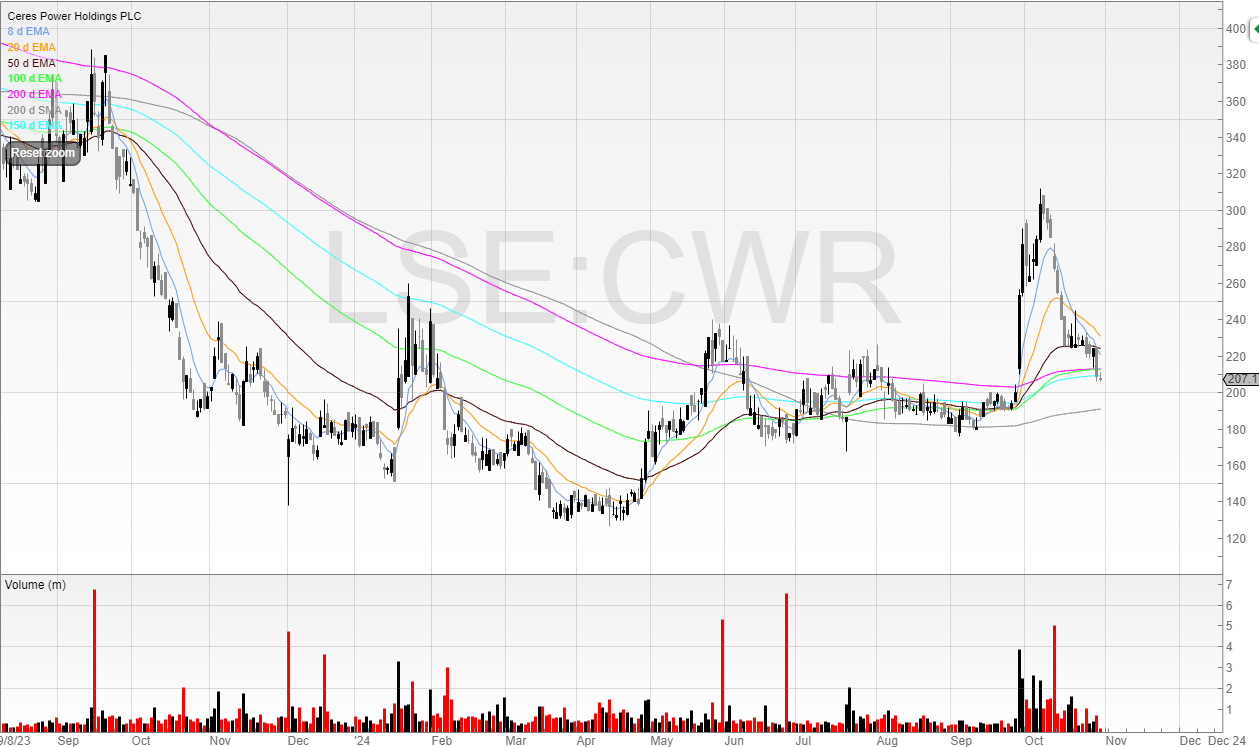

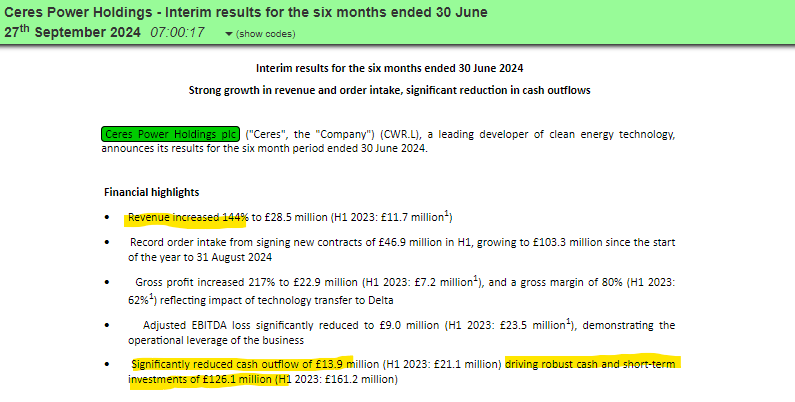

Ceres Power Holdings plc (CWR) has been on a run recently, only for it to give back plenty of its gains.

The reason for the move is because of the jump in revenue but more importantly it looks like a clearer path to cash breakeven.

Of course, whether it actually achieves it is a different thing.

But for now, the company has a strong balance sheet, and has been a punter favourite in the past.

Any positive news in the budget for alternative energy and I believe CWR will go on a run.

Popular private investor holdings

Private investors move in herds.

Everyone has been selling and scared to buy.

That means lots of stocks have taken a beating yet remain popular with private investors.

Beeks Financial Cloud (BKS) has fallen plenty.

Although it’s up strongly this morning!

Intercede (IGP) (I hold a long position in this company) has also fallen sharply in the last few weeks.

My view is that if nothing has changed or the business prospects have only strengthened during the selling, then the removal of uncertainty and cash flows into the market will see that capital be directed towards popular stocks.

That said, I could be wrong of course.

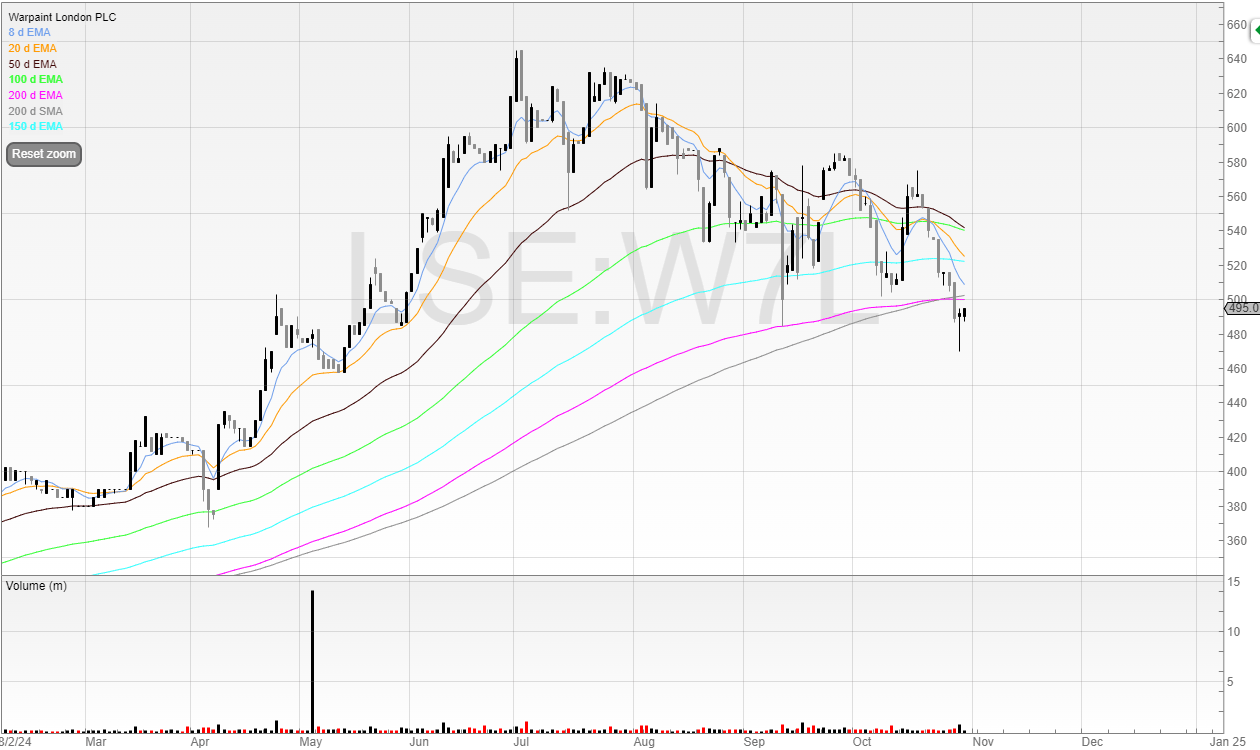

Warpaint (W7L) is another popular growth stock.

Vaping

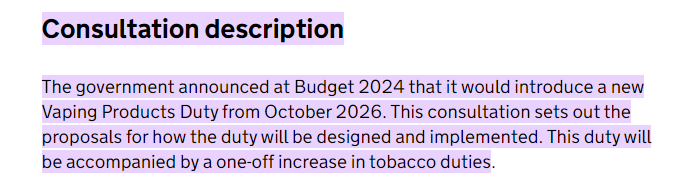

It’s no secret that vaping is likely going to be mentioned.

Despite reports of ‘the Vape Dragon’ Angela Rayner partying in Ibiza, it’s likely that an extra tax will be going ahead here.

Regulation and taxation is only ever going to go in one direction in this sector, much like tobacco and gambling.

We know that a new Vaping Products Duty is coming from October 2026.

So this is what’s priced in. We just don’t know how much it will be.

The disposable ban has also gone from April 2025 to June 2025.

However, I don’t see this as being an issue.

The semi-disposables are easy enough as pods are quickly changed instead of the entire device being thrown away. This is certainly better for the environment, and the vapes look identical. I see no reason why this will affect demand.

Obviously, it’s a risk. People may decide that they don’t want to recharge a vape or swap a pod and stop altogether. But why would they given how easy it is?

The main worry here is that the duty is highly punitive, and whilst Supreme (SUP) (I hold a long position in this share) also has other revenues outside of vaping, the majority of the business (around two-thirds of EBITDA) comes from vaping.

We can see how this has affected the price.

The stock now sits on long-term support, and with forecast profit after tax for 2024 at £23.1 million this puts the stock on a PE of just above 7.

There is clearly risk with this share and I expect it to move today. If the new vaping tax hits profits harshly I expect a fall, whereas if this is a small additional tax then I expect it to rally.

Let’s hope for a good budget - and see you on the other side!