A few weeks ago I wrote about Gulf Keystone Petroleum (GKP).

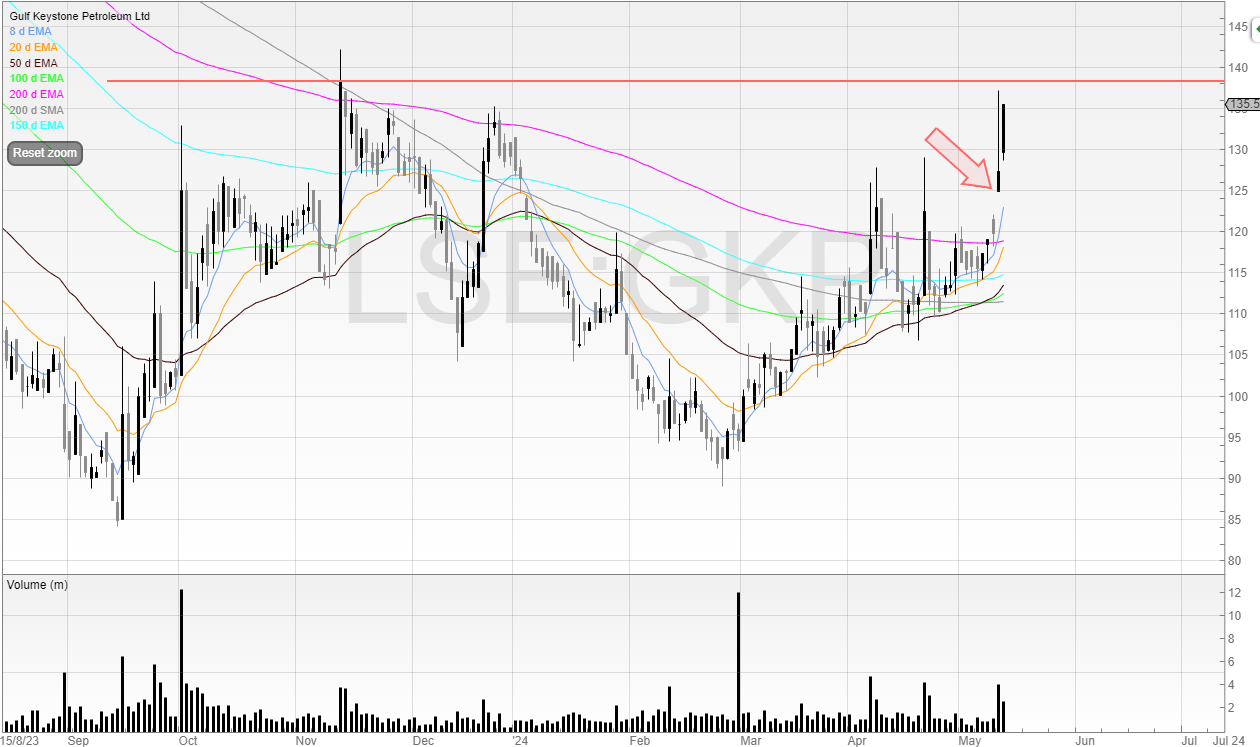

Basically, it’s a high beta stock, and when there’s news it moves.

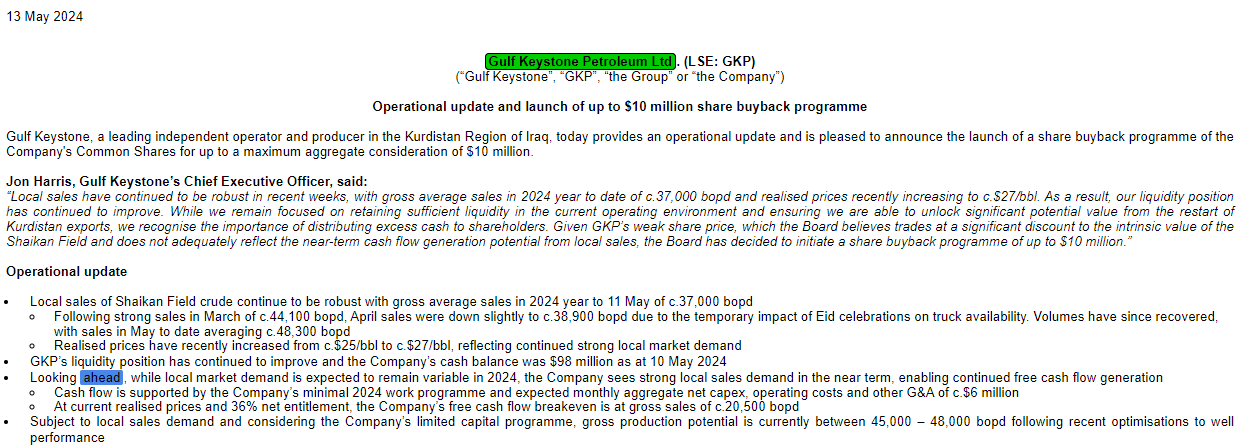

And this week it announced it was doing share buyback.

If you’re subscribed to my main newsletter where you’ll already know that share buybacks can be good and bad.

Good if they’re used to buy back stock that is significantly undervalued.

Bad if they’re used to artificially inflate EPS so management can get their bonuses paid out.

But this RNS makes sense.

The company’s liquidity position has continued to improve. As of 10 May the company’s cash balance was $98 million - up from $86 million on 20 March with the company having no debt.

So a $10 million buyback isn’t huge. But the board says this:

Given GKP’s weak share price, which the Board believes trades at a significant discount to the intrinsic value of the Shaikan Field and does not adequately reflect the near-term cash flow generation potential from local sales, the Board has decided to initiate a share buyback programme of up to $10 million.”

We don’t yet know the details, but it was good news, and an easy buy.

As I mentioned on Twitter, I’ve taken some off and now have a trailing stop.

And if the ITP starts flowing again then I think this stock can more than double - it’s a cash machine.

But punters have been high on hopium waiting for that news.

Me? I’ll just wait and pay higher if I have to. But it removes the downside and potential time wasted waiting around.

Traders need to be efficient with capital. Waiting around is not effective. Especially in markets like this when plenty of stocks are breaking out.

Here’s another thing I spotted..

On The Beach (OTB) rose 16% into the close before the trading update.

The results were in line.

So what does that mean?

Trader brain should be thinking fade the move. Unless the news is better than what was expected (in line suggests not) then the obvious shout is for the rally to give something back.

Unfortunately, I was looking for a ‘pop and drop’. A bit of exuberance on the bell to whack but the stock just collapsed straight from the open.

What I should’ve done is stuck in half and then I had the option either to add more in on any exuberance or if the stock fell.

I went for the best risk/reward trade by wanting to short exuberance and paid the price!

The read across trade

Another mistake I made yesterday was forgetting the read across trade.

Currys (CURY) moved on good news. I scalped this but forgot about AO World (AO.) - mainly because it hasn’t been much bothered by CURY news before.

But as Old Turkey said: “Why, this is a bull market, you know!”

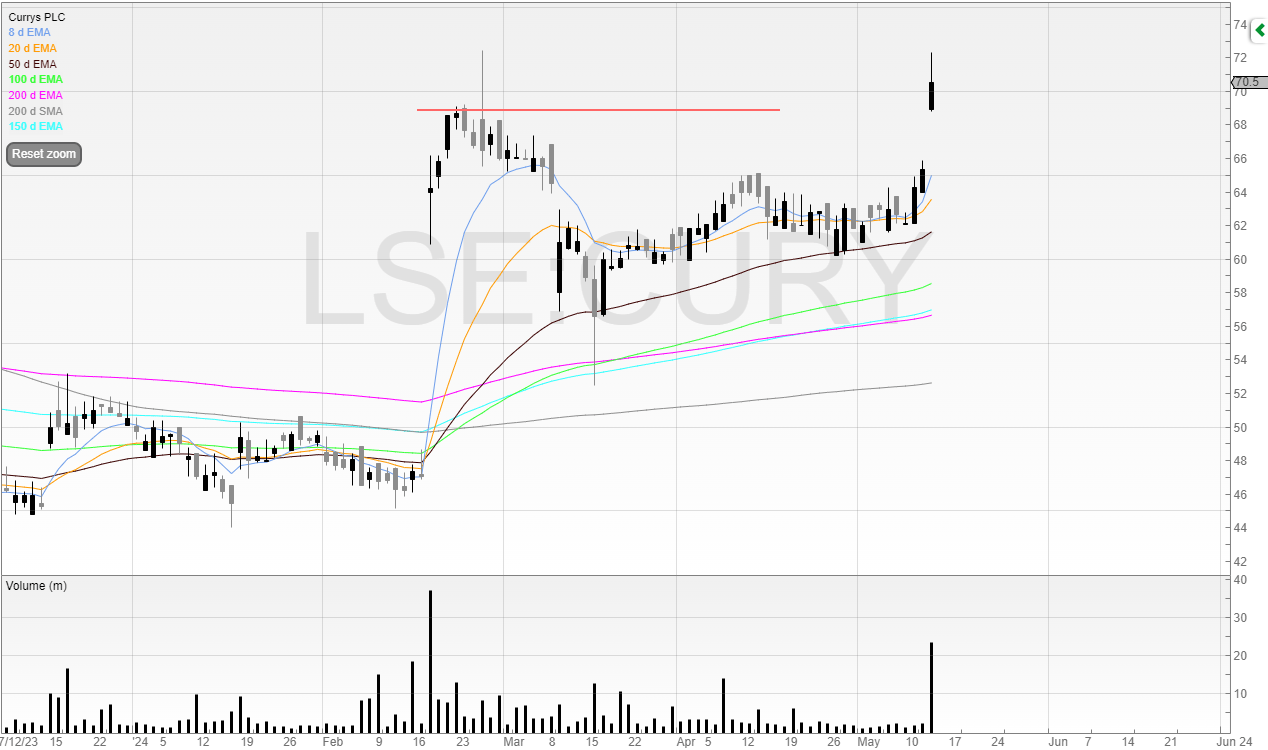

Here’s Currys.

I traded this not because the news was so great.

But because I thought others would think the news was great.

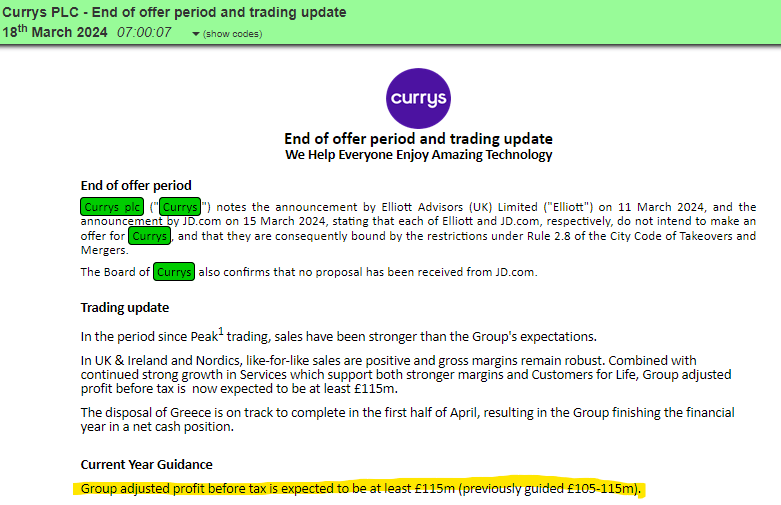

I don’t know if this was deliberate but it sounds as if this was a new upgrade.

“previously guided to at least £105m”

But go back to 18 March and we see this is a rehash of old news..

The company also mentioned a strong start to the year too and Nordics being better than expected. And as Old Turkey said..

Admittedly, not a huge move in AO World. But a decent r/r trade as no gap.

But still, plenty of opportunities, and long may they continue.

Speak soon.