Budget day!

Probably one of the most exciting days of the year.

Lots going on, with several changes highlighted but nobody knowing for certain.

Quick reminder, if you want to join my webinar tonight you can do so here.

But the last few weeks have been rife with speculation, as headlines have been teased and the government can see what sticks.

Rachel Reeves is facing a shortfall of around £20-£30 billion, which is a lot of money.

This means, realistically, she can’t titter around the edges and needs to go big or go home.

Tinkering with this and that isn’t going to cut it.

I think given that Cash ISA reductions have been floated, shelved, and then resurfaced days before the Budget, it seems likely to assume that these will be cut.

However, this will make no difference whatsoever if the ISA allowance is left unchanged.

Here are some sectors and stocks I feel could move given on what is announced, or what is not announced.

Gambling

Gambling stocks are an easy target. Nobody is going to cry if gambling companies and casinos are hit with higher taxes.

But let’s not kid ourselves who really is going to pay the tax… punters.

To maintain margins, gambling companies can just worsen the odds.

And it’ll be punters who lose money faster.

You could argue that they’ll only lose this money anyway, so it might as well go to HMRC, but there are other potential issues.

Punters might get fed up of losing and being offered poor odds, and instead go elsewhere to overseas operators and unregulated providers, where they’ll be fleeced also but HMRC won’t receive any of that money in tax.

So it’s a tricky one. Personally, I hate gambling because I hate playing games that I know are rigged against me. I don’t see the point.

But many people do enjoy the odd flutter, and it’s a very good source of revenue for HMRC.

It’s worth noting that one gambling company has said they would shut down all stores if gambling taxes were increased, but how likely is that? It’s easy to say things before an event to try and stop it, and then backtrack when you realise you’d be out of pocket.

They’ll stay open.

One proposed scenario has been to include raising the Remote Gaming Duty (online casino profits) from 21% to as high as 50%.

In the UK, we’ve got Flutter (FLTR), Entain (ENT), Evoke (EVOK), and Rank (RNK) that are listed.

Flutter and Entain are both £25 billion and £5 billion market caps respectively, so these are much more likely to be efficiently priced.

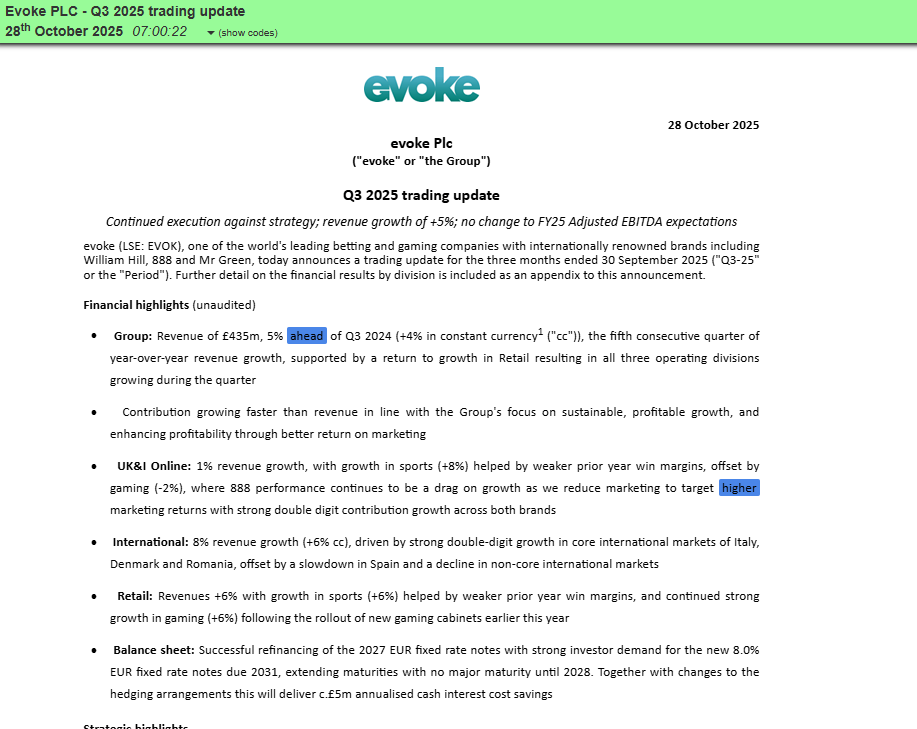

Evoke (the old 888) is now worth only £168 million.

It’s also got £1.7 billion in borrowings.

It’s paying £79.5 million in interest as of the interims, and generated net cash of £139.3 in operating activities.

So a large amount of interest sucks up the cash flow.

However, it could trade out of the hole.

If gambling companies aren’t taxed, or get off lightly, I would expect EVOK to have a move upwards in the coming sessions.

It’s been thoroughly hammered since the rumours started flying.

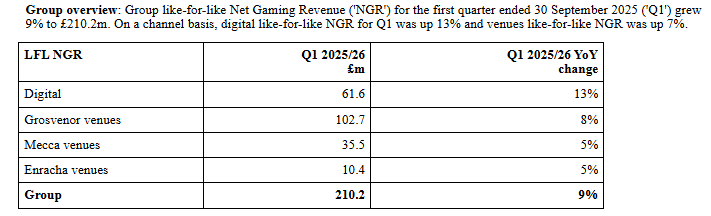

That’s also been the case with Rank.

However, a larger portion of Rank’s revenues come from physical casinos.

My gut feel is that the market is expecting gambling taxes to increase, so if these are lighter than expected there will be some moves.

North Sea oil & gas industry

This is an industry that has been thoroughly whacked since the dumb Energy Profits Levy, or Windfall Tax as it’s better known, and is already hurting jobs and investment.

Whilst I am in favour of green energy, the reality is we need oil & gas to manage that transition.

And instead of importing it elsewhere… why not provide jobs and collect taxes on the resource right on our doorstep?

Who knows what goes on in these decision makers’ heads, as it was a silly Conservative policy made even more ridiculous by Labour.

Any (positive) changes to the Windfall Tax will be welcome news for the industry.

BP (BP.) and Shell (SHEL) are global operators and so there is going to be less of an impact to them.

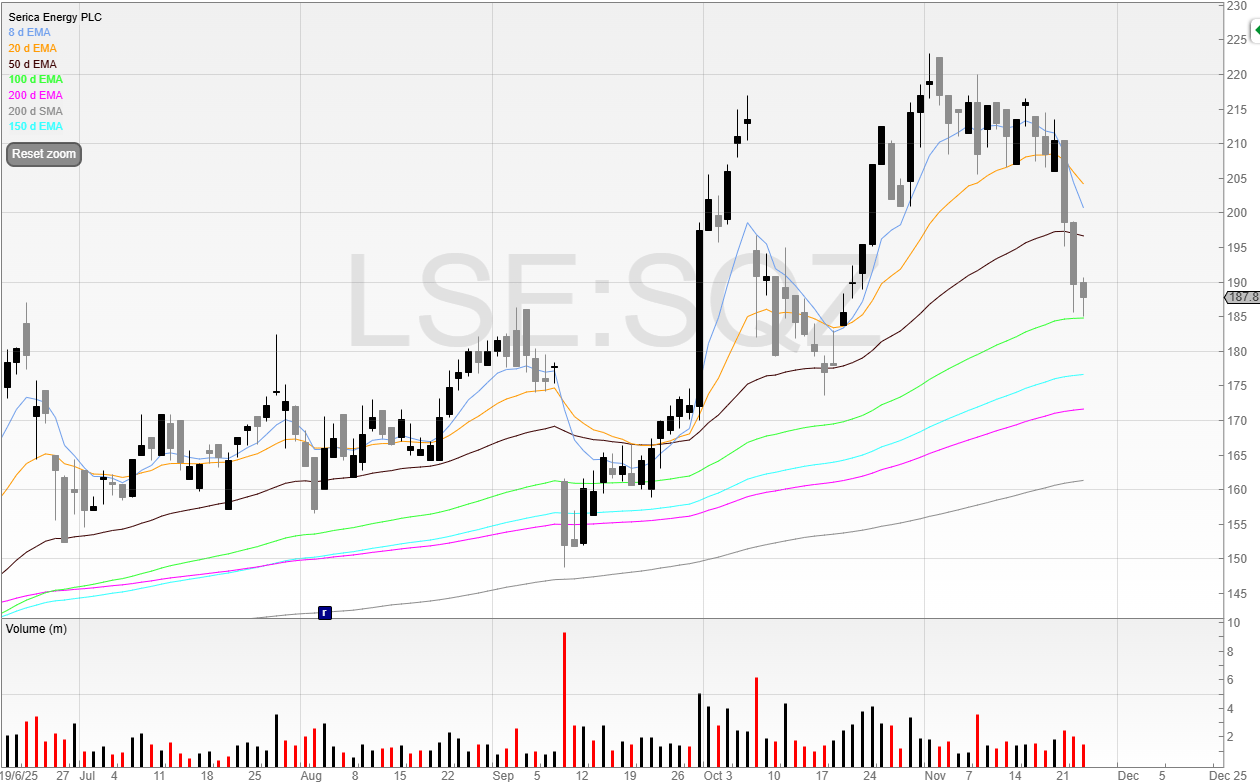

It’s smaller operators that are directly involved in the North Sea such as Serica Energy (SQZ), Harbour Energy (HBR), and Enquest (ENQ).

We already know that HBR has made active decisions to put its UK assets into managed decline and shift its investment focus elsewhere, so any change to this would fundamentally change the economics of those UK assets.

Last year, there were worries that the EPL would be extended, and as I wrote this time last year North Sea oilers could see an uplift if there were no changes, which ended up being the case.

This year, looking at the charts, I don’t believe the market has priced in any positive changes.

SQZ would be my pick here as it’s a cash-generating monster.

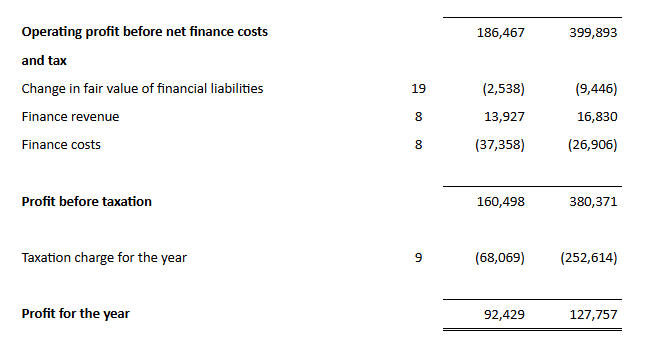

Here’s the bottom line of its P&L.

It trades on a PE of 8.

And here’s the cash flow statement.

Nearly half a billion dollars generated.

Given that Serica has just announced the proposed acquisition of UK assets from BP, any positive change here will significantly impact the business for the better.

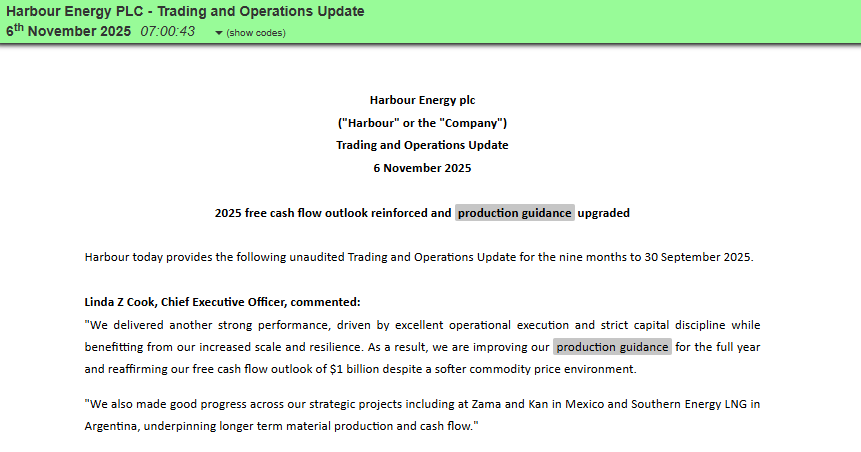

Harbour Energy also upgraded its guidance recently, which would see a jump on any positive change.

It’s entirely possible that we see a surprise extension or higher taxation change for the sector, given that Rachel Reeves needs to find £30 billion.

In that case, whilst sentiment for these stocks is slow, an additional negative would put more pressure on stock prices.

Stamp Duty on new listings

It’s been reported that the Chancellor has considered scrapping Stamp Duty on new listings.

Good.

But it’s not good enough.

We want people to invest, so why are we asking them to pay 0.5% on all purchases for Main Market shares?

AstraZeneca has moved its primary listing now to New York, which means no more Stamp Duty will be collected.

I think it’s unlikely Rachel Reeves will scrap Stamp Duty altogether, as money is tight and it raises around £3.3 billion annually for the Treasury.

But you also need one or two more companies of AstraZeneca’s size to avoid it to take out a huge chunk of that.

However, any positive changes would be welcome news for the London Stock Exchange.

As for any direct trades here, I don’t think there are any.

De Minimis

Another good idea is to scrap the ‘de minimis’ rule which allows SHEIN and Temu huge advantages against British retailers.

This rule in the UK means that overseas retailers don’t have to pay import duties on shipments worth less than £135.

Which means plane loads (literally) of junk is being shipped directly to consumers from overseas.

Now, whilst I understand an immediate change might’ve been a challenge (as Trump saw earlier this year), delaying this until 2029 is idiotic.

However, if there are any positive changes here than UK-listed retailers, especially clothing, will see a boost.

Next (NXT) is the sector behemoth but this won’t have too much of an impact.

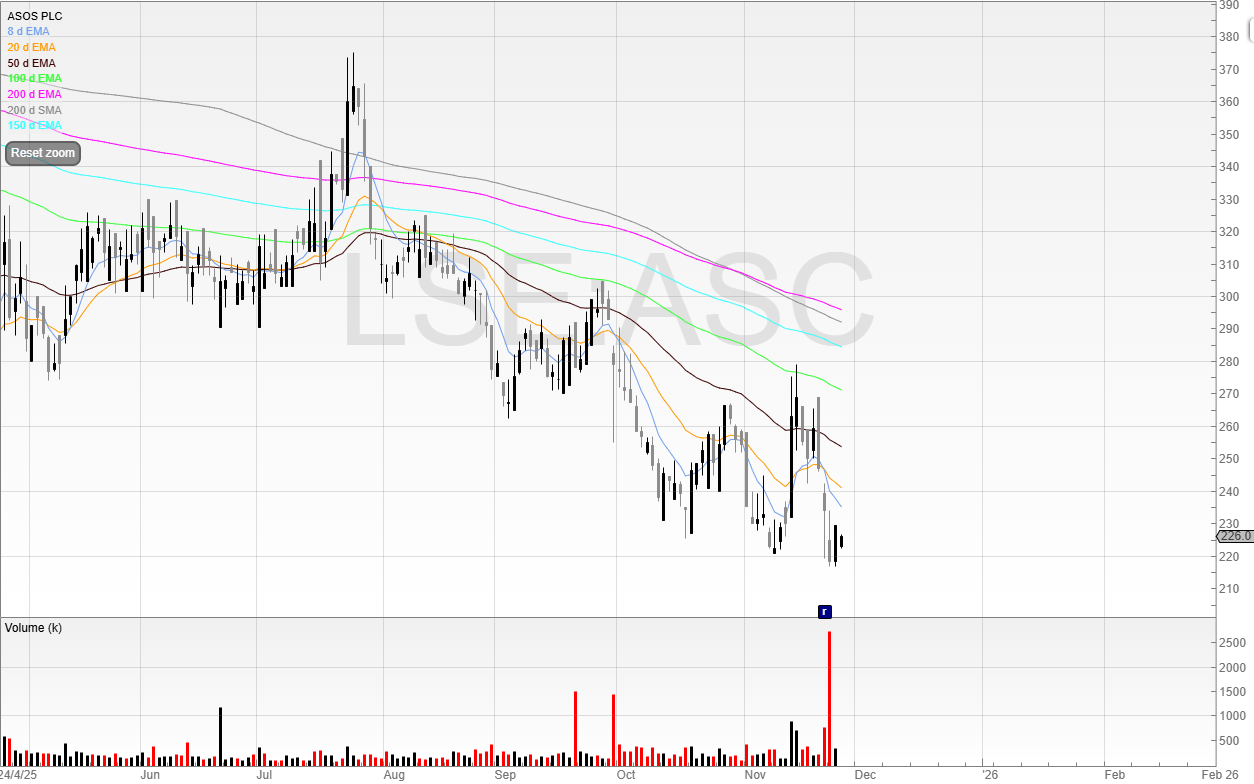

However, garbage such as ASOS (ASC) and Boohoo, now known as Debenhams (DEBS), stand to gain here as SHEIN is eating both of their lunch.

ASOS refinanced with materially improved terms and increase liquidity headroom, which saw the price jump, but the results showed that the turnaround is taking its time.

With the stock trading at all time lows, an immediate change to de minimis could have an impact, however, if consumers are smacked with less money then this is a negative factor.

I don’t believe either of these are viable businesses now, and would steer well clear.

Tax thresholds & sentiment

It’s reported that Reeves will freeze the tax thresholds for another year.

This pushes more and more into higher tax bands because of inflation, and creates more revenue for the treasury.

It’s also not an immediate shock to the economy, and so I think this is likely.

Given that sentiment is rock bottom for Rachel Reeves and popularity for Labour is down massively, it’s also possible that everyone is now expecting maximum pain.

And if we only get moderate pain, that can be positive for the market in the coming weeks.

In any case, it’s going to be an interesting day.

Speak tonight!

Michael