Morning {{ first name | legend }},

You might’ve seen my Instagram yesterday where I talked about how selling put options are akin to picking up crumbs in front of a steamroller.

If you didn’t - here it is.

I’m not against options. But unless you’re an experienced trader, the likelihood you’ll be able to develop a profitable strategy is low.

And on that theme, let’s cover another financial instrument: CFDs.

CFDs are Contracts For Difference.

They're a derivative product offering a total return swap - which is a fancy way of saying it mimics the underlying asset.

For example, if I buy 10,000 shares of Vodafone with a CFD, my exposure is the same as if I'd bought 10,000 shares of Vodafone via stock.

The difference is that unlike straight equity, CFDs offer leverage and the opportunity to magnify (and obliterate) your capital.

There are various differences you need to consider when trading CFDs.

By the end of this email walkthrough you'll understand everything you need to know.

CFDs offer leverage

As mentioned above, CFDs give the opportunity for traders to use margin.

For example, if you want to drive your capital harder, you can put up capital as collateral and the broker will give you more firepower.

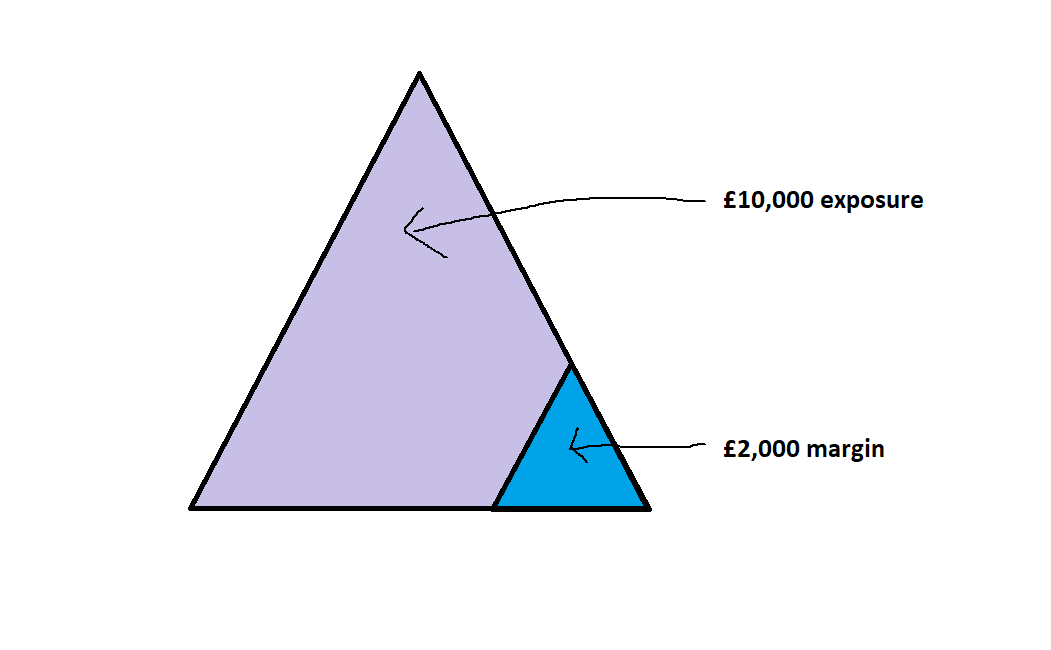

Retail investors are offered 20% margin (or leverage of 1:5) meaning that for every £1 the broker will offer you £5 of exposure.

But what this also means is that if you use this maximum leverage and your position drops by 20%, you've now lost 100% of your capital.

Here's a highly sophisticated picture I've drawn on Microsoft paint to visualise this point.

Yes, I know. I should’ve been a graphic designer instead.

Now, leverage is a double-edged sword and it works both ways.

Used correctly and sensibly, it can juice your returns.

Used with an unchecked ego it can wipe you out.

My advice: Don't even consider leverage if you haven't got at least one year of consistently profitable trading under your belt.

CFDs allow you to go both long and short

Being able to trade both ways can be a huge advantage in the market.

As we've seen in recent weeks, stocks don't only go up, and having the capability to profit from stocks falling in a bad market is a good way to both profit and hedge.

You'll have noticed that stocks fall a lot quicker than they take to rise.

Therefore, the potential for harm in higher volatility environments is increased.

Hypothetically, your downside is unlimited because there is no limit to a stock's upside.

In reality, this is not the case for two reasons:

ESMA legislation means retail clients can no longer go into negative equity (they can't lose more than they deposit)

The broker wants to avoid having to pay for your protected losses so they'll take actions to avoid that

That said, if you want to short a stock, CFDs can sometimes be a better instrument to use for the following reason..

CFDs offer Direct Market Access

The key difference between spread bets and CFDs is that CFDs offer direct market access. This is the ability to trade on the order book and become a market maker.

For example, let's say the price of a stock is 120p but you only want to pay 110p.

You can then submit a limit order and go on the bid in your size at 110p.

Pro tip: Never use big round orders - always go up/down an integer. 110.2p means you have a much better chance of being filled than lazy traders who enter 110p.

You can then leave this order working for the day (never use Good Till Cancelled orders!) and if you're filled then you're filled, and if you're not then the order expires.

However, another good advantage is that if the stock is illiquid stock and the market makers aren't doing much size, you can use the order book to your advantage.

For example, I shorted Pro Cook (PROC) from 140p down to 120p with a CFD by going into the market hitting bids and putting stock on the ask to be lifted.

Once I'd got my position through CFD, I then transferred it to myself and got my position in a spread bet account, then waited for what I thought would be a collapse in the share price.

Unlike spread bets, CFDs are taxable. When the company announced a profit warning and halved instantly, these profits were tax-free because of the move.

This type of trade works on mispricing. The stock still maybe mispriced but pre-profit warning the stock was a highly asymmetrical trade.

If the stock beat expectations, or traded inline, then the price may've risen slightly.

But in my view the profit warning potential was not priced in at all.

Therefore, I was getting a good risk/reward payout.

CFDs offer iceberg capability

An iceberg is a specific order that places tranches into the market whilst keeping its fill priority at the set market price.

This means that as each tranche is executed another tranche will instantly be reloaded and no other orders jump ahead.

Iceberg orders mean we can disguise our total order in the market.

For example, if the average trade size in the market was between 10-30k shares and we wanted to deal in 100k, placing that order in one go would alert the market and potentially move the price.

With an iceberg, we can split that order into 5 tranches of 20k.

This means that nobody can see the true size of the order and we can work this on the book.

CFDs can offer stops on all markets

CFDs are a derivative. You can set stop losses on both SETS and SETSqx stocks.

This is an advantage because unless you have a broker working an order for you on a SETSqx stock (usually done on a best endeavours basis), there is no way of putting a stop loss on a market maker stock.

With CFDs (and spread bets), you can place stop losses, and even guaranteed stop losses.

This can be great for someone who doesn't have the time to be at screens all day and offers protection in the market.

Remember, with SharePad you can set email alerts and many brokers will offer a rudimentary alerts system, so you can make use of these as well as stop losses.

And whenever you’re ready..

There are three ways I can help you.

If you’re wanting to profitably trade UK stocks then I’d recommend my entry level course:

Spread Bet Accelerator: The exact system I use to trade and get you to your first £10k in profits. Use the code GIVEME99 for a subscriber discount.

Want more trading ideas and a clearer view of the markets?

Buy The Bull Market Premium: Free 30-day trial covering potential trades and insights as a professional trader.

Want to work with me personally?

Alpha Trader is where I work closely with traders who want to get to a professional level.

We have our own channel, meet up, and have fun trading and learning [closed].

Speak soon!

Michael